views

Choosing a Card

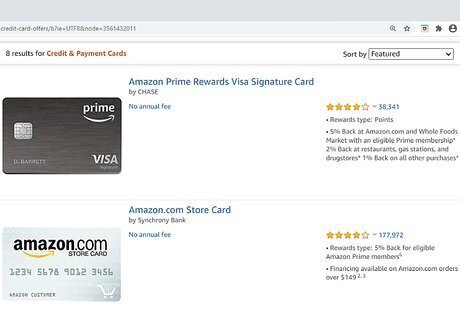

Pick a Prime Visa Signature Card if you have a Prime membership. The Amazon Prime Rewards Visa Signature Card is the most popular option, and it gives you 5% of your money back from Amazon and Whole Foods, 2% of your money back from restaurants, drug stores, and gas stations, and 1% of your money back on all other purchases. You won’t be charged extra for using the card out of the country, and it provides fraud and theft protection; however, you could be charged anywhere from 14% to 24% interest depending on your credit score. The Visa Signature Card is provided through Chase Bank, so you can look on their website for any other information you need. You can only apply for a Prime Visa card if you have an Amazon Prime membership.

Go for the Amazon.com Store Card for an easier approval. The Store Card gives you 5% of your money back on all of your Amazon purchases as long as you have an Amazon Prime membership. When you sign up for the card, a $60 credit will automatically be loaded onto your Amazon account; however, the interest rate of this card is 25.99% no matter what your credit score is. This card is provided by Synchrony Bank. You can use this card for other purchases, but you won’t get money back unless you use it on Amazon items. This card is easier to get approved for since you get less money back overall.

Apply for a Visa Signature Card for a lower interest rate. The Amazon Rewards Visa Signature Card is very similar to the Prime Visa Card, but it only gives you 3% of your money back on purchases from Amazon. The 2% back from drug stores, restaurants, and gas stations remains the same, as well as the 1% money back from other purchases and fraud protection. The interest rate depends on your credit score, but it ranges from 14% to 24%. This card is also provided through Chase Bank. You don't need to have a Prime membership to apply for this card.

Pick a Business Card if you have an Amazon business. The Amazon Business Prime American Express Card offers 5% of your money back on Amazon purchases, 2% of your money back from gas stations, restaurants, and drug stores, and 1% of your money back on other select purchases. You can only apply for this card if you have a registered business, though, and they will ask for your business name on the application. This card is provided through American Express. The interest rates of this credit card depend on your credit score at the time of your application.

Applying for an Amazon Credit Card

Log into your Amazon account. Before you apply, you’ll need to either create an Amazon account or log in to your existing one. Make sure you sign in to the account you’d like to have linked with the credit card that you apply for. If you’re using the Amazon app, you’ll probably already be signed in.

Find the card that you'd like to apply for. Head to the Credit Card Marketplace to look through each card offer, or go straight to the page of the card you'd like to apply for. You can double check the terms and conditions as well as read customer reviews to make your final decision. To check out the Credit Card Marketplace, visit https://www.amazon.com/compare-credit-card-offers/b?ie=UTF8&node=3561432011.

Click “Apply now” on the page of the card you chose. Once you decide on a card, click on the credit card and then hit the button that says “Apply now.” This will redirect you to the bank’s page, and Amazon may ask you to log in again to double check that it’s really you. Although the credit card is through Amazon, you have to apply on the bank’s website since it’s technically their credit card.

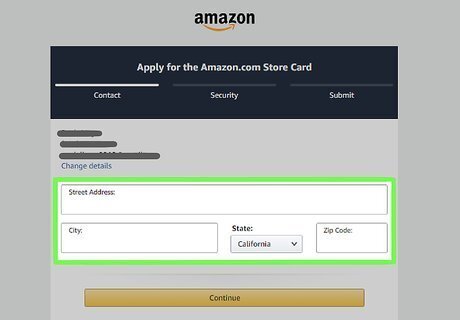

Fill out the application fully with your information. Make sure all of the information you put on the application is accurate to avoid delaying your acceptance. Have your driver’s license, social security card, and address nearby to fill it out so you don’t have to get up and search for them later on. The first section of the application process will ask for information about you—full name, physical address, and email address. The physical address must be a US address. Click “Continue” or scroll down for the next page. The next section or page will ask for your phone number, social security number, date of birth, and mother's maiden name. Fill it in accordingly, then scroll down or click “Continue.” In the third section or page, you will be asked for information on your finances (e.g., annual net income). Provide all the information asked, and scroll down or click “Continue.” The last section or page will display the terms and conditions as well as the fees and prices of the card, which you should read through carefully before you move on.

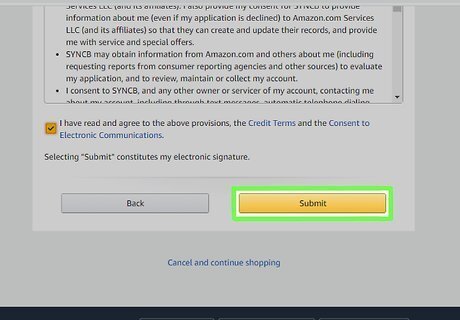

Submit the application. Make sure you filled out all of the necessary information in your application, and that you didn’t leave any required fields blank. Click the “I agree” option at the very bottom of the page before clicking “Submit.” Submitting an inaccurate application can lengthen the approval process for your credit card, so it’s very important to double check all of your information before submitting it.

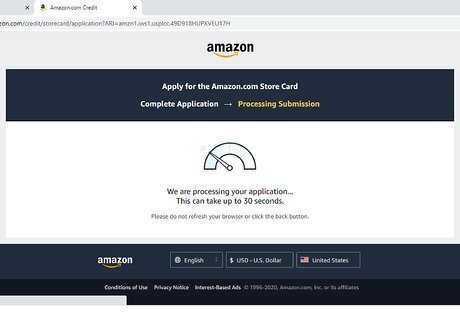

Wait to get your card or notification. Now all you have to do is wait for the approval (or rejection) on your application. If your application is approved, you will get a response within a few seconds, and you can begin using your card number on Amazon immediately. The actual card will be mailed to the address you entered, and you should receive it within 7 to 10 business days. If you aren’t approved, you will receive a notification from the bank within 2 to 4 weeks. You may not be approved if your credit score is lower than 640 or you have no credit history at all.

Comments

0 comment