views

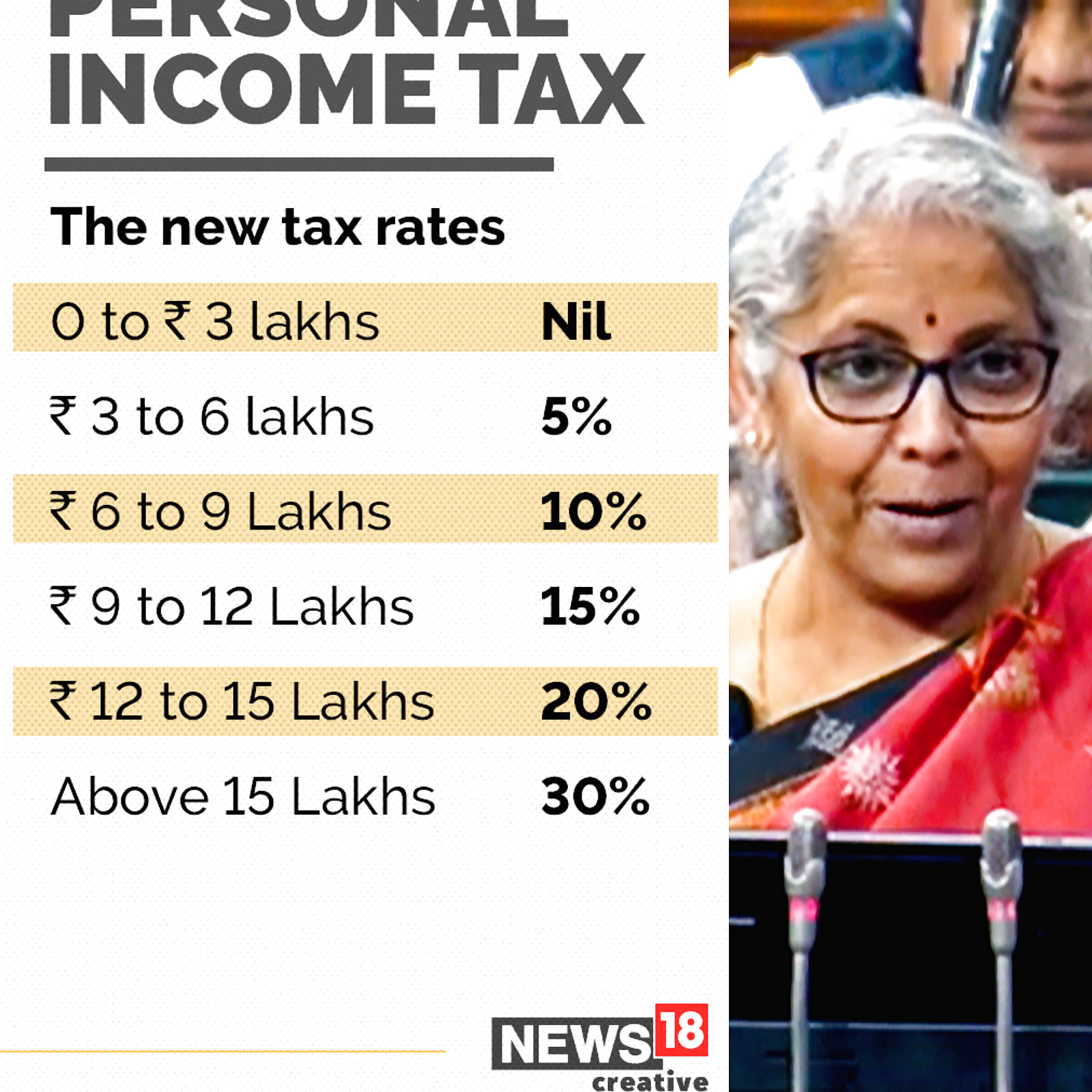

Budget 2023, Income Tax Benefits For Salaried Individuals: Finance Minister Nirmala Sitharaman on Wednesday provided much-needed relief to individual taxpayers, including the salaried class. The income tax exemption limit has been increased by Rs 50,000 to Rs 3 lakh, and the rebate has been increased from Rs 5 lakh to Rs 7 lakh. Apart from this, a standard deduction of Rs 50,000, which was available for the old regime, has also been extended to those opting for the new regime. According to an estimate by Maneet Pal Singh, partner at I.P. Pasricha & Co, those earning up to Rs 10 lakh will now be able to save over Rs 15,000, though those earning up to Rs 7 lakh in a year will not have to pay any tax.

However, in this tax estimate, a professional tax that levied in almost all states up to Rs 2,500 per annum has not been factored in.

New Regime: Income Tax On Annual Income Up To Rs 10 Lakh

Those earning an annual income of Rs 10 lakh earlier: Currently, these salaried people have a total tax due of about Rs 75,000, and a four per cent education tax over and above this, which aggregates to a total tax liability of Rs 78,000.

Also Read: Budget 2023: If Your Income Is Just Rs 10 Above Rs 7 Lakh, This is The Tax You’ll Pay

Now, after the latest announcements, individuals’ tax liability will be reduced by up to Rs 15,600 on an annual income of Rs 10 lakh. In the financial year 2023-24, there will be an income tax due of about Rs 60,000, against Rs 70,000 earlier, on an annual income of Rs 10 lakh. Over and above this, the higher education cess rate will remain the same at 4 per cent, which will be Rs 2,400. In total, the tax liability in 2023-24 on the annual income of Rs 10 lakh will be Rs 62,400, a benefit of Rs 15,600 as compared with Rs 78,000 tax liability currently.

Importantly, standard deduction will not be allowable in the new tax regime up to March 2023. The standard deduction from April 1, 2023, of Rs 52,500 is allowed to be deducted from gross salary only if it exceeds Rs 15,50,000.

Archit Gupta, founder and CEO of Clear, said, “It is clear that the government is working towards making the new tax regime more attractive with perhaps the intention of phasing out of the old regime. With lower taxes and zero tax at Rs 7 lakh, disposal income will rise easing out inflation pressure on the middle class. This is a big relief to them.”

New Tax Regime: Computation of Rs 10 Lakh Total Income (as provided by Maneet Pal Singh, partner at I.P. Pasricha & Co)

- Salary Head — Current Tax Calculation — Tax Calculation For FY24

- Gross Total Income — Rs 10 lakh — Rs 10 lakh

- Income Tax Due — Rs 75,000 — Rs 60,000

- Add: HEC@4% — 3,000 — 2,400

- Total Tax Liability — 78,000 — 62,400.

Read all the Latest Business News and Budget Live Updates here

Comments

0 comment