views

Initiating Residency Requirements

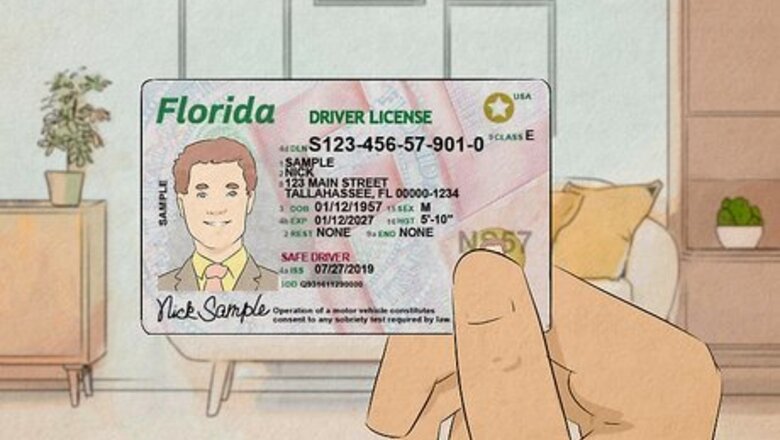

Get a Florida driver's license. The sooner you get a Florida driver's license (or State ID) the better. If you already have a license from another state, you will not have to take the written or driving tests to get a Florida license. For the record, you have 30 days after filing the Declaration of Domicile to get a Florida driver's license (you may get a Florida license with or without this declaration, which we’ll discuss in the second section). To get your license: Bring your out-of-state license to your local Florida Department of Highway Safety and Motor Vehicles (county tax collector). Take an identifying document with you too, such as the original or certified copy of your birth certificate. It's also okay to bring a US Passport, or a Certificate of Naturalization. Provide proof of your Social Security number. This could be your Social Security card, a W-2 or a pay stub. Offer two documents that prove your Florida address. A mortgage deed, Florida car registration or recent utility bills are the most commonly accepted, but anything with your new address should suffice. If you don’t intend to drive, you need to get a State ID card. This is the same exact process as getting a Driver’s License (without any tests, of course).

Register your out-of-state car. Transfer your car title and get registration for your car ‘’in Florida’’. You have 10 days after establishing Florida residency status to complete this task. Get car insurance in Florida. Submit proof of your policy to the county tax collector. Show the original title to the county tax collector. Bring the car you want to register to your county tax collector's office, so they can check out the VIN. Pay the fees. It costs around $225 to title and register your car for the first time in Florida. You will also have to pay the typical registration fees, which vary depending the age, type, and weight of your vehicle.

Register to vote. It is convenient to do this while getting your Florida driver's license – often at the DMV (county tax collector) they will attach a voter registration form along with your new address forms. However, you can also register with the Supervisor of Elections. You must wait until the voter registration books open, as they close 30 days prior to an election and reopen after an election. This is a simple form that takes about 5 minutes to fill out. After you hand it in, your work is done. It's as simple as that! You can also register online at registertovoteflorida.gov.

Establishing Yourself as a Floridian

If you live in two different states, file a Declaration of Domicile. Just having a home in Florida technically isn’t enough. Because plenty of “snowbirds” go to Florida just for the winter, a Declaration of Domicile confirms that it is your primary residence. Your signature on this document, once approved, confirms that you now reside in Florida, and that the state is your permanent residence. This is done through the clerk of the circuit court. To get this declaration approved, you need two things: physical presence in Florida and intent. The former is pretty self-explanatory. As for the latter, “intent” can be shown through employment, having a doctor, being registered to vote, being involved in the community – the list goes on and on, and we'll discuss many aspects below. Having this means that all your taxes now go to the state of Florida and nowhere else (starting with the next full calendar year, of course). Because Florida has no income, death, or estate tax, this may be a wise move. If you only have one residence, a declaration of domicile isn't necessary, though it is wise (for tax benefits).

File for a homestead exemption. Florida’s Homestead Law protects any Florida resident from losing his or her home to a creditor or any other lien holder, with the exception of mortgages. Should you have to declare bankruptcy, having a homestead exemption can let you breathe a sigh of relief. You can file this once you have a Declaration of Domicile to your name. It also affects your taxes (for the better). The Florida “Save Our Home” Act says that once qualified for the homestead exemption, the assessed value of your property for tax purposes carries an exemption for the first $50,000 of taxable value for all taxing entities except the school district (which allows a $25,000 exemption). In addition, once qualified, the assessed value for tax purposes cannot rise more than 3% in any given year. That means equity you won’t have to pay on.

Accept employment. One of the clearest methods of making it hard to argue legally that you are a resident of any other state is to accept employment in Florida. With wages coming from Florida and a residence in Florida, no one will question you otherwise! If you are looking to provide intent between two states, this is a good way to do it. Having employment in Florida will add weight to your case should your Declaration of Domicile be in question.

If applicable, enroll your child in a Florida school. Another way of showing intent and moving toward veritable Florida residency is to enroll your child in a Florida school, public or private. Child here meaning under the age of 18, of course. With a child in the Florida school system, this too adds weight to your Declaration of Domicile case.

File federal taxes after becoming a Florida resident. You will send your tax returns to the Atlanta, Georgia location of the Internal Revenue Service Center when you move to Florida. When you file your final tax return for your previous state, write "final return" on it, and use your current address so it is clear that you have moved. If you live in two states in the same year, look into filing part-year returns. States combine differently (each state has different regulations), so look into your specific situation before assuming anything.

Making Recommended Moves

Transfer all accounts to Florida institutions. If you belonged to any banks, clubs or churches in your previous state, find a Florida location to join. Doing so will show that you are committed to being a resident of Florida, rather than another state. Here are some ideas: Bank Church Gym Community groups, organizations, or affiliations Insurance-approved medical group

Notify the parties necessary of your address change. Whether it’s your magazine subscriptions, distant relatives, or your dessert-of-the-month club, notify the parties necessary that your new address is now in Florida. Start by filing an address change with the Postal Service and then contact organizations individually. This can show intent in your Declaration of Domicile, too. Should any tax issues arise, this will certainly help your case.

Renew any licensure for the state of Florida. If you have any licenses or certification that are good state-by-state, make sure you get reassessed in Florida so your licensure is valid and you can still practice. Whether you’re a nurse, a lawyer, or a real estate agent, this is necessary not only for your workflow, but also to show that Florida is where you intend to stay. If there is any doubt, it's always best to check out your situation. What's more, you may run into new rules and regulations you didn't know if in your research.

Get involved in your community. To further prove that you are a Florida resident, start getting involved. Vote, join a gym, be a part of your neighborhood association, find a doctor and a dentist, and establish your roots. The more engrained you are, the more you’ll truly be a resident of Florida. It wouldn’t hurt to get an annual pass for Disney World, either!

Comments

0 comment