views

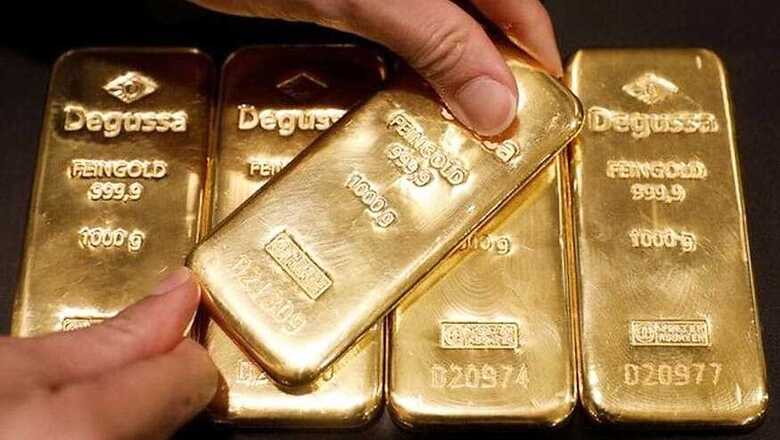

Bengaluru: Gold prices touched their highest in four weeks on Monday, supported by political uncertainty in the United States that pushed the dollar to its lowest in over a year.

The dollar struggled near a 13-month low against a basket of major currencies as U.S. political woes dampened hopes for quick passage of Trump's stimulus and tax reform agendas.

A weaker greenback makes dollar-denominated gold less expensive for holders of other currencies, while the metal is also used as an alternative investment during times of political and financial uncertainty.

"I think people are getting more nervous and careful about what is going to happen (in terms of the controversies surrounding the administration of U.S. President Donald Trump)," said Yuichi Ikemizu, Tokyo branch manager at ICBC Standard Bank.

"The market is expected to be quiet heading into the summer holidays in Asia, but if it moves at all, it'll move to the upside rather than the downside."

Spot gold was nearly flat at $1,254.31 per ounce at 0346 GMT. It earlier hit a 4-week high of $1,257.18 an ounce, having risen 2.1 percent last week.

U.S. gold futures for August delivery were also nearly unchanged at $1,254.70 per ounce.

"We would expect that gold will continue to find friends on dips now as we head into a packed Central Bank and data week," said Jeffrey Halley, a senior market analyst at OANDA.

Spot gold may peak around resistance at $1,261 per ounce, as suggested by a Fibonacci retracement analysis, a rising channel, and the hourly relative strength index, according to Reuters technical analyst Wang Tao.

Hedge funds and money managers increased their net long position in COMEX gold for the first time in six weeks in the week to July 18, U.S. Commodity Futures Trading Commission data showed on Friday.

Meanwhile, gold demand in Asia eroded last week due to higher prices, with a seasonal slowdown denting the lure for the precious metal in second-biggest consumer India.

In other precious metals, silver prices fell 0.3 percent to $16.42 per ounce, after earlier hitting their highest since July 3 at $16.53. The metal rose 3.26 percent last week, its biggest weekly gain since early January.

Platinum dropped 0.4 percent to $929.40 per ounce. It climbed nearly 2 percent last week in its largest weekly gain since mid-May.

Palladium eased 0.2 percent to $843.08 per ounce, after falling 1.5 percent last week.

Comments

0 comment