views

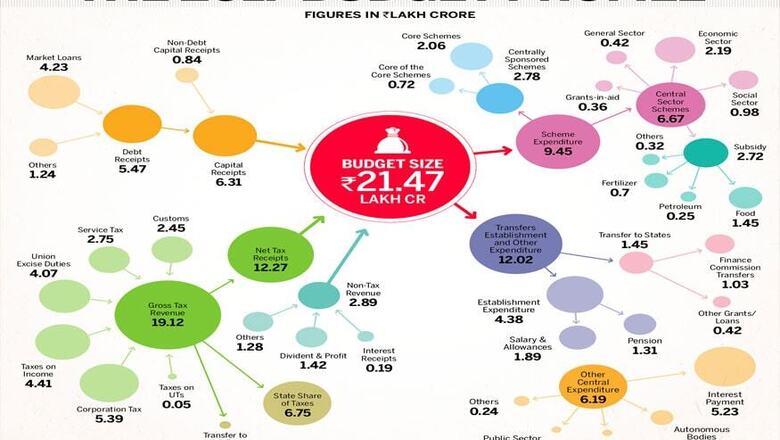

New Delhi: Finance Minister Arun Jaitley presented a Rs 21.47 budget on Wednesday. At its simplest, the budget is a financial statement about the government’s income and expenditure. The government gets revenue from different sources and spends that money on various schemes. The revenue is classified as tax and non tax revenue. Taxes can be of two types: Direct and indirect. Direct taxes are levied on the incomes of individuals and companies. Individual and Corporate income tax is an example of direct tax. Sales tax, VAT, excise and octroi are examples of indirect taxes.

On the other hand, the government has spending commitments. Apart from paying salaries and pensions to its employees, infrastructure, social welfare and economic programmes have to be funded. The government also subsidises petrol, food and fertilizer costs. A shortfall in the expenditure of the government is met by the government borrowing money to bridge the deficit. The following graphic explains the sources the Union Government receives money from and what it spends on.

Comments

0 comment