views

London: The UK's National Crime Agency (NCA) on Tuesday said that it has secured a settlement of 190 million pounds with a Pakistani real estate tycoon following an investigation into his frozen bank accounts in the UK.

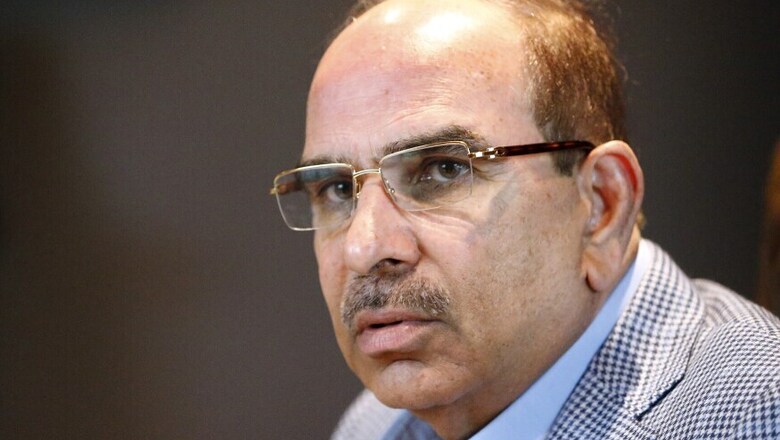

The proceeds from the assets and cash settlement, which will be returned to the state of Pakistan, include a prime UK property at 1 Hyde Park Place in London valued at approximately 50 million pounds as well as all of the funds in frozen UK bank accounts of Malik Riaz Hussain.

The 190 million pounds settlement is the result of an investigation by the NCA into Malik Riaz Hussain, a Pakistani national, whose business is one of the biggest private sector employers in Pakistan, the NCA said in a statement.

The settlement is a civil matter and does not represent a finding of guilt. The proceedings were against the funds themselves, not against any named individual, it noted.

In August, eight account freezing orders were secured at Westminster Magistrates' Court in London in connection with funds totalling around 120 million pounds.

These followed an earlier freezing order in December last year linked to the same investigation for 20 million pounds. All of the account freezing orders related to money held in UK bank accounts.

The NCA said its unit responsible for the settlement struck this week is principally funded by the UK government's Department for International Development (DfID) and therefore concentrates its resources where there is a clear link with countries that receive overseas development aid from the UK, with Pakistan being a key aid recipient of the UK.

Hussain, who owns Bahria Town Pakistan's largest privately-owned property development firm, took to Twitter to lash out against any allegations of wrongdoing.

Some habituals are twisting the NCA report 180 degrees to throw mud at me. I sold our legal and declared property in UK to pay 190mn pounds to Supreme Court Pakistan against Bahria Town Karachi, he said.

His Bahria Town Karachi development has been plagued by problems in recent months and the funds were owed as a result of a Pakistan Supreme Court ruling.

Comments

0 comment