views

Digital payments and mobile wallets are serious business these days, as a crucial part of the government push towards cashless transactions. The numbers and projections tell their own tale, and the coronavirus pandemic has quickened the pace of digital payment adoption. As a user, I have plenty of choices. Paytm, PhonePe, Google Pay, Airtel Money, Mobikwik, Amazon Pay, WhatsApp Pay, HDFC PayZapp and more. Competition between these mobile payment platforms has largely meant good service, an ever-widening scope of services that are available within each app and quite often, good offers and cashbacks that can be availed depending on what you are paying for. Needless to say, it has become incredibly convenient to pay for utility bills, mobile and broadband bills, prepaid recharge, buying insurance or paying premiums, buying and recharging the FASTag for your car, pay for Zomato and Swiggy food deliveries, making quick cashless payments in stores, transfer money to contacts and more. Credit cards, UPI and multiple modes of payments are available on these apps.

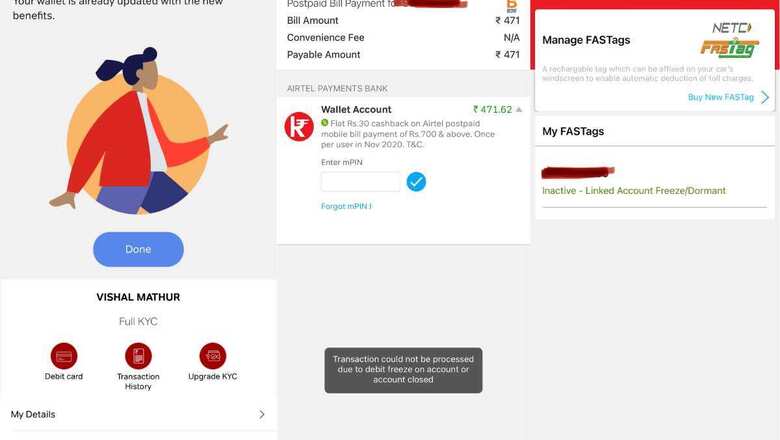

It was pretty surprising when on Thursday, November 26, I noticed something somewhat interesting with my Airtel Wallet. A bolt from the blue, mind you. On the face of it, nothing had changed. Open the Airtel Thanks app on the phone, tap on the Bank tab and you see your wallet balance, auto-scrolling banners with offers and schemes for bill payments and all the available payments umbrellas listed. I had to pay an Airtel mobile postpaid bill in the family and proceeded to make the payment as usual. However, when it came to actually paying the bill after selecting a payment option, which in this case is the balance in the Airtel Money wallet account, it tells me “transaction could not be processed due to debit freeze on account or account closed”. No others modes of payment listed either, including UPI or Amazon Pay, for instance. Interesting. As I had mentioned earlier, the Airtel Wallet homepage had given absolutely no such indication at all.

I checked again. The View Profile option in the wallet tells me my account is “Full KYC”, and still no hints that something was amiss with the mobile wallet. There is also the “upgrade KYC” option proudly plastered at multiple places in the Airtel Wallet services listings. I tapped on that, and it tells me in a very cheerful tone that “You are all set!” and that “your wallet is already updated with the new benefits”. This is how it has always been since I got the physical KYC done for the Airtel Money wallet done a year ago, before buying the FASTag for the car. My linked FASTag says “Inactive – Linked account freeze/dormant”. Great. Not that I had to, but what if I had to travel interstate on national highways around that time? A little more thought could have helped. At least allow the FASTag to be linked to a UPI source? Or let the FASTag wallet remain separate?

In a written communication with Airtel, the response initially was pretty vague. “We have checked as there is a temporary hold on the ability to do transactions on your Full KYC wallet. We want to secure your account with additional identification & verification of documents,” they said. But there is more. It is all a tad confusing because buried deep inside the FAQs section on their website, Airtel says, “Currently we do not have the provision of changing to FULL KYC category. We will soon have an update for the same with a detailed process.”

The guidelines by the Reserve Bank of India are very clear, as per the notification RBI/DBR/2015-16/18 Master Direction DBR.AML.BC.No.81/14.01.001/2015-16 for Know Your Customer (KYC), 2016. The guidelines state that in case of a deposit account being opened using an OTP (in this case the Aadhaar OTP), in the non-face-to-face mode, these accounts shall not be allowed for more than one year within which identification as per Section 16 is to be carried out. The guidelines also state that if the Customer Due Diligence (CDD) is not completed within this one year or at the end of one year, these accounts shall be closed immediately, and no further debits shall be allowed.

Two things here. First, when the KYC for my Airtel Money account was done in person at an Airtel Store 12 months ago, why was it marked as a non-face-to-face KYC mode, if it even matters? Secondly, why does the Airtel Money wallet not show any hallmarks that KYC may be needed again while claiming Full KYC contrary to what Airtel says on their own website?

Remember the vague response that Airtel shared earlier? They went on to say, “We request you to share a scanned copy of your POI [Proof of identity]/POA [Proof of address] used while registering your Airtel Money Wallet along with a written consent to upgrade your Airtel Money Wallet to Airtel Payments Bank Saving account at [email protected]. Please mask the first 8 digits of your Aadhaar number to ensure your information is safe & secure.” And added that they would like to send an executive to my home address to sort out the problem. But this is where the underhanded tactics have been revealed. They want a user, who wants to continue using services they may have tied themselves in with (such as a FASTag), to upgrade to a Payments Bank Account instead.

What are Payments Banks? It was in 2014 that it was officially announced that certain institutions will be able to start banking operations which will be defined as payments banks. Basically, they would be able to do most banking operations such as open accounts, handle deposits and withdrawals, investments but without being allowed to offer loans or credit cards or any credit risk. Airtel Payments Bank is one such bank.

Coming back to the original point, this is a pretty sneaky way of forcing people to sign up for a Payments Bank account when they may or may not want to. I most certainly didn’t want to. When pressed further about whether a fresh KYC will allow the Airtel Wallet operations to resume without upgrading to an Airtel Payments Bank, the curt reply said it all, “it would not be feasible to continue using Airtel Wallet.”

It is interesting that Airtel does not offer any eKYC or video KYC methods at this time. The only options as a customer are to either request for an executive to come home to complete the KYC process again or to visit an Airtel physical store to get this completed—both options not the most viable at a time when human interaction ideally must be at a minimum. By the way, the RBI had allowed video KYC at the beginning of this year, something that the likes of Paytm are using to make things convenient for users.

Now compare this with my experience with upgrading my Paytm wallet after the first year KYC was complete. And indeed, that KYC was done via the non-face-to-face method, via an Aadhaar OTP, as per the guidelines at the time.

For Paytm, I was reminded at multiple points in the app that I needed to get my KYC done to use the wallet, else I can continue to use the UPI linked account to make and receive payments on Paytm. To be honest, the Paytm experience worked well with just UPI as well to make school fees payments, pay mobile bills and more. Yet, it was the convenience which made me get the Full KYC done, nonetheless. Within the Paytm app is an option to complete KYC, including the choice of video KYC. It was as seamless as it could have been. The steps are listed beforehand, such as what documents to keep handy and that you should be connected to a stable internet connection. Once you give your consent to go ahead, the Paytm KYC executive connects over a video call and guides you step by step on how to show them the physical documents via the phone’s camera and the details you need to confirm. It really takes less than 2 minutes, and the KYC completion confirmation is given right away. That’s it—my existing Paytm Wallet, re-KYC-ed to become an active Paytm Wallet again. Paytm also has the Paytm Payments Bank, yet there were no underhanded tactics to force users to sign up for that. All there was, a polite mention by the KYC agent with the request to check out the benefits in the app and consider upgrading to a Payments Bank account.

Needless to say, I have let my Airtel Wallet lie dormant—complete with the money that was loaded in the wallet and the now inactive FASTag. It isn’t for anything but a question of ethics. And how consumer friendly you want to be as a company. Not many people would perhaps make such a move, something that would probably get Airtel a few more Payments Bank signups as a result. And drive people to the stores, at the cost of their health too perhaps, to complete the KYC process again. Saves them the cost of having a video KYC infrastructure up and running. All this, even as the government urges people to adopt mobile wallets and digital payments as a habit for paying for stuff on a regular basis. As for now, all my FASTag links too are with Paytm. And so are the bill payments and recharges.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment