views

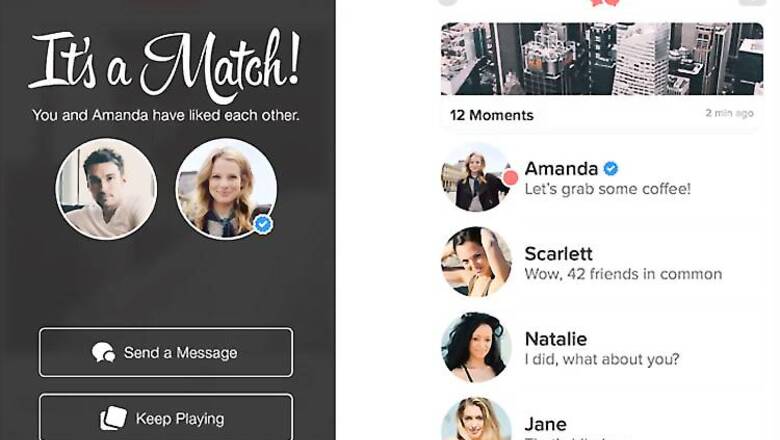

New York: Match Group is swiping right and hopes investors will do the same: The parent of Tinder, Match.com and OkCupid is filing for an initial public offering of stock.

The company valued the offering at $100 million, although that is an estimate made for purposes of calculating a filing fee and could change. Match Group Inc. says it will list its shares on Nasdaq under the symbol "MTCH."

Match Group is a unit of IAC/InterActiveCorp, which is controlled by billionaire Barry Diller. IAC/InterActiveCorp will still have majority control of Match after the offering. It also owns Web properties like Vimeo, HomeAdvisor, About.com and CollegeHumor.

Match Group says it has turned a profit in each of the last three years. The Dallas-based company says it had $1 billion in revenue over the 12 months ended June 30. Before the end of the year it expects to buy yet another site, PlentyOfFish, for $575 million.

According to a filing with regulators, as of Sep. 30 Match had about 59 million active monthly users, 4.7 million of them paid, using its "dating products" in 38 languages in more than 190 countries.

The filing comes at a time of slowing IPO activity because of concerns about the health of the global economy, which has led to turmoil on Wall Street. IPOs are currently at their slowest pace in about four years, according to Renaissance Capital, and many of the companies that have gone public have seen their stocks start trading at lower prices than they had hoped.

This week, payment technology company First Data Corp. went public with the largest US-listed IPO of the year, but the $2.56 billion offering was smaller than the company had expected. Supermarket operator Albertsons Cos. postponed its IPO because of the state of the markets. Albertsons, the owner of Safeway and other chains, had said it expected to raise as much as $1.7 billion. That would have been the second-largest offering of the year so far.

Competing dating site and app operator Zoosk filed for an IPO in April 2014, but withdrew its plans the following month. At the time Zoosk said it had $178 million in revenue and had yet to turn a profit.

Comments

0 comment