views

Ola, India’s ride-sharing company, launches a comprehensive in-trip insurance program for its customers across India. Ola extends the benefits of the ‘Chalo befikar’ insurance program to its customers across all categories viz. cabs, auto, kaali-peeli, and e-rickshaw.

Ola has partnered with Acko General Insurance Ltd to launch this program designed to benefit its customers across 110+ cities. A user booking an Ola ride can opt for an in-trip insurance cover while booking the ride at a premium of Rs 1 for all intra-city travel; Rs 10 for Ola Rentals; Rs 15 for Ola Outstation.

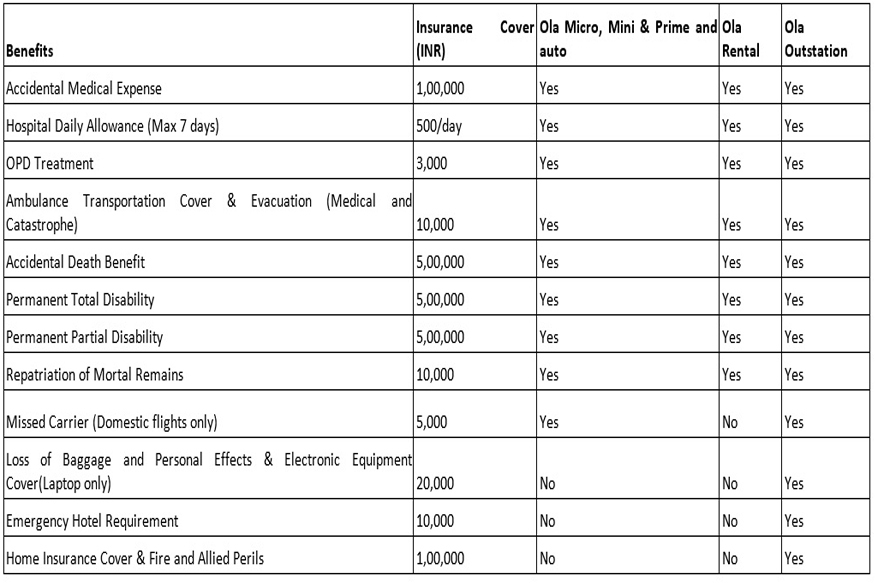

The program is being rolled out for customers in major metros and will be scaled up to all cities, covering the entire base in the coming weeks. The comprehensive insurance program provides benefits in cases of loss of baggage or laptops, missed flights, accidental medical expense, ambulance transportation cover, and much more the company said in a statement. The optional in-trip insurance program can be purchased through the Ola app. The claims can be made through the Ola app as well as Acko’s website, mobile app and, call center. Ola’s partnership with ICICI Lombard General Insurance Ltd will be live in the coming months.

Here is how a customer can avail in-trip insurance program:

1. New user → in-app communication while booking a ride

2. Menu → profile → ride insurance → toggle insurance ‘on’ (once a customer has given his/her consent, insurance is charged on all his/her future rides unless the toggle is put to ‘off’)

The in-trip insurance will cover the following:

Watch: Vivo V9 Review: First Android Clone of iPhone X in India

Comments

0 comment