views

India’s gross GST revenue collected in the month of July, 2023 is Rs 1,65,105 crore of which CGST is Rs 29,773 crore, SGST is Rs 37,623 crore, IGST is Rs 85,930 crore (including Rs 41,239 crore collected on import of goods) and cess is Rs 11,779 crore (including Rs 840 crore collected on import of goods).

In the latest data released today, the government has settled Rs 39,785 crore to CGST and Rs 33,188 crore to SGST from IGST. The total revenue of Centre and the States in the month of July 2023 after regular settlement is Rs 69,558 crore for CGST and Rs 70,811 crore for the SGST.

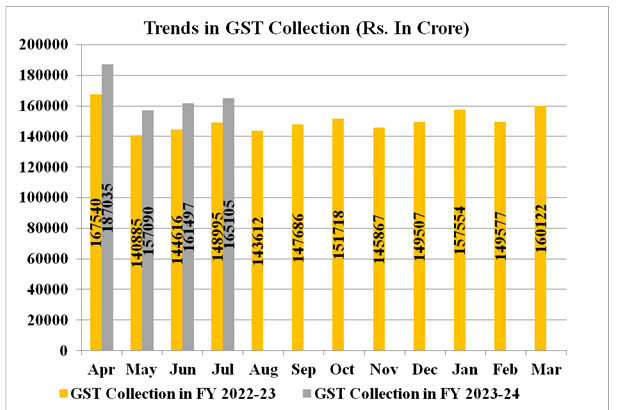

The revenues for the month of July 2023 are 11% higher than the GST revenues in the same month last year.

Also Read: Big News For Exporters! No Automated IGST Refunds On These Items, Check Details Here

During the month, the revenues from domestic transactions (including import of services) are 15% higher than the revenues from these sources during the same month last year. It is for the fifth time, the gross GST collection has crossed Rs 1.60 lakh crore mark.

In June, GST collection was Rs 1,61,497 crore.

Abhishek Jain, partner and national head – indirect tax, KPMG, said, “The continued growth in GST collections with 1.6L and above being the norm brings a substantial cheer. With approaching normal period of limitation for FY 17-18 and approaching festive season, this cheer is expected to only increase.”

Comments

0 comment