94

views

views

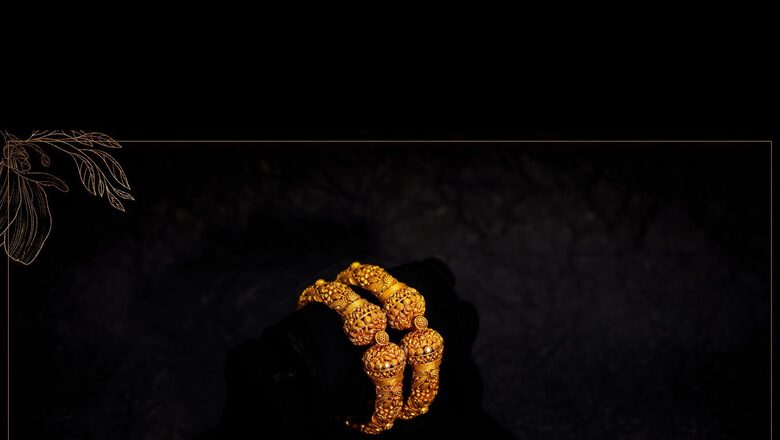

Many lenders offer gold loan per gram based on the purity of your gold jewellery, at minimal rates of interest, and with multiple options for repayment.

Financial emergencies often come unannounced. In situations where your regular source of income falls short, getting a loan against your gold jewellery can be one of the smartest sources of instant funding. Due to its high market value, you can pledge your gold jewellery to get a gold loan for a value as high as Rs. 2 crore. Many lenders offer gold loan per gram based on the purity of your gold jewellery, at minimal rates of interest, and with multiple options for repayment.

Read on to know how a gold loan can help you during financial emergencies.

- Medical emergenciesIn the past two years, we have learned that medical emergencies often lead to huge expenses that sometimes are not covered by insurance. The best gold loan comes in handy during such situations because of their easy credit eligibility and hassle-free documentation process. You just need to bring your pure gold jewellery and basic KYC documents to your nearest gold loan branch for quick disbursal of funds.

- Agricultural needsIf you are struggling to meet the varying expenses of your farm, taking a loan against gold jewellery can be a great way to overcome this. This helps you manage your large expenses like buying land, irrigation equipment and other farm machinery, raw materials, and more. Reputed lenders like Bajaj Finserv offer these loans with easy repayment plans and part-release facility, making the loan affordable.

- Business expansionShortage of funds can often put your business expansion plans on hold. This often results in failure to meet market demand, or loss of opportunity till the situation gets resolved. In such situations, you can get a loan of up to 75% of the total worth of your gold jewellery in the market.Also, as it is a secured loan, gold loan interest rates offered by banks and NBFCs are usually low.

- Home repair Running short of funds while building or renovating your dream house? Get quick access to funds by pledging your 22-karat gold jewellery, otherwise lying idle in your lockers. Most lenders disburse gold loans within a few hours of application with minimal processing fees.

- Education In situations where you do not have enough funds to cover college tuition, meeting the deadline of fee payment becomes a real emergency. In such cases, pledging your gold jewellery to get a loan can be a real lifesaver. As gold is a tangible asset, reputed lenders like Bajaj Finserv offer gold loans up to Rs. 2 crore, with long tenures and a host of other benefits that make these loans convenient, and easy on your budget.

This is a Partnered Post.

Read all the Latest News here

Comments

0 comment