views

Almost a hundred kilometres from where Prime Minister Narendra Modi launched the India Post Payments Bank deploying 3 lakh postmen for doorstep banking on Saturday, Ajit Singh, a postman all his life is not surprised. To him, the new scheme is an urban image of what has been practiced in rural counterparts for ages.

The rollout that made headlines has caught the 65-year-old Singh, a resident of Jewar in Uttar Pradesh, unmoved. He returns to his post-retirement, evening ritual of sipping tea and educating his friends about how post-offices are a better place to park money and carry out other financial transactions than conventional banks, a habit he developed while serving in rural parts of Uttar Pradesh for more than three decades.

"We were banks on cycles in villages. Villagers often approached us for financial assistance. We educated them about various schemes that the post-office offers. Money orders were a regular. This has been going on for ages, way before even I joined as a postman," says Singh.

In the absence of banks in the rural areas, deeply penetrated post offices have long served as the only trusted Central institution where salaries, however irregular, were deposited and money orders were received.

Singh recalls how postmen were treated as family and celebrations began when remittances in the form cash orders dropped in. One of the many instances Singh remembers is one of an army officer whose family had not seen him for a couple of years.

"I remember seeing them cry. They treated me with lunch and blessed me for informing them that their son had sent money. They had not seen him since two years and were in dire need for cash. We were treated as special, as if we were the ones giving them money," recalls Singh, beaming.

He also explains how money orders are almost a folklore now.

"When I tell my children how post-offices helped in transferring money, they laugh. They cannot imagine the concept of anything other than online bank transfers and cheques," laughs Singh.

Meanwhile, back in New Delhi, it seems the Centre is keen on reviving these forgotten practices, ramped up with technological additions along with bringing the forgotten postman back on centre-stage. In an effort to provide a major boost to financial inclusion, PM Modi launched the payments bank of the Indian postal department that will take banking to the doorstep of every citizen, particularly in rural areas, through an unmatched network of post offices and almost three lakh postmen and ‘Grameen Dak Sewaks’.

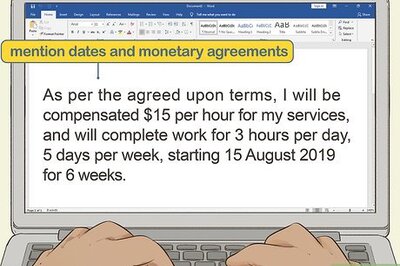

India Post Payments Bank (IPPB) will be like any other bank but its operations will be on a smaller scale without involving any credit risk. It will carry out most banking operations like accepting deposits but can’t advance loans or issue credit cards.

The payments bank will accept deposits of up to Rs 1 lakh, offer remittance services, mobile payments/transfers/purchases and other banking services such as ATM/debit cards, net banking and third-party fund transfers. The government owns 100 percent in IPPB, which has been set up under the aegis of the Department of Posts.

The detailed explanation of the scheme has Singh's octogenarian neighbour amused. He, too, has mostly lived in the rural parts of the country and knows the financial importance of post-offices. The first thing he did after retiring was to open a Senior Citizens Savings Scheme (SCSS) at the post office.

“We are conventional in our thought processes. I wanted to put my life-long savings in a safe place. What better place than a post office? The interest rates are the highest compared to banks and my money is secure too. For people like us, the post office is the best option,” he says.

The Senior Citizens Savings Scheme of the post office currently provides an interest rate of 8.3 percent; one of the highest when compared to both public and private run banks. Therefore, it’s no surprise then that it is a big hit with the retired. Thanks to their wide consumer base, the senior citizen scheme along with a few others provide a major chunk of revenue to post-offices. This gains further importance owing to the dwindling practice of money orders, postal stamps, among others.

Along with SCSS, the Indian post-office provides nine small savings schemes: Post Office Savings Account, 5-Year Post Office Recurring Deposit Account, Post Office Time Deposit Account, Post Office Monthly Income Scheme Account, Senior Citizen Savings Scheme, 15-year Public Provident Fund Account, National Savings Certificates, Kisan Vikas Patra and Sukanya Samriddhi Accounts.

Experts are of the opinion that such schemes have a social cause attached to them. Some of them, such as the SCSS, are also subsidised by the government, which makes them lucrative for pensioners who want stable returns. They affect the lives of the common people directly.

Singh, who knows the benefits of the schemes in details has invested in the Sukanya Samruddhi Scheme offered by the Indian post-office. A legal guardian of a girl child can open this account for a minimum of Rs 1,000 and invest up to Rs 1.50 lakh in a financial year. The interest rate of 8.1 percent is compounded annually. "I found it to be the best scheme that I could invest in till my daughter grows up. I have propagated about the scheme in the villages as well," says a proud former-postman.

While Saturday's rollout did not seem new to the 65-year-old, he did agree that it will help increase penetration of the internet and digitisation in rural areas. At a time when transactions are moving towards a digital interface, it would be interesting to see how the IPPB stands against Paytm Payments Bank and Airtel Payments Bank, and create a consumer base for itself.

Comments

0 comment