views

New Delhi: As the debate rages over the CIA’s classification of the Vishva Hindu Parishad (VHP) as a political pressure group, there’s more that the United States’ intelligence agency mentions in its World Factbook.

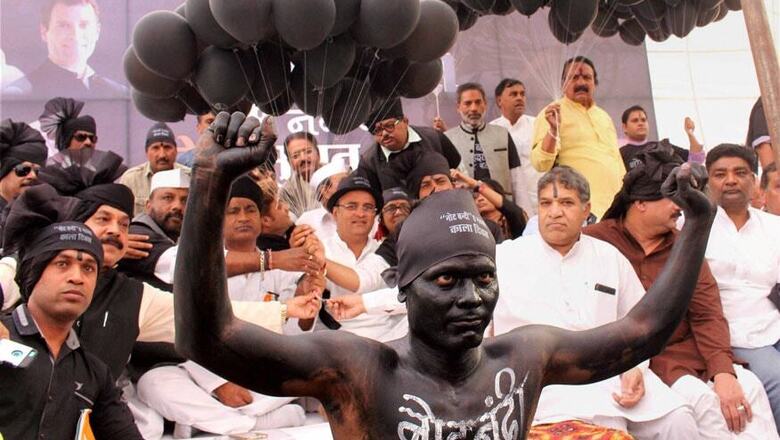

The agency has categorically stated that the Indian economy slowed down in 2017 due to the shocks of demonetisation and Goods and Services Tax (GST).

“The economy slowed in 2017, due to shocks of ‘demonetisation’ in 2016 and introduction of GST in 2017. Since the election, the government has passed an important goods and services tax bill and raised foreign direct investment caps in some sectors, but most economic reforms have focused on administrative and governance changes, largely because the ruling party remains a minority in India’s upper house of Parliament, which must approve most bills,” the CIA said.

The statement, however, is in contrast to the stand of the government, which has for long termed demonetisation and GST successful.

According to government data, GDP at constant (2011-12) prices in the third quarter of 2017-18 is estimated at Rs 32.50 lakh crore, as against Rs 30.32 lakh crore in the third quarter of 2016-17, showing a growth rate of 7.2 percent.

GDP growth rates for first and second quarters of 2017-18 at constant prices are 5.7 percent and 6.5 percent respectively.

The agency further added that despite India having capitalised on its large, educated English speaking population to become a major exporter of information technology services and others, “per capital remains below the world average” and it still has traces of its past autarkic policies.

It added that regardless of a high growth rate as compared to the rest of the world (till 2016), “India’s government-owned banks faced mounting bad debt in 2015 and 2016, resulting in low credit growth. Rising macroeconomic imbalances in India and improving economic conditions in Western countries led investors to shift capital away from India, prompting a sharp depreciation of the rupee through 2016. India’s government-owned banks faced mounting bad debt in 2015 and 2016, resulting in low credit growth and restrained economic growth”.

It also cites India’s long-term challenges, which include the country’s discrimination against women and girls, an inefficient power generation and distribution system, ineffective enforcement of intellectual property rights, decades-long civil litigation dockets, inadequate transport and agricultural infrastructure, limited non-agricultural employment opportunities, high spending and poorly targeted subsidies, inadequate availability of quality basic and higher education, and accommodating rural-to-urban migration.

Comments

0 comment