views

X

Trustworthy Source

US Social Security Administration

Independent U.S. government agency that administers Social Security and related information

Go to source

The amount of annual fraud, however, has been estimated at nearly a billion dollars.[2]

X

Research source

If you suspect fraud, then you should report it to SSA.

Understanding Fraud

Identify fraud. There are many examples of fraud, waste, and abuse which should be reported to the Social Security Administration (SSA). Benefit applicants commit fraud when they: Make false statements on claims. When an individual applies for Social Security Benefits, they must affirm that all information on their forms is true. If they knowingly report false information, then they may have committed a crime. For example, someone may state that they are single on their application when they are married, or that they are blind when they actually have a driver’s license and are seen driving. Hide facts that might affect eligibility. An individual can commit fraud by omission as well as misstatements. If an applicant does not disclose relevant information that would affect their eligibility (such as receiving worker’s compensation benefits when applying for disability benefits), then they have also committed fraud. For example, a person may be in jail but fail to report that fact, or they may continue to collect and cash checks when a beneficiary has died.

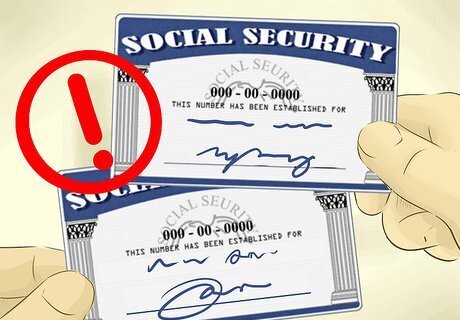

Recognize fraud committed by third parties. Fraud isn’t committed solely by beneficiaries. Other people can commit fraud which you should report to SSA. Individuals also commit fraud when they: Misuse benefits. When a Social Security beneficiary cannot handle his or her own finances, SSA will appoint someone to act as a Representative Payee. If this person misuses Social Security Benefits, then they may have committed a crime. For example, the Representative must spend the benefits on the beneficiary’s immediate needs, such as food, clothing, shelter, utilities, and medical care. Any left-over funds should be invested on behalf of the beneficiary, not spent by the Payee for their own benefit. Buy or sell Social Security cards. It is a crime to buy or sell legitimate or counterfeit Social Security cards. Run a scam impersonating an SSA employee. Sometimes a person who pretends to be an SSA employee will call people in the hopes of stealing their identity or money from their bank accounts. You should not release this information to someone who calls you; instead, you should report the incident as fraud. Bribe a Social Security Administration employee. It is illegal to offer an SSA employee something of value (such as money or gifts) in exchange for government services. Likewise, it is fraud for an SSA employee to accept a bribe. Misuse grant or contracting funds. SSA administers many contracts and grants. Any fraud, waste, or mismanagement of this money should be reported. For example, a contractor may have used an SSA grant to purchase substandard supplies, or the contractor may have bribed an SSA employee in order to win a contract.

Be alert to fraud committed by SSA employees. SSA also seeks to eliminate fraud and abuse committed by its own employees. Employees most commonly commit fraud when they violate their standards of conduct. SSA employees are bound by an ethical code. If an SSA employee violates this code, they should be reported. For example, an employee violates the ethical code when he or she fails to obey an federal, state, or local law or regulation.

Confirm that fraud has been committed. What might look like fraud or abuse to one person may be perfectly reasonable given all of the facts. For example, you might think that someone failed to report their worker’s compensation when they applied for disability benefits; however, that person may have ended their worker’s compensation by the time they applied. Before reporting alleged fraud to SSA, you should have a reasonable suspicion that fraud is being committed. Although you don’t have to be one hundred percent sure, you don’t want deprive someone of a vital form of financial support unless you have a legitimate reason to think someone is committing fraud, waste, or abuse. If you are worried that a Payee Representative has misused funds, you might want to speak to the beneficiary and gently ask if he or she knows what their SSA benefits are being spent on. If the beneficiary does not know, then you might want to follow up with the Payee Representative and ask. Also, if you think someone has falsely reported that they are blind when you see them driving around town, you might want to clarify with the individual whether or not they claim to be legally blind.

Gather evidence. If you are reasonably sure that someone is committing Social Security fraud, then you should try to document the fraud as best as you can. Write down the reasons why you think fraud has been committed. What have you seen, heard, or been told that makes you suspicious? If someone is buying or selling fraudulent Social Security cards, document how much the cards cost and how payment is made. Also write down how individuals contact the seller. If you think an SSA employee has committed a crime, then hold onto copies of any paperwork that supports your suspicion, such as emails, internal memos, or handwritten notes. If you think the death of a beneficiary has not been reported to SSA, then you should clip out any obituary from the newspaper or print off the obituary from the web.

Understand whistleblower protection. If you are a federal employee and seek to expose fraud, waste, or abuse in SSA, you should realize that you are protected by whistleblower laws. Under these laws, SSA cannot retaliate against you solely because you submitted an allegation of fraud, waste, or abuse.

Reporting the Fraud

Report online. You can submit a report at https://www.socialsecurity.gov/fraudreport/oig/public_fraud_reporting/form.htm. You will be asked to provide as much of the following information as you can: Whether you are filing as a private individual or business. Your personal contact information, such as name, address, home and work phone numbers, as well as your Social Security number. Whether you are the victim of the violation/fraud. Whether the person committing the fraud is a private individual or a business. The alleged perpetrator’s contact information, date of birth, sex, race, and state of birth. If the perpetrator is a business, then provide the business’s contact information and Employer Identification Number. The primary victim’s name, contact information, Social Security number, date of birth, sex, and race. A summary of the fraud. Provide the “who, what, where, when, how, and why” to describe the violation. You are given 4000 characters. Also name anyone else who you think has information of the fraud.

Report by phone. If you do not want to submit a report online, you can report by telephone. Call toll free at 1-800-269-0271. Someone will be available from 10:00 am to 4:00 pm Eastern Standard Time. For the deaf or hard of hearing, call 1-866-501-2101. If you cannot reach anyone at the above number, then call 1-800-772-1213 from 7:00 am to 7:00 pm. You may also report fraud to any Social Security office. The information will then be forwarded on.

Report by mail. If you don’t want to call or report online, you can write a letter containing the necessary information and mail it to Social Security Fraud Hotline, P.O. Box 17785, Baltimore, MD 21235. You may also fax the letter to 410-597-0118.

Choose whether to remain anonymous. You have the ability to report fraud anonymously. However, the Social Security Administration could be limited in the kind of investigation it conducts if you choose anonymity. Know that if you choose not to remain anonymous, you can still ask SSA to keep your name confidential. If you do so, the office will protect your identity unless required to disclose it by order of law (such as a subpoena or court order).

Send SSA requested documents. Once SSA receives your report, the agency will conduct an investigation. It cannot update you on the status of the investigation. The agency may, however, contact you for further information or to request any documentation that you have. Provide the requested information as soon as possible. If SSA requests documents, you should send copies, not originals. The agency may not return originals to you.

Comments

0 comment