views

Basic Calculations

Understand credit sales. Credit sales are distinct from cash sales in that the customer is not required to make a full payment on the date of sale. Instead, they purchase their order on account and are allowed a set amount of time in which to make payments. From a business's perspective, this transaction is recorded as revenue, even though payment has not been received. In addition, the amount of the sale is added to "Accounts Receivable," an asset account that records the amount of money owed to the business by its customers. When orders are paid for, the Accounts Receivable account is reduced for the amount of the order and cash is increased.

Sum up individual credit sales. The simplest method used to find total credit sales is to maintain your Accounts Receivable account and to update it for each sale made on credit. This method is most accurate as it accommodates for changing product prices as well as all cash sales. If you want a total for annual or quarterly credit sales, you can simply start recording a credit sales amount at the beginning of that period. Then, each time you update accounts receivable, you can add to the sale amount to your credit sales amount for that period. Remember that sales tax is included in credit sales amounts.

Calculate credit sales from total sales. Total sales can be calculated as number of goods sold multiplied by the selling price. However, this can be complex if you offer different products at different prices. For example: If a company sold 100 unites of laptops at $100 a piece, its sales would be 100 × 100 = $ 10 , 000 {\displaystyle 100\times 100=\$10,000} 100\times 100=\$10,000. To calculate credit sales, start by finding the cash received. Lets assume that the customers on an average paid $60 in cash for those 100 laptops, so cash received would be $6000. Then, you can calculate credit sales by reducing total sales by total cash received. The credit sales would be equal to total sales minus cash received, which in this example is $ 10000 − $ 6000 = $ 4000 {\displaystyle \$10000-\$6000=\$4000} \$10000-\$6000=\$4000.

Calculate credit sales from accounts receivables. The initial value at the start of the year can be seen from the balance sheet of the company. Let's assume the value to be $10000. Start by finding the ending accounts receivable. It is the value at the end of the year which can also be found out from the balance sheet itself just like initial accounts receivables. Let's assume it to be $5000. Then, determine the cash received. This should be in the company's records. Let the cash received for the year be $20000. Finally, calculate credit sales by finding the difference. So the credit sales can be calculated as (cash received - initial accounts receivable + ending accounts receivable). In the example above, it would be $20000 - $10000 + $5000 = $15000. So the credit sales would be $15000 for the year.

Net Credit Sales

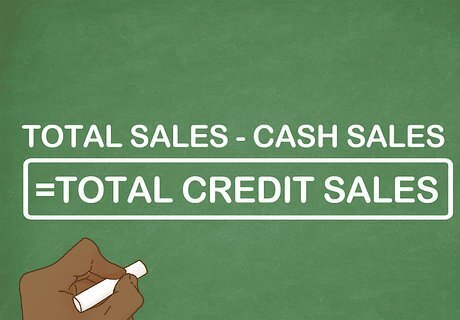

Start with total sales on credit. Net credit sales is a measure of how much credit a business extends to its customers. It takes into account any reductions in credit sales caused by discounts, returns, and other allowances. Net credit sales is also useful for calculating a number of financial ratios. To find net credit sales, start with total sales on credit for a given period. Remember to reduce total sales by cash sales to get total credit sales. For example, a company might have $200,000 in credit sales over the course of a year. Start with this value to calculate net credit sales. Total sales on credit can be found using the methods from part of this article titled "Calculating Credit Sales."

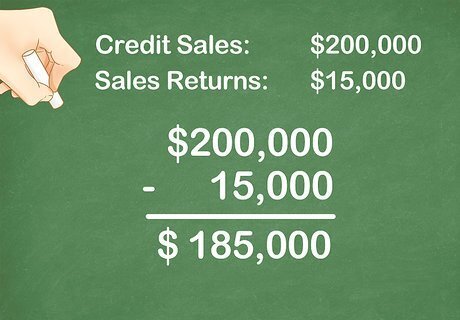

Reduce credit sales by sales returns. Most businesses will experience a loss in credit sales as customers return defective or unwanted items. Returns, then, are recognized as a reduction to net credit sales. Sum up all returns made on credit sales over the course of the period. Then, subtract the total value of these returns from credit sales. If the company from the previous example had $15,000 in returned items over the same year, they would reduce their $200,000 in credit sales by the $15,000 to get $185,000. This information can be found in the general ledger account Sales Returns and Allowances.

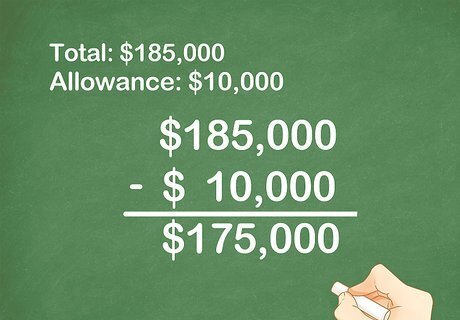

Subtract allowances. Allowances are discounts given to customers for a variety of reasons. For example, a company might allow early-payment discounts or apologize for an order that arrived late by reducing its price. These allowances also reduce net credit sales. Add up the total value of all allowances on credit sales over the period and subtract this amount from your total. For example, if the same company had $10,000 in allowances over the year, then they would further reduce their $185,000 total to $175,000. These transactions can be found in the general ledger under Sales Returns and Allowances.

Add back in returns and allowances on cash sales. The reductions made on net credit sales up to this point should have only been those returns and allowances made on credit sales. The best way to ensure accuracy in these calculations is to keep these accounts for credit sales separate from those for cash sales. However, many businesses do not keep these accounts. Go back and look at your values for returns and allowances and identify any additions that were related to cash sales rather than credit sales. You will then have to add the value of these sales back into your total. For example, if the previous company determined that $5,000 worth of its returns were actually made on cash sales, it would have to increase its net credit sales value by $5,000. This would give a net credit sales value of $175,000 + $5,000, or $180,000.

Credit Sales Ratios

Calculate a business's percentage of credit sales. Finding a business's percentage of credit sales will tell you what proportion of their total sales were made as credit sales. This can be calculated by dividing net credit sales by total sales for the period. The result should be expressed as a percentage. It can then be compared to the same value for other companies. This ratio can also be used to assess a company's susceptibility to liquidity issues, as a higher percentage of credit sales means that the company is dependent on its customers' timely payments to maintain its cash flows. For example, if a business had $200,000 in total sales over a period of time and $140,000 of those were credit sales, their percentage of credit sales would be 70 percent. This means that a large majority of their sales are made on credit and means little to a business owners on its own. However, if combined with a long or increasing collection time, this may be a cause for concern, as the business is exposed to consider liquidity risk. A manager might respond in this case by extending credit to fewer customers.

Determine an allowance for bad debts. In some cases, customers may never make payments on sales made on credit. In these cases, the loss is written as the "allowance for bad debts." This account is an expense recorded on the balance sheet and represents the expected proportion of accounts receivable that are likely to go uncollected (even if the accounts in questions are not late yet). To calculate the allowance for bad debts, look at previous periods and compute the percentage of debts that went unpaid. Average them and multiply the result by current accounts receivable to get your allowance for bad debts. The allowance can be set by a variety of different methods, including a pure guess, since it is reconciled at the end of an accounting period.

Calculate accounts receivable turnover. Accounts receivable turnover represents how frequently a business is able to collect on its credit sales within a period. Specifically, it is calculated as Net Credit Sales ÷ Average Accounts Receivable {\displaystyle {\text{Net Credit Sales}}\div {\text{Average Accounts Receivable}}} {\text{Net Credit Sales}}\div {\text{Average Accounts Receivable}}. The result, which will be a number likely greater than one, will tell you how many times, on average, accounts receivable are collected upon during the period. A high value indicates that payment for credit sales is collected efficiently, whereas a low value generally means that it does not. Values are judged as relatively high or low within an industry. Overall, the goal should be to increase this ratio over time. However, a very high ratio may mean that the business is using overly-strict collection policies. For example, if a business had average accounts receivable of $50,000 for the year and $600,000 in net credit sales for the same year, its receivable turnover would be 12. This result may be relatively high or low, depending on the industry the business operates in.

Convert turnover to average collection period. This ratio is calculated as 365 ÷ Accounts Receivable Turnover {\displaystyle 365\div {\text{Accounts Receivable Turnover}}} 365\div {\text{Accounts Receivable Turnover}}. The result represents how many days the average credit sale stays in accounts receivable until being paid. This ratio can be analyzed to figure out how liquid a company is versus its historical liquidity or against that of other companies. It can also be used to determine how efficient collections are versus extension of credit. This ratio is simply another expression of accounts receivable turnover. Ideally, the average collection period should be reduced over time by improving collection efficiency.

Comments

0 comment