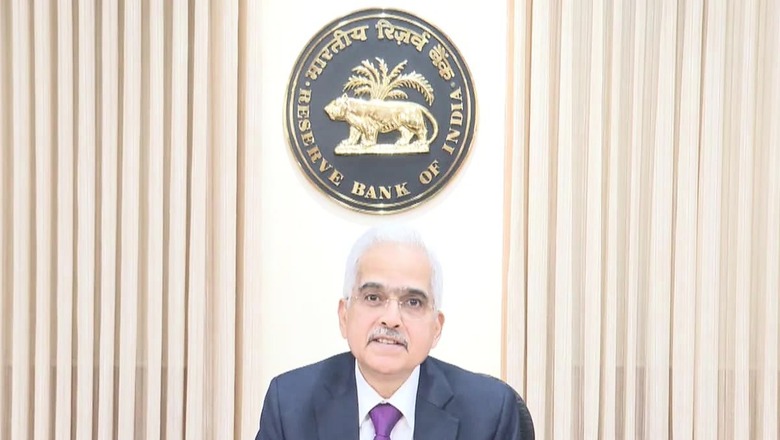

Why Has RBI Raised FY25 GDP Growth Projection? What Shaktikanta Das Said On Indian Economy, Rate Cut

views

Interest rates in the country are expected to remain unchanged for some time as the Reserve Bank of India (RBI) has decided to keep the repo rate unchanged at 6.5 per cent. While announcing the monetary policy, RBI Governor Shaktikanta Das on Friday raised GDP growth forecast for FY25 to 7.2 per cent as against 7 per cent earlier.

Though the repo rate decision is in line with analysts’ expectations, the upward revision in FY25 GDP growth is contrary to the analysts’ expectations as they expected a downward revision due to a high base of 8.2 per cent in FY24.

“At the moment, the Indian economy is at an inflection point in its path towards greater transformational changes that will bring about more stability and growth,” Shaktikanta Das said in the monetary policy statement.

Shaktikanta Das on Domestic Economy

The RBI governor said the inflation-growth balance in India is moving favourably, growth is holding firm, and inflation continues to moderate, mainly driven by the core component, which reached its lowest level in the current series in April 2024.

The deflation in fuel prices is ongoing. Food inflation, however, remains elevated.

“During 2024-25 so far, domestic economic activity has maintained resilience. Manufacturing activity continues to gain ground on the back of strengthening domestic demand. The eight core industries posted healthy growth in April 2024. Purchasing managers’ index (PMI) in manufacturing continued to exhibit strength in May 2024 and is the highest globally,” Das said.

Looking ahead, the forecast of above normal south-west monsoon by the India

Meteorological Department (IMD) is expected to boost kharif production and replenish the reservoir levels, he added.

“The developments relating to growth and inflation are unfolding as per our

expectations. When the projected GDP growth of 7.2 per cent for 2024-25

materialises, it will be the fourth consecutive year with growth at or above 7 per cent,” he said.

On inflation, the RBI governor said headline CPI continues to be on a disinflationary trajectory. This is evident from the decline in headline

inflation by 2.3 percentage points between Q1: 2022-23 and Q4 of 2023-24.

Supply-side developments and government measures also contributed to this moderation of headline inflation. Repeated food price shocks, however, slowed down the overall disinflation process, he added.

The RBI has kept the inflation forecast for FY25 unchanged at 4.5 per cent.

“Real GDP growth for 2024-25 is projected at 7.2 per cent with Q1 at 7.3 per cent; Q2 at 7.2 per cent; Q3 at 7.3 per cent; and Q4 at 7.2 per cent,” the RBI said in the second bi-monthly monetary policy on FY25.

Shaktikanta Das On Global Economy

In the recent years, the world has gone through one crisis after another; and the pattern continues. Even against this backdrop, the Indian economy exhibits strong fundamentals, together with financial stability and positive growth momentum, Das said.

Global growth is sustaining its momentum in 2024 and is likely to remain

resilient, supported by rebound in global trade. Inflation is easing, but the final leg of this disinflation journey may be tough. Central banks remain steadfast and datadependent in their fight against inflation.

While gold prices have surged on safe-haven demand, equity markets have gained in both advanced and emerging market economies since the last MPC meeting, he added.

On US Fed Rate Cut Expectations

RBI Governor in his monetary policy statement said, “Market expectations regarding the timing and pace of interest rate cuts are changing with incoming data and central bank communication.”

Later, while addressing the press conference on Friday, the RBI governor said, “Even if US Fed eases (on interest rates), we may not.”

On Friday, June 7, the RBI’s Monetary Policy Committee decided to keep the key repo rate unchanged for the eighth consecutive time at 6.5 per cent, mainting the stance of ‘withdrawal of accommodation’. The decision has been taken with 4:2 majority. The RBI has revised upwards FY25 GDP projection to 7.2 per cent as against 7 per cent earlier. However, it projects CPI inflation for 2024-25 same at 4.5 per cent.

The RBI MPC also kept the SDF unchanged at 6.25 per cent, and MSF and Bank Rates maintained at 6.75 per cent. The SDF is the lower band of the interest rate corridor, while the MSF is the upper band.

Comments

0 comment