views

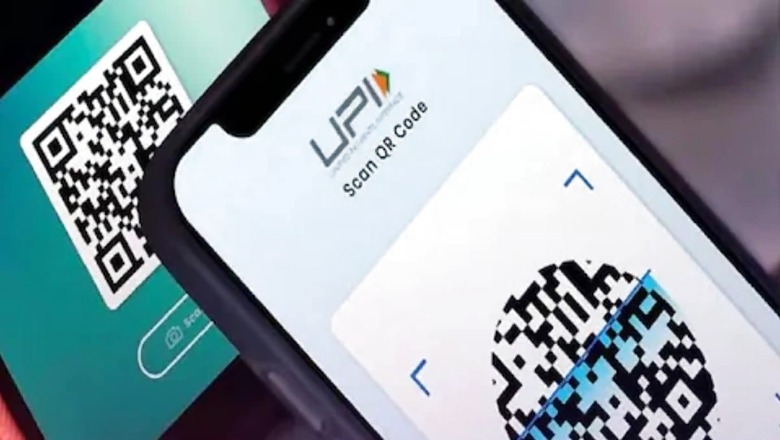

BOBCARD LIMITED, a wholly owned subsidiary of Bank of Baroda, has announced the introduction of its EMI service on UPI Payments in partnership with RuPay.

The new feature allows RuPay BOBCARD holders to seamlessly convert their purchases into EMIs by scanning a QR code through the UPI app, providing a more convenient and hassle-free payment experience, the company said.

BOBCARD Limited, a Non-Banking Financial Company, (formerly known as BOB Financial Solutions Limited) was established in 1994.

How Does It Work?

Through this facility, RuPay BOBCARD holders can use UPI for payments at any;

- UPI-accepting merchant, both online and offline, and convert their transactions into EMIs at the point of purchase.

- Customers can apply for the EMI facility directly on their linked RuPay credit card through any UPI app, where the UPI PIN serves as user consent upon acceptance of the relevant terms and conditions.

- At checkout, users can select the EMI option at the time of payment, allowing them to choose their preferred EMI period during shopping.

- The process is entirely digital, requiring no additional paperwork, making it a hassle-free experience.

- Furthermore, the UPI app allows users to track their ongoing EMIs, ensuring timely payments and full transparency—essential during the high-spending festive months.

- Customers can also convert past purchases made with their RuPay credit card into EMIs by accessing their transaction history on the UPI app.

This initiative is designed to meet the growing demand for flexible payment options during the festive season and aims to drive the adoption of digital credit solutions across India, particularly in Tier 2 and Tier 3 cities, the company added.

Ravindra Rai, whole-time director, BOBCARD LIMITED, said, “We are thrilled to introduce the EMI feature on UPI in partnership with RuPay, marking a significant step towards enhancing customer convenience. This feature empowers our customers with greater flexibility and control over their finances, aligning with our commitment to delivering innovative solutions that meet customer’s evolving needs.”

Things To Keep In Mind While Availing EMI Service on UPI Payments From Any Lender

The convenience of UPI payments has been further enhanced with the introduction of EMI options. However, it’s essential to understand the nuances before opting for such services offered by any financial institution.

Here are some key points to consider:

Read the Fine Print: Each UPI provider and bank may have different terms for their EMI services. Carefully review the terms and conditions, including penalties for late payments and any hidden charges.

Easy Access to Credit: The convenience of EMI options can make it easier to make larger purchases without fully considering the financial implications.

Compare Rates: Interest rates for EMI on UPI payments can vary. Compare offers from different banks or UPI apps to find the most favorable terms.

While EMI can lower monthly payments, the total cost of the purchase due to interest can be significant, especially for higher-value items.

Choose Wisely: Select a tenure that aligns with your financial capabilities and repayment preferences. A longer tenure might mean lower monthly payments but higher overall interest costs.

Deferred Payments: The ability to spread payments over time can create a false sense of affordability, leading to purchases that might not be sustainable in the long run.

Comments

0 comment