views

The RBI Monetary Policy Committee (MPC) had met to discuss the assessment of the evolving domestic and global macroeconomics as well as financial conditions of India. During these sessions concerns about the third and fourth wave of Covid-19 were quelled somewhat as the MPC decided to take a more accommodative stance for as long as necessary in an attempt to revive and sustain the growth of the economy in the wake of the pandemic.

The committee had maintained a positive outlook on the matter and made it clear that it expects the economic activities to gain momentum in the days to come. This prediction was made on the basis of progressive upscaling of vaccinations, continued large policy support, buoyant exports among other adaptations that have been made to the Covid-19 protocols in place. The committee also gave credit to benign monetary and financial conditions for playing a role in these positive expectations.

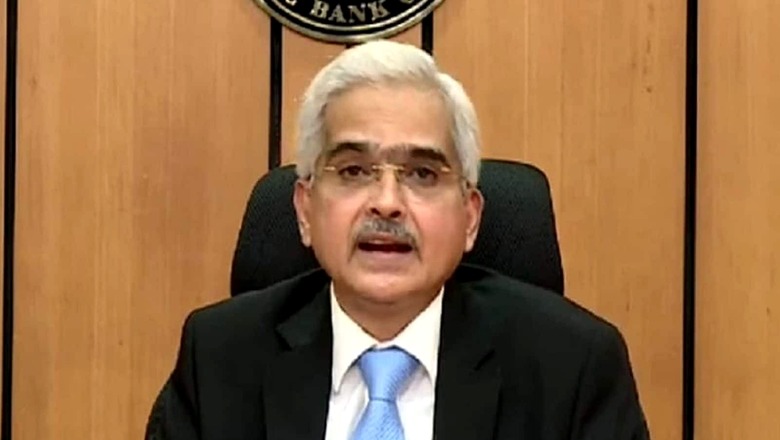

Speaking on the outlook of the next wave of the virus, Governor Shaktikanta Das said, “As the COVID-19 second wave ebbs, there is optimism that with adequate pandemic protocols and ramp-up in the vaccination rate, we should be able to tide over a third wave, if it occurs. As a nation, we should continue to be vigilant and ready to proactively deal with any resurgence of the pandemic with more rapidly transmissible mutants of the virus, should it happen.”

During the sessions, the MPC had unanimously decided that the policy for the repo rate would be unchanged and that the repo rate would be kept at 4 per cent. The Reserve Bank of India (RBI) acknowledged the strong growth and the negative surprise on the inflation front. It should be noted that while there are no substantial changes to the policy, the bond market participants were told that they will have to take the more nuanced change in language more seriously. It should also be noted that there is a possibility of the yields at the 10-year end could edge up to 6.50 per cent over time. It was advised that investors should invest in bond funds with less than a 3-year maturity to mitigate the risk to the interest rate.

The RBI projected that the Consumer Price Inflation (CPI) would hit 5.7 per cent by FY22 and 5.1 per cent by Q1 of FY23. Das had added to this projection and stated that the central bank projected the CPI at 5.9 per cent in the second quarter of FY22 and 5.3 per cent in Q3.

Adding to the concern of inflation in light of the pandemic, Das said, “Before the onset of the pandemic, headline inflation and inflationary expectations were well anchored at 4 per cent, the gains from which need to be consolidated and preserved. Stability in inflation rate fosters credibility of the monetary policy framework and augurs well for anchoring inflation expectations. This, in turn, reduces uncertainty for investors, reduces term and risk premia, increases external competitiveness and, thus, is growth-promoting. Since the start of the pandemic, the MPC has prioritised revival of growth to mitigate the impact of the pandemic.”

“The recovery remains uneven across sectors and needs to be supported by all policy makers. The Reserve Bank remains in “whatever it takes” mode, with a readiness to deploy all its policy levers – monetary, prudential or regulatory. In parallel, our focus on preservation of financial stability continues. At this juncture, our overarching priority is that growth impulses are nurtured to ensure a durable recovery along a sustainable growth path with stability. In this endeavour, we have consciously chosen optimism over gloom,” said Das.

India has seen more than 44,643 new Covid-19 cases on Friday, August 6. There have also been reports of around 464 deaths in the last just in the last 24 hours according to Union ministry data. A total of 1,640,287 tests were conducted the previous day. The current recovery rate stands at 97.36 per cent. The country has 414,159 active cases at present. As many as 495,327,595 people have been vaccinated so far across India.

Read all the Latest News, Breaking News and Coronavirus News here.

Comments

0 comment