views

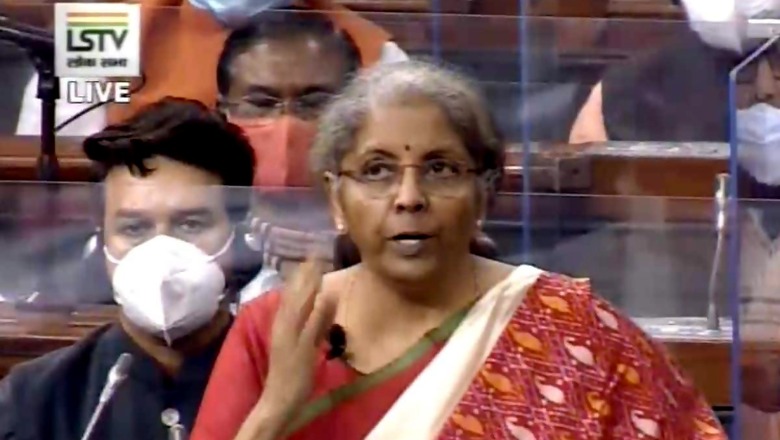

Finance Minister Nirmala Sitharaman’s third budget in two years was one that registered unprecedented fiscal deficit, an intent that is definitely encouraging for an economy that has been beaten to the ground by a ‘once in a century crisis’. Being compared to its 30-year-old counterpart, when the then Finance Minister Manmohan Singh opened the Indian economy for liberalisation, Sitharaman’s budget will be remembered for uplifting living standards of the populace in the face of a battered fiscal.

Budget 2021’s tone was clear: reviving the severely hit urban population while making sure that the rural folk is not left wanting.

It is common knowledge that cities are the engines of growth. About a third of India lives in its urban centres but contributes twice their size to the GDP. This, along with India’s aspiration to become a $5-trillion-economy by 2024 were what may be considered as the foundation thought behind the Budget.

The annual economic exercise addressed five of India’s biggest urban concerns: water, housing, transportation , hygiene and, ofcourse, money.

Sitharaman in her budget speech in the Parliament on Monday announced a mission to provide universal water supply to areas under all 4,378 urban local bodies and the next phase of the Swachh Bharat Mission focusing on management of sludge, waste water and construction and demolition waste in cities.

This mission will be implemented over the next five years with an expenditure of Rs 2.87 lakh crore.

The Swachh Bharat Mission (Urban), which was being implemented by the Housing and Urban Affairs Ministry, is set to get a second round. It will be implemented over five years – 2021 till 2026 – with an outlay of Rs 1.41 lakh crore.

In order to further felicitate urban commute, Sitharaman announced a new scheme for public buses and extension of the Metro networks in Kochi, Chennai, Bengaluru, Nagpur and Nashik. A total of Rs 18,000 crore was allocated for this. The scheme aims to deploy innovative PPP models to enable private sector players to finance, acquire, operate and maintain over 20,000 buses.

Two new Metro technologies, MetroLite and MetroNeo, will be used in the tier-2 cities and peripheral parts of the tier-1 cities to provide Metro connectivity at a lower cost compared to conventional Metro systems.

The budget for metro projects in the Housing and Urban Ministry grew from Rs 14,470 crore in 2018 to Rs 18,908 crore in 2019.It has now an increased allocation of Rs 23,500 crore.

Sitharaman also extended the affordable housing benefit by one more year until March 2022. The FM also announced tax exemption for rental housing projects in her Budget speech. The income tax rebate of Rs 1.5 lakh for affordable home loans will continue until March 2022, she said.

In order to promote supply of Affordable Rental Housing for the migrant workers, it is also proposed to allow a new tax exemption for the notified Affordable Rental Housing Projects, she said. The finance minister also said that the government is committed to provide affordable rental housing for migrant workers.

Further, the Budget made space for easing norms around setting up of One Person Company (OPC) by reducing the residency limit of NRIs from 182 to 120 days. Earlier, only Indian resident citizens were allowed to form one person companies in India.

While the urban population may complain that personal income tax respite was not provided, the Finance Minister focussed on ease of compliance this year.

To further simplify income income tax filing, capital gains from listing securities and interest income to come pre-filled in ITRs, FM announced. The Central government also proposed to make income tax appellate tribunals faceless and set up national income tax appellate tribunal centre. Further, exemption from tax audit limit was doubled to Rs 10 crore turnover for companies doing most of their business through digital modes.

Also, in a relief to senior citizens, Sitharaman announced that no income tax filing required for seniors citizens above 75 years of age and who have income only from pension and interest income in the Union Budget 2021.

It was not as if the Budget turned a blind eye towards those living outside cities.

The Agriculture and Farmers’ Welfare Ministry has got 5.63 per cent more budget allocation at Rs 1,31,531 crore for 2021-22. Among the key central schemes, a major allocation of Rs 65,000 crore has been made for PM-KISAN, allocation for the Pradhan Mantri Annadata Aay Sanrakshan Yojana (PM-AASHA) has been increased to Rs 1,500 crore.

Similarly, the allocation for formation and promotion of 10,000 farmer producer organisations (FPOs) has been increased to Rs 700 crore from Rs 250 crore, while agriculture infrastructure fund has been raised to Rs 900 crore from Rs 208 crore.

The allocation for Pradhan Mantri Krishi Sinchai Yojana (PMKSY)- Per Drop More Crop has been increased substantially to Rs 4,000 crore from Rs 2,563 crore in the revised estimated for 2020-21.

Mahatma Gandhi National Rural Employment Guarantee Act, the social security scheme that aims to guarantee the ‘right to work’ by giving livelihood security in rural areas through 100 days of wage employment, has received an allocation of 73.000 crores for the financial year 2021-2022.

Therefore, while there is a definite booster shot being injected into the urban space, it has been made sure that its counterpart does not turn malnourished.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment