views

The Indian mutual fund industry has witnessed several interesting trends in recent times, and flexi-cap funds are right at the centre among some of them. These funds are a type of mutual fund that invests across companies of all market capitalisations – large, mid, and small.

Market capitalisation (market cap for short) refers to the total market value of a publicly traded company. It essentially reflects the investor’s perception of a company’s overall worth.

Mutual Fund Trends:

- Rising SIP Investments: Systematic Investment Plans (SIPs) are gaining traction, indicating a shift toward long-term wealth creation through disciplined investing.

- Increased Focus on Equity Funds: Equity mutual funds, including flexi-cap, are attracting more investors compared to fixed-income options, reflecting a growing risk appetite.

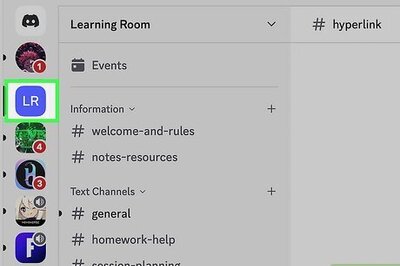

- Digital Adoption: Online platforms and mobile apps are making mutual fund investments easier and more accessible for a broader audience.

- Focus on Diversification: Investors are recognising the importance of diversification, and flexi-cap funds cater to this need perfectly.

Flexi Cap Mutual Fund Meaning

The term “flexi-cap” denotes flexibility in the fund manager’s investment approach, allowing them to dynamically allocate assets across different market segments based on their assessment of market conditions, valuation levels, and growth prospects. Unlike large-cap or mid-cap funds, flexi-cap funds are not restricted to a specific market cap range. This gives the fund manager the flexibility to invest in companies that they believe have the best growth potential, regardless of their size.

Some key features of flexi-cap funds:

- Diversification: Flexi-cap funds offer diversification by investing across market capitalisations. This diversification helps reduce the risk associated with investing in a particular segment of the market.

- Market Flexibility: Unlike funds that are restricted to specific market segments such as large-cap or mid-cap, flexi-cap funds have the flexibility to adjust their allocation based on changing market conditions. Fund managers can tilt the portfolio towards segments they believe offer better growth opportunities.

- Risk-Return Profile: Flexi-cap funds typically offer a balanced risk-return profile. By investing across different market capitalisations, they aim to capture opportunities for both capital appreciation and downside protection.

- Active Management: Since flexi-cap funds involve actively managing the portfolio, investors rely on the expertise of the fund manager to make investment decisions. The fund manager’s ability to identify promising investment opportunities across market segments is crucial for the fund’s performance.

- Potential for Outperformance: Flexi-cap funds have the potential to outperform funds that are constrained to specific market segments, especially during periods when certain market segments are performing better than others. The flexibility to adapt to changing market conditions can give them an edge in generating returns.

Investors considering flexi-cap funds should evaluate the track record and investment approach of the fund manager to ensure alignment with their investment goals.

Do your research before investing

If you’re considering investing in flexi-cap funds in India, it’s important to do your research and understand the risks involved. You should also consider your investment goals and risk tolerance before making any investment decisions.

Investors must note that mutual fund investments are subject to market risks. They should read all scheme-related documents carefully before investing. The Net Asset Value (NAV) of the units issued under the schemes of the fund can go up or down depending on various factors affecting the securities market, including fluctuations in interest rates.

Also, the past performance of any scheme or the Asset Management Company (AMC) / any other mutual fund is not necessarily indicative of the future performance of the schemes. The mutual fund does not guarantee or assure any dividend under any of the schemes and the same is subject to availability of distributable surplus. Investors are advised to consult their financial advisor to understand the suitability of the scheme for their risk profile and specific investment objectives.

Comments

0 comment