views

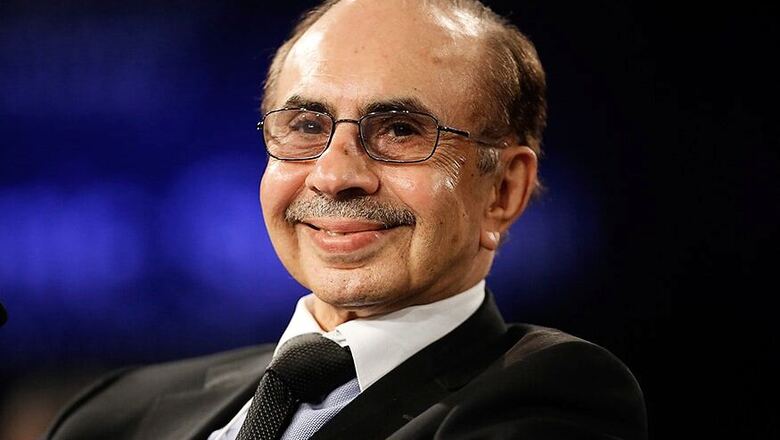

The Union Budget did not have too many provisions for economic revival, Adi Godrej, the chairman of Godrej Group said after meeting finance minister Nirmala Sitharaman Friday to renegotiate surcharge on overseas investors earning above a certain limit in the backdrop of an economic downturn.

The meeting with foreign portfolio investors (FPIs), attended by key ministry representatives, including tax officials, was organised to signal that the government is open to reviewing an unintended tax burden on them following the budget proposal to increase tax surcharge on the super-rich.

“Several things needs to be done. The economy has slowed down. Unfortunately, the budget didn’t have too many provisions of reviving the economy. Now it is clearer and I hope that the government does something,” Godrej was quoted as saying by CNBC-TV18.

The higher tax surcharge on the super-rich - that came into force with the President signing the Finance Bill (2), 2019 into law on August 1 - flustered FPIs and resulted in withdrawal of funds worth $1.93 billion in July.

Critical of this move, Godrej said that perhaps it would’ve been best if it was never done. “Now we do not need to correct the situation and then we have to see whether the economy picks up,” he was quoted as saying.

The government was pushed to the wall in face of economic slowdown and was forced to start consultations with the industry to re-work an arrangement.

About rollback of the surcharge for FPI, Godrej said, “The market will be reassured to a certain extent.” On stimulus package front, he said, “Not assured but they are looking at it.”

To grant concessions to FPIs, the government will need the approval of Parliament or may have to get an Ordinance promulgated since it cannot undo what is in the law with an executive order.

The higher surcharge is applicable to individuals, Hindu Undivided Families (HUFs) and Association of Persons (AoPs), including trusts that are assessed as AoPs. It had been increased from 15% to 25% in cases where income is in the ₹2-5 crore range and from 15% to 37% in the case of those earning more.

Comments

0 comment