views

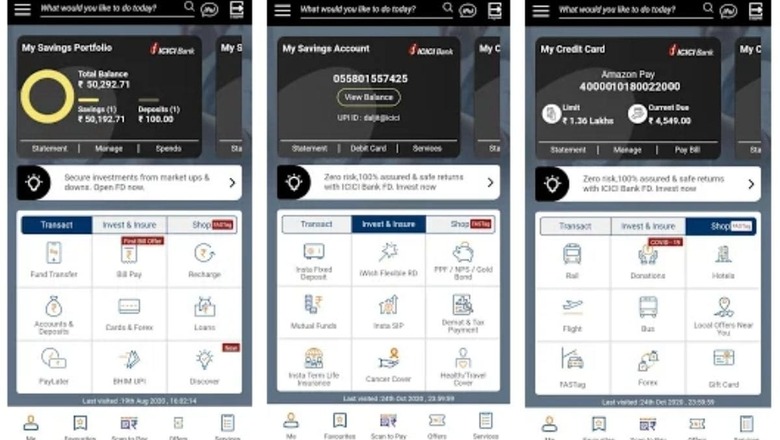

ICICI Bank has announced that over a million customers from other banks have started using the ‘iMobile Pay’ app, nearly three months after it extended the platform to all users. In a statement, the Mumbai-based bank says that it anticipates the number is likely to double in two months. On the other hand, the iMobile Pay app for Android and iOS offers over 170 banking services to its native customers. ICICI Bank adds that its mobile app has recorded a fair amount of traction from large metros like Mumbai, Delhi, Bengaluru and Chennai as well as from other large cities such Pune, Hyderabad, Ahmedabad, Jaipur, Lucknow, and Patna. Other parts of India such as Indore, Ludhiana, Bhubaneswar, Guwahati, Agra, Kochi, and Chandigarh have also contributed significantly to the growth of the number of users, the company notes.

The growth in the userbase of the iMobile Pay app is also attributed to the introduction of UPI-based payments. Customers from any bank have the option to link their account with the app to use UPI payments. ICICI Bank claims that the app’s Pay to Contacts has been the most used feature. The functionality enables users to send money to a mobile number, UPI ID, or a digital wallet.

The other services such as ‘Scan to Pay,’ ‘Check Balance’ and ‘Bill Payments’ have seen the maximum usage. The trends further show features like ‘track application status’ for credit cards or loan, transfer funds and create VPAs are also liked by users. ICICI Bank has not specified the time frame of the trends.

Speaking more over the development, Bijith Bhaskar, Head of Digital Channels and Partnership at ICICI Bank said that after the launch of iMobile in 2008, the app got a new avatar in December 2020 and the name was changed to iMobile Pay. He added, “The objective of this endeavour was to offer customers of any bank the benefits of seamless payments and digital banking services through our app. We made it possible by leveraging NPCI’s interoperable infrastructure.” Apart from the payment services, the ICIC iMobile Pay app also allows customers to open an ICICI Bank savings account digitally or apply for a credit card at zero joining fee. Customers can also check out ICICI Bank-related offers or apply for a personal loan.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment