views

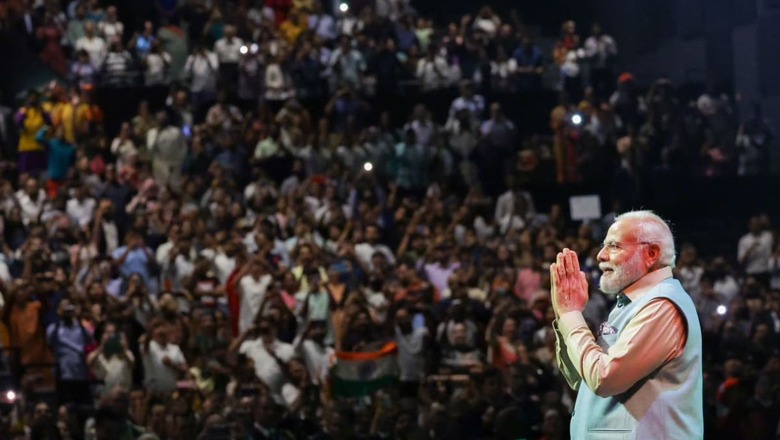

Every Independence Day is a milestone for collective reflection on India’s growth trajectory. Ahead of India’s 77th Independence Day, Prime Minister Narendra Modi’s economic prognosis that India will become the third-largest economy during Modi 3.0 goes beyond hollow pre-electoral rhetoric, as his economic optimism is substantiated by most recent data points that converge on this assumption.

India before 2014 was a follower and not a leader, a nation that was compelled to conform to the writ of advanced economies. At the culminating point of the Modi-led government’s tenure, India is dominating agenda-setting for global peace, climate transition and economic development almost on par with the United States of America.

When economies expand and prosper, the world listens, as sellers listen to buyers. This is because it confers upon buyers greater purchasing power to spend on development and defence procurement from developed nations.

India’s enhanced economic power is because of its remarkable post-Covid rebound that has sustained into 2023, and can be gauged through multiple objective prisms:

- As validated by vibrant macroeconomic data, with India’s manufacturing and services PMI witnessing consistent growth

- International Monetary Fund’s (IMF) Word Economic Outlook Database projections

- Morgan Stanley upgrading India to the topmost rating amongst Asian Emerging Markets just a few days back

- S&P Global report released last week

The above four pointers are not about cherry-picking data to endorse preconceived assumptions. Instead, they state multiple factors that are powering India to dominate global discourse during what I term ‘The Modi Decade’. To paraphrase a famous economist, “India’s golden period is now”, and not in some distant future.

In the likely event of a stable political outcome in 2024, a stable regime in India favourably impacts domestic and international business and investment sentiments, as also portends positive geopolitical calibrations for the future of regional stability in the Asian continent and in the Western world.

The IMF’s Word Economic Outlook Database projects that India will overtake Japan and Germany by 2026-27. However, while a consistent average GDP growth rate of 6 per cent ensures that India retains the tag of remaining the ‘fastest-growing economy’, in order to achieve higher living standards and inclusive growth, we will also need to work towards boosting per capita GDP and per capita productivity.

Such an outcome is only possible through greater provisions for higher skilling and churning out job-ready youth. Currently, only 45 per cent of India’s graduate jobseekers are equipped with relevant technical skills to meet industry 4.0 fast-changing needs.

How did India under Modi ascend to global pole position? This is because India has undergone a tectonic socioeconomic makeover during the Modi years, attributed to structural reforms and predictable policies.

The progressive transition of India’s demographic profile is due to increased economic intensity over the decade, despite the de-growth during the two years due to Covid. As a result, the poor have become less poor; the rich have become richer, thereby creating more jobs and paying higher taxes; while middle-class household incomes have surged to between Rs 6 lakh and Rs 18 lakh annually.

The rise of the ‘middle order’ having higher disposable incomes converts to higher levels of domestic demand and consumption, transforming India into one large gigantic marketplace, making it a favourable investment destination, especially for inbound investors looking for the ‘China +1’ option.

This is in sharp contrast to factors deterrent to global growth due to the West experiencing the highest levels of historic inflation and interest rates. Besides, the developed nations have been de-globalising, and “growing warmer, older and more politically fraught with geopolitical variables.”

Of the 27 countries tracked by Morgan Stanley, India has been upgraded to the topmost rating among Asian Emerging Markets. Rating upgrades usually presage positive MNC sentiments, as FPIs and FDIs begin to accord higher weightage when considering geographical expansion.

The trending upturn of the Indian economy is due to measures set in motion during Modi 1.0, like the formalisation of the economy via GST; the new bankruptcy code leading to faster debt recovery and resolution, coupled with a sharp decline in corporate leverage and competitive taxation rates for setting up new industries, which have had a positive impact on industrial acceleration.

A separate report by S&P Global also echoes similar economic projections of India growing at 6.7 per cent annually between 2024 to 2031, thereby portending a sustained upwards growth cycle. S&P estimates India’s GDP is expected to double to $6.7 trillion from the current $3.4 trillion, while per capita income is expected to rise to $4,500 from the current $2,500.

During India’s ongoing G20 presidency, as also during Prime Minister Modi’s visit to the US in June, India’s newfound assertiveness has repeatedly flagged the need to reform multilateral development banks (MBDs). In order to address the challenges of the 21st century, Modi has stressed the need for MBDs to allocate higher financial resources to developing countries for climate transition and global public goods; allow for greater leniency in debt resolution and relief to poorer economies, and also championed the cause for higher development funding for the Global South.

Most multilateral meetings are confined to idealistic and long-term goal setting without setting definitive timelines, so they morph into mere talk-shops. In contrast, under India’s G20 presidency, the focus is on outcome-driven agendas to review progress more frequently in critical areas.

Building on past precedents set by G20 presidencies, PM Modi has initiated multiple pro-environment initiatives, like:

- Encouraging resource efficiency and a circular economy

- Focusing on the prevention of land degradation and enriching biodiversity

- Pursuing climate-resilient water resource management

- Initiating the International Solar Alliance

- Focusing on Disaster Resilient Infrastructure

The most significant transition the Modi-led government has spearheaded as a paradigm module for ‘global best practice’ emulation is to showcase the lead it has taken in developing its digital public infrastructure (DPI) at the G20 high table.

DPI has been adopted at a population scale due to the lowest data rates in the world and high mobile density (despite the hurdles of low digital literacy), functioning as a digital pathway to enable the seamless delivery of essential services and financial transactions to end-users.

As this unique module has transformed India from a high-cash economy to the world’s largest platform for digital transactions, it is finding developed nations expressing interest in collaborating with Indian policymakers to replicate the efficiencies of India’s DPI evolution.

India under the ‘Modi Decade’ has now moved from 80 per cent of the population being unbanked to 80 per cent of people having access to formal banking. From being an offline, informal, low-productivity set of microeconomic system nine years back, we have become a single online, formal and higher productivity mega economy.

The DPI-powered financial inclusion is an enabler for data generated from the use of digital transactions to provide ‘digital capital’, and also captures a vast digital database, which can be stored and is inter-usable for multiple future vectors of growth and referrals.

All these measures are a testament to India leading by example, consensus and cooperation. In order to drive the global agenda for outcome-driven systemic changes, no single nation can address the challenges of the 21st century in isolation, without leveraging collective action.

The author is ex-Chairperson for the National Committee for Financial Inclusion and Literacy, Niti Aayog. Views expressed in the above piece are personal and solely that of the author. They do not necessarily reflect News18’s views.

Comments

0 comment