views

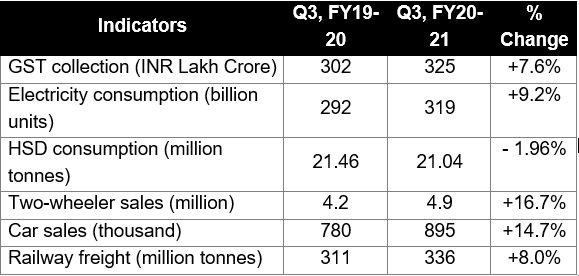

For a nation battered by Covid-19, this is the year of optimism. The roll-out of the vaccines Covishield and Covaxin this year brings abundant hope in people who struggled for livelihoods in the summer of the lockdown. The early economic indicators (Table 1) for Q3-FY21 suggest that our economy has made a smart recovery from the historic contraction in the aftermath of the lockdown and has moved into a positive growth cycle. Against this backdrop, finance minister Nirmala Sitharaman has undertaken an onerous task of presenting a “never before” like Budget on February 1, 2021.

Key economic challenges

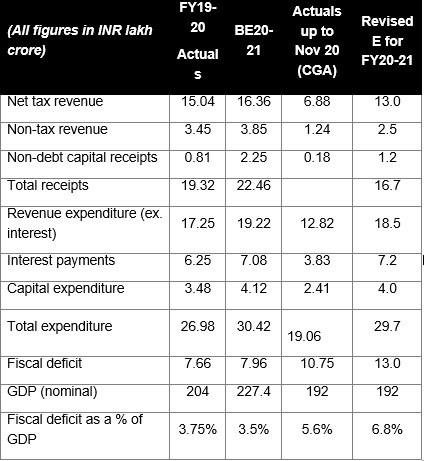

An obvious challenge for the FM is to match the numbers. The exuberant revenue projections of Budget estimates 2020-21 have been battered. With the shrinkage in the economy, government tax collections are down, but expenditure remains the same, pushing up the fiscal deficit (Table 2). The estimated fiscal deficit till November 2020 was 5.6% of GDP, which is expected to touch 6.8% for the full fiscal year. Higher borrowings also push the interest payment upwards to 43% of total government revenues for FY20-21.

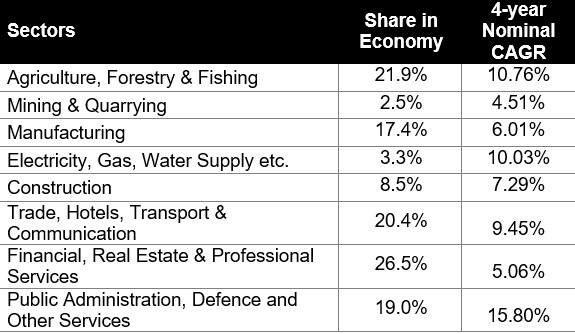

A perusal of the four-year growth of eight sectors of the economy shows the second economic challenge for the FM (Table 3). While public administration, defence and agriculture have been provided most of the growth, financial services, real estate and construction have lagged, indicating tepid capital formation. Further, hospitality and transport, which contribute a sizeable share to the economy, are reeling due to the Covid-19 crisis.

The banking sector reeling under the stress of non-performing loans (NPL) and write-offs has been the prime reason because of which the Indian economy has remained a caged tiger. The slowdown, job losses and fall in consumption imply a higher NPL that further diminishes the banking credit. This spiral needs to be broken for a sustainable economic recovery.

The third major challenge and possibly the biggest concern for the FM is on the job creation front. Many people who lost employment due to the pandemic are yet to find jobs. A CMIE report suggests, between March and December 2020, 5.5 million jobs were lost in the services sector, 11.4 million jobs were lost in the manufacturing whilst 5.4 million more people were employed in agriculture. Considering the fact that the “haves” have recovered faster than the “have-nots”, the message for the finance minister is clear. This impacts consumption and overall economic demand.

Then there are other challenges of how to enhance manufacturing competitiveness and bolster exports, how to ensure digital disruption reaches rural India and poor communities, and so on. Similarly, there are silver linings. Foreign capital is looking positive for India. Global anti-China sentiments are also expected to benefit India.

What the Budget should do?

Almost everyone agrees: increase spending and investments. The on-going farmers’ agitation warrants a higher allocation in agriculture, fertiliser and food processing. Roll-out of vaccines demands a higher allocation in healthcare. Similarly, the new National Education Policy released in 2020 would see a higher allocation in education. Further, the economy requires vigorous investment in infrastructure – ports, airports, railway lines, highways, logistics parks, housing, hospitals, schools, and a big communications infrastructure.

The challenge remains, when money is elusive how to address this. While there could be a temptation to bridge the shortfall in tax revenue with new forms of taxes, surcharge or cess, it would be best if the FM could avoid this as much as possible. Any extra tax in the year of recovery could perceptibly be coercive.

The way forward

Creativity is a subtle art when the chips are down and pressures are high. A Budget high on reform is the need of the hour. Be candid and courageously pursue economic reforms such as:

• Attract foreign investment through government sponsored plug-and-play industrial parks to make India part of the global supply chain

• Simplify GST from five slabs to three slabs of 0%, 10% and 20%

• Strategic sale of public sector enterprises must be undertaken to bridge revenue gaps. The time for government giving business to government-owned enterprises to create monopolies is over. Unlocking these monopolies is the critical need of the hour.

• While our experience with public-private partnerships other than highways so far has been lukewarm, the lessons from highways must be extrapolated to other sectors like railways, ports, hospitals, housing and other urban infrastructure to tap foreign and private capital into sectors that can have higher employment multiplier. This is the year when PPP should be brought back with audacity

• Make labour laws and their compliance easier for job creators

• Finally, provide smartphones for free to poor children all across the country. India cannot harvest the demographic dividend if the children of Bharat struggle for their education for the want of a laptop or smartphone. This can also propel manufacturing into a new-age industry.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment