views

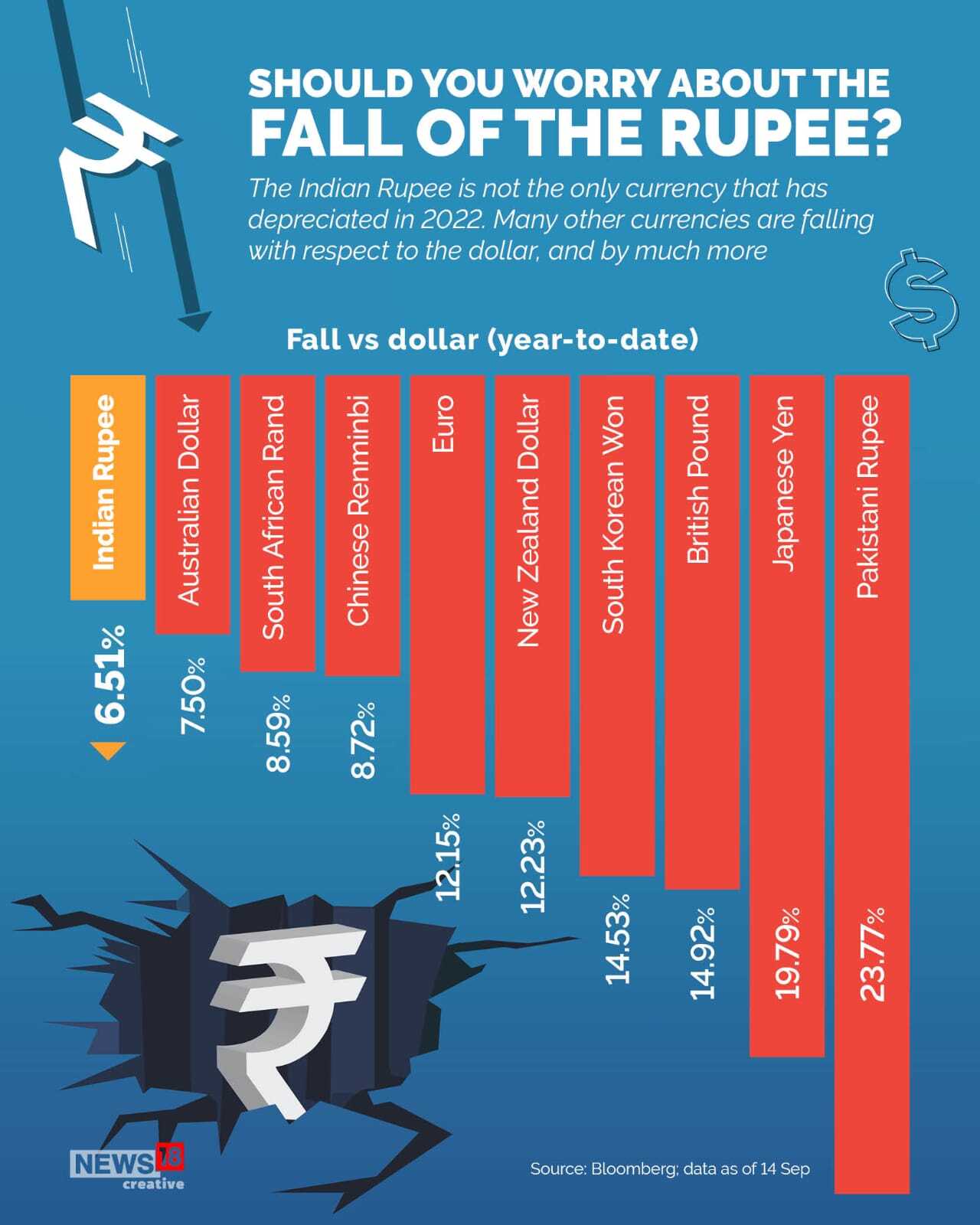

The rupee, which has seen multiple lows so far this calendar year, has fallen just 6.51 per cent against the dollar so far in 2022 as compared with about 7.5 per cent decline in Australian dollars, an 8.59 per cent drop in South African Rand and a 19.79 per cent skid in Japanese Yen. Here’s how much the rupee has fallen against the US dollar vis-a-vis other currencies in the world:

The Pakistani Rupee has seen a significant decline of 23.77 per cent in 2022 till September 14, while the Japanese Yen has fallen 19.79 per cent, the British Pound has dropped about 14.92 per cent, South Korean Won has plummeted 14.53 per cent. The euro, which recently fell below one dollar, has witnessed about 12.15 per cent fall in total in the current calendar year so far; the Chinese Renminbi has declined 8.72 per cent; the South African Rand has dropped about 8.59 per cent; and the Australian dollar has slipped 7.5 per cent, according to Bloomberg data.

The Indian rupee has fallen about 6.51 per cent in the current year till September 14, which is the lowest among these major currencies given here. The rupee was at 73.77 against a US dollar on January 12 this year, which has now declined to 79.47 to a dollar on Wednesday (September 14). The Indian rupee in August had touched an all-time low of 80.15 against the US dollar.

The fall in the Indian rupee this year has been due to the continuous outflow of foreign investments, surging crude oil prices, tight monetary policy by US Federal Reserve, and general dollar strength. This was aggravated by global uncertainties arising out of a geopolitical crisis due to the Russia-Ukraine war.

On Tuesday (September 13), Chief Economic Advisor V Anantha Nageswaran said India is not defending the rupee and the Reserve Bank of India is taking necessary steps to ensure that the movement of the rupee is gradual and in line with market trends. Nageswaran added that the rupee is being managed in a manner that reflects the fundamentals of the economy.

“India is not defending the rupee… I don’t think Indian fundamentals are such that we need to defend the rupee. The rupee can take care of itself,” he said at an event here.

“The Indian rupee remained under pressure (on Wednesday) amid a broad-based gain in the dollar after much-awaited US inflation data came higher than expected,” said Dilip Parmar, research analyst at HDFC Securities.

The dollar bided well after the rate market started pricing a full percentage point hike in the next week’s Federal Open Market Committee (FOMC) meeting. “However, recovery in domestic equities and corporate dollar supply gave support to the rupee after a weak opening,” Parmar said, adding that in the near term, spot USD-INR is expected to trade in the range of 79.65 to 78.70.

Between October 2021 and June 2022, they sold a massive Rs 2.46 lakh crore in the India equity markets, which put a heavy strain on the rupee and weakened it significantly. However, there is a clear trend reversal in FPI (Foreign Portfolio Investment) flows from July onwards since when overseas investors turned buyers in India after nine straight months of massive net outflows.

Foreign investors have pumped in close to Rs 5,600 crore into the domestic equity markets in this month so far on expected growth in consumer spending in festive season and better macro fundamentals compared to other emerging markets. This comes following a net investment of staggering Rs 51,200 crore in August and nearly Rs 5,000 crore in July, data with depositories showed.

Read all the Latest Business News and Breaking News here

Comments

0 comment