views

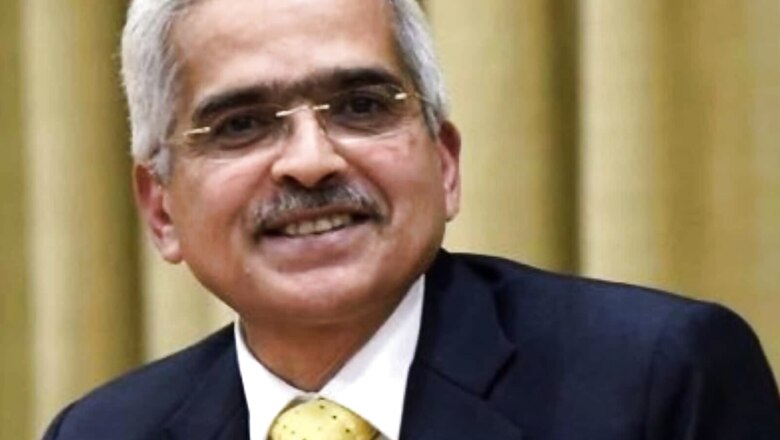

Terming price rise as a major challenge, Reserve Bank Governor Shaktikanta Das on Saturday expressed hope that inflation print for October will be lower than 7 per cent. Retail inflation in September increased to 7.4 per cent from 7 per cent in August on higher food and energy costs.

He attributed the expected moderation in inflation in October to measures taken by both the government and RBI in the last 6-7 months.

Speaking at the HT Leadership Summit, Das there is no need to change the goal post for inflation targeting as higher than 6 per cent inflation would hurt growth. The rate-setting Monetary Policy Committee headed by the RBI Governor has been mandated by the government to keep inflation within 2-6 per cent range.

On the Indian economy, Das said the macroeconomic fundamentals remain strong and growth prospects are looking good. “We expect the October number which will be released on Monday to be lower than 7 per cent. Inflation is a matter of concern with which we are now dealing and dealing effectively,” he said.

For the last six or seven months, he said, both the RBI and government have taken a number of steps to tame inflation. The RBI on its part increased the interest rates and the government also announced several supply side measures, he added.

Das also exuded confidence that India will continue to be the fastest growing major economy with a likely growth rate of 7 per cent in 2022-23 on the back of strong macroeconomic fundamentals and financial sector stability.

Das said the entire world has withstood multiple shocks. “I call it triple shocks of COVID-19 pandemic, then the war in Ukraine, and now the financial market turmoil.” The Governor said the financial market turmoil is mainly emanating from the synchronised monetary policy tightening across the world by central banks, especially those in advanced countries, led by the US Fed, and the spillovers are being felt by the emerging market economies, including India.

“So far as India is concerned, economy, overall macroeconomic fundamentals, the financial sector stability, all these aspects remain resilient. The banking sector that is the financial sector is stable because of all the parameters with regard to banking or the non-banking lenders or the other major financial sector players,” he said.

Read all the Latest Business News here

Comments

0 comment