views

BENGALURU/MUMBAI: Gold buying in India lost steam this week as prices scaled a 2-1/2 month peak ahead of major festivals, while discounts in top-consumer China dropped on a surging yuan.

Indians celebrate the Diwali and Dhanteras festivals next week.

“Retail demand has started falling due to the price rise. Even jewellers have cut down purchases,” said Mukesh Kothari, director at Mumbai gold dealer RiddiSiddhi Bullions.

On Friday, local gold futures jumped to 52,425 rupees per 10 grams, a peak since Aug. 20, tracking a jump in global spot rates.

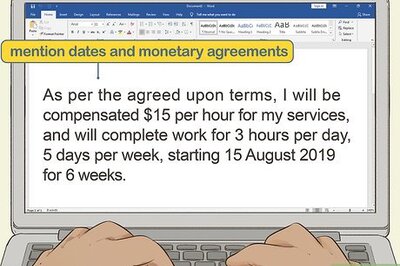

Dealers offered discounts of $4 an ounce over official domestic prices, inclusive of 12.5% import and 3% sales levies, flipping from last week’s $1 premiums.

Jewellers have made ample amount of purchases for Diwali and now they’re awaiting a correction, said a Mumbai-based dealer with a bullion importing bank.

In Singapore, gold was sold at $0.80-$1.40 an ounce premiums over international spot prices.

“Jewellers have seen a little pick-up in jewellery buying but I don’t think that’s something to shout about. We might see some buying because of the festivities but it won’t be substantial as compared to major markets in China and India,” said Brian Lan, managing director at dealer GoldSilver Central.

But increasing coronavirus-led lockdowns in Europe and the U.S. election uncertainty have driven robust safe-haven buying, said Zvika Rotbart, South East Asia business development executive at J. Rotbart & Co.

Discounts in China dropped to $20-$26 an ounce from $30-$32 last week, on a strengthening Chinese yuan, which hit a 28-month high on Thursday.

A stronger renminbi is making gold cheaper but Chinese demand is still steady, said Peter Fung, head of dealing at Wing Fung Precious Metals.

“People showed some interest in buying when prices fell to around $1,870-$1,880 per ounce,” he said.

Gold was sold at premiums of $0.50-$1.50 in Hong Kong, while Japanese markets operated at about $0.50 premium.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment