views

Preparing to Report Tax Fraud

Know the warning signs of tax fraud. Tax fraud involves the under-payment of any kind of taxes, including income, sales, property, or other business taxes. Tax fraud costs everyone by forcing the government to raise taxes or cut services. While there is no definitive way to spot fraud, there are some common warning signs that someone may be committing fraud. Using cash to purchase items that are hard to trace and easy to sell. For example, antiques, collectibles, and precious metals. Lie about their residence to avoid state income taxes. Examples of this include creating fake residences by renting post office boxes in states with no income tax. Falsely claiming dependents. This doesn't just mean "inventing" children. It can also include claiming they cared for elderly relatives in an attempt to get Head of Household status and extra exemptions. Blatantly under-report business income by not documenting sales, performing services for cash, and recording non-existent purchases of goods or supplies. Paying employees and vendors in cash.

Gather the information. Before you can file an anonymous report for tax fraud, you need to have some basic information. The forms will ask for the name of the person or business, address, year it occurred, description of the activity, and why you believe fraud is being committed. At this stage you can determine whether it is worthwhile to file the report. You can balance the amount of information you have versus how much information you need to file a complete report. The taxing jurisdiction is unlikely to act on a vague report with little or no details to back it up.

Identify the taxing jurisdiction. The type of fraud will determine where you report it. For example, if you suspect income tax fraud, it won't help if you report it to the sales tax authority. In general, tax fraud falls into three categories: federal, state, and county. The Internal Revenue Service has jurisdiction over individual and business income taxes. Any suspected fraud concerning income tax should be reported to the IRS. The IRS also takes reports on tax scams by paid tax preparers and other abuses. Every state has a taxing authority. It is often called the Department of Revenue, Department of Finance, or the Tax Commission. The states have jurisdiction over state income tax, sales tax, vehicle taxes, and other business taxes. The county Treasurer or Assessor is responsible for collecting property taxes and managing tax funds that are collected by the state and rebated to the county.

Categorize the type of tax fraud. The tax authority doesn't expect you to be an expert. However, you will need an idea about the type of fraud you are reporting. The IRS provides checkbox choices on its reporting forms. Choices include false deductions, unreported income, and altered documents. For businesses, including households that hire domestic help, fraud can include failure to withhold and submit necessary employment taxes. The state will be interested in the same types of income tax fraud and sales tax fraud. For example, if a business overcharges sales tax or fails to pay it to the state. Property tax fraud can include false appraisals, lying about the use of the property, or having a senior citizen falsely listed as property owner to avoid property tax.

Reporting Federal Tax Fraud

Decide if you will make the report anonymously or identify yourself. The IRS encourages you to identify yourself and that information is kept confidential. However, the forms are clear that your identity is not required for the report to be reviewed. If you are willing to identify yourself, you may be eligible for a reward as a whistleblower. If your information leads to the recovery of unpaid taxes, penalties, and interest, you may be eligible for a reward of up to 30 percent of the recovered amount.

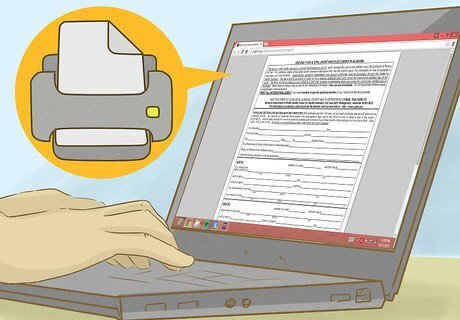

Choose the correct form. The IRS will not accept allegations of tax fraud by phone or online reporting. However, there are a variety of forms available depending on the type of fraud you are reporting. The Information Referral, Form 3949-A is the general form for all types of tax evasion and fraud. You can use this form to report an individual or a business. Fill out the form as completely as possible. Every bit of information aids the IRS in its investigation. You may not know details like Social Security number, but including the home address will help the agency identify the fraudster. Another common type of tax fraud is stealing Social Security numbers. If you believe your SSN has been used by another person to gain employment or file tax returns, you should use Form 14039 (or Form 14039SP in Spanish.) This is not an anonymous report. You want the IRS to help you regain your tax identity. Form 14157 is used to report complaints about a paid tax return preparer. You can report theft of refunds, incompetence in filing, falsifying documents, and failure to property complete or remit employment taxes. You are encouraged to identify yourself, but it is not required.

Affix postage and mail the form to the correct IRS office. The mailing address for each form is included in the instructions for the completing the form. Sending the form to the wrong office will severely delay, or even disqualify, your report from being reviewed.

Reporting State and County Tax Fraud

Locate the appropriate state or county agency. Whether you need the state Department of Revenue or Tax Commission, you will have to find the correct state agency and either their online tax fraud reporting website or the mailing address. To find the tax fraud reporting procedure and address, perform an online search for "[your state] tax fraud reporting". You can also call the general information phone number for your state government or tax authority.

Decide if you will file an online or written report. Many states have an online tax fraud reporting system. For example, California has a step by step reporting wizard that walks you through the process. Conversely, Kansas has an online form that is very simple, more like an email. In both, you are encouraged to identify yourself, but it is not a required field to submit the online report. To file a written tax fraud allegation, you need to prepare a letter with all of the information you have, including name, address, business identification, and everything you know about the fraud. Use IRS Form 3929-A as a guide in preparing your letter.

File a report with your county. Most counties will not have an online system. You will need to write a letter detailing what you know about the city or county tax fraud. Address it to your county Treasurer, the county commission, or if your county has a specific complaint mailing address. You can send the letter anonymously. The mailing address will be on your property tax documents or in the phone book. At the county level, the tax fraud will most likely concern property tax or other local assessments such as tobacco or liquor taxes. Be as detailed as possible in your letter identifying the person or business, the type of fraud you suspect, and any details that you have.

Collecting a Reward

Know who to contact. Some state governments and the federal government offer rewards for credible information that leads to a collection of unpaid taxes. If you are reporting federal tax fraud, you will need to contact the IRS' Whistleblower Office. If you are reporting state tax fraud, you will need to contact your state's department of revenue.

Submit a federal whistleblower claim. If you wish to receive a reward for reporting tax fraud, you will need to fill out an Application for Award for Original Information (IRS Form 211). You will need to provide specific and credible information that results in the collection of taxes, penalties, and interest the non-compliant taxpayer. The IRS will keep your identity secret unless you are required to testify in open court about the tax fraud you uncovered. However, you must identify yourself in Form 211 and cannot collect a reward if you anonymously report something to the IRS.

Apply for a state reward. Some states also offer rewards for information about tax fraud. For example, in Florida, their Department of Revenue will reward someone who provides information that leads to an investigation that proves a violation and that leads to the collection of all the money owed. To apply for a reward, you will need to contact your state's department of revenue and ask for an award form. In Florida, you can simply go online and download the Application for Compensation for Tax Information (DR-55). The form will ask you to identify yourself and explain the violation you observed. In Florida, while you can report tax fraud anonymously, you will not be allowed to recover an award unless you provide your name.

Comments

0 comment