views

Get in touch with a registered depository. In order to open a demat account, you’ll have to first get in touch with a registered depository participant (DP). For a list of registered DPs, visit the NSDL (National Securities Depository Limited) or CDSL (Central Depository Services Limited) websites.

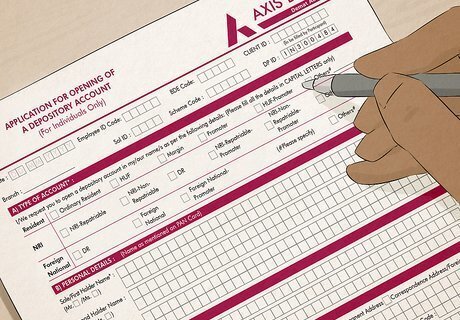

Download the forms. Download or collect the account opening forms from the respective DP’s office or website. Fill up the requested details in the account opening form and provide the necessary signatures. Affix photographs and submit a copy of PAN Card, proof of address, bank statement or other documents as required by the company. Or you can

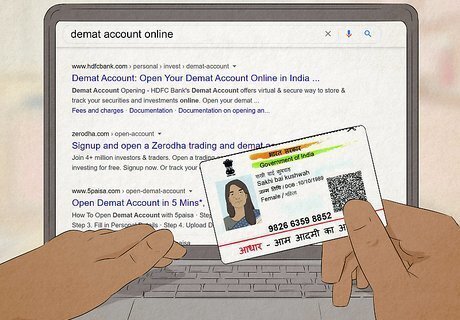

Open an online demat account. With Aadhar number, you can open a demat account online.

Select the right broker. The broker who Open Demat Account With Aadhar number.

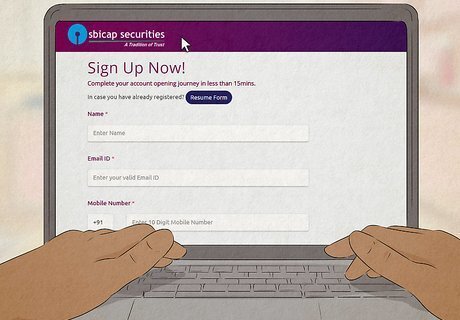

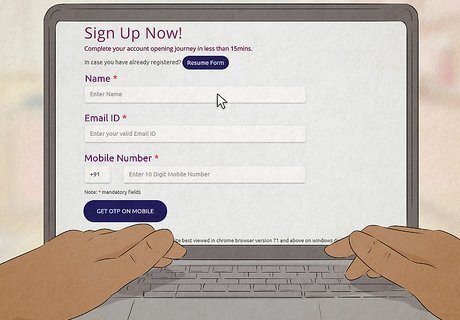

Fill in basic details. Your Name, Mobile Number and Email id.

Set password. Set a unique password and don't share with anyone. With help of password, you can continue your online application

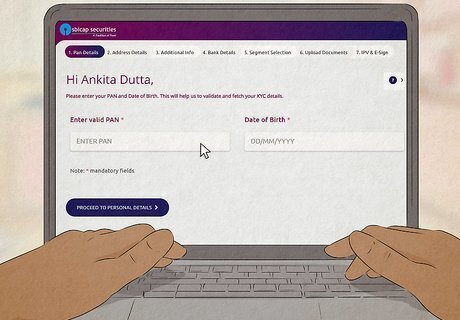

Enter Pan Card details. Broker fetch your details from a government authorized site, whether you are KRA register or not.

Pay account opening charges. Pay account opening charges to your broker by net-banking or credit card.

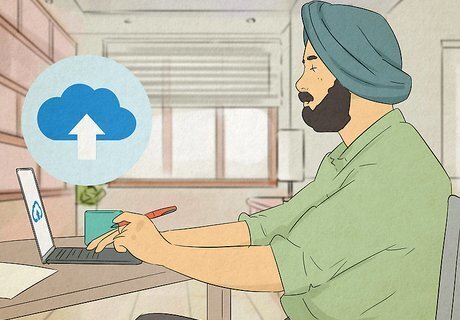

Create DigiLocker. The government approved Digilocker allows you to upload your personal documents. with help of you can share securely your data with your broker.

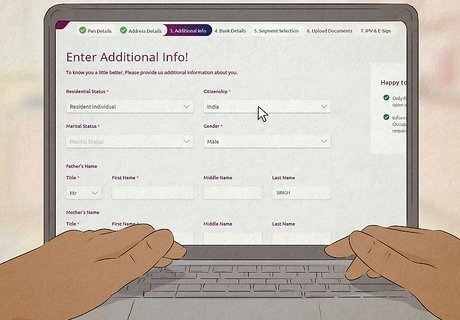

Fill KYC Details. Fill out your personal information including name, mother's name, bank account number, and trading experience.

Upload your documents. Please upload your financial documents securely, including a canceled cheque, bank statement, income proof, signature copy, PAN card copy.

E-Sign with Aadhar. You will receive OTP (One Time Password) on your mobile number and Email id. Enter both OTP on Aadhar card website for eSign with Aadhar.

Wait the turn-around time. It usually takes about a week or two for the welcome kit to reach you, depending on different company policies. A demat account can be opened with zero balance in your account. There is no compulsion to maintain a minimum balance either.

Nominate your nominee. It is important that you add a nominee while applying for a demat account. Check and double check the nominee details for accuracy. This will enable the nominee to receive the benefits of your securities in the event of exigencies. After opening an account, the DP will assign you a beneficial owner identification number that will be needed for all future transactions. When you wish to sell your shares, you need to coordinate with your broker and give a 'Delivery Instruction' to your DP. Your account will then be debited with the number of shares sold by your DP. You will receive the payment from your broker.

Trade. Similarly, when you want to buy shares, inform your broker. The shares that you bought will be credited into your account by the DP. You can also use the trading account linked to your demat account to buy and sell shares online. The DP will provide periodic statements of your transactions

Comments

0 comment