views

Creating a Debt Payment Plan

Create a budget. Start by creating a budget that lists all of your monthly expenses. Then, subtract the total amount of your expenses from your total income every month. This will give you a sense of how much income you will need to set aside for your expenses. Your budget should include necessary and non-essential expenses, such as: Housing: This could be a monthly rent payment or a monthly mortgage payment. This is a necessary expense. Food: This is a necessary expense and should include all grocery expenses for the month. Utilities: This should include any heating or electricity expenses for the month. You should also include expenses like internet and your cell phone bill. These are also essential expenses, though you may have some wiggle-room as to how much you pay for these things (like your cell phone bill). Transportation: Whether you need money for gas, a car payment, or a bus pass, make sure this is added into your budget. Extras: This should cover anything that is a "want," and not a "need," such as money for going to the movies, dining out, or for that new gaming system you really, really want... but isn't essential to your survival. You should try to limit any extra spending in your budget, as the majority of your income should be going towards paying down your debt. You should also set up an emergency fund that is equal to two or three months of your essential expenses. This way, you are less tempted to use credit cards to pay for items and can lean on your emergency fund in the event of a sudden bill or charge that falls outside your budget.

Make a list of all your debts, from lowest to highest. Be honest and include every debt you have, from credit card debt to student loan debt. Write down the exact amount of your debt, from the lowest debt amount to the highest debt amount. You should also note the interest rate attached to each debt. For example, you may list credit card debt at $5,556, with an interest rate of 4.5%. This could be your lowest debt amount. You may then list your student loan debt at $25,000, with an interest rate of 2.5%. This could be your highest debt amount.

Compare your debts to your monthly expenses and your monthly income. Once you have listed your debts and created a budget, you should compare your debt amount to your essential expenses and your income. You can then determine how much money you can afford to put down on your debts each month. Add the monthly debt payments to your budget so you are prepared to pay them every month. Make sure you set your debt payments to a specific amount that you can afford and that fit within your budget.

Consolidate your debts. Look over your debts and see if there are ways where you can combine your debts together so they are all owed to one financier or all under a lower interest rate. You may have credit card debt, for example, on two different credit cards. Use one credit card (whichever charges lower interest) to pay off the other credit card debt, thereby consolidating your debt onto one credit card. You can also do this with student loan debt, using your student loan to pay off your credit cards, thereby leaving you with only student loan debt to deal with. Consolidating your debt can be helpful if you have trouble remembering to make multiple payments each month, as this will simplify the process.

Choose your strategy. Two options include paying off the debts with the lowest amounts owed first, or to “ladder” your debts, organizing them starting with the debt with the highest interest rate and ending with the debt with the lowest interest rate. Both strategies have their good and bad points; decide which works best for you an your situation. Paying off your lower end debts first can act as a great motivator, as you will likely pay off the lower amounts first and feel a sense of accomplishment. You can then remain motivated enough to move down your list and tackle the second lowest debt amounts next, until you reach your highest debt amounts. The "ladder" method is effective because you will end up saving money on interest payments and pay off your debts fast. You will work your way down the ladder, paying off the higher interest rate debts first, finishing with the debt with lowest interest rate.

Put down more than the minimum payment for your debts. Putting down just the minimum payments every month will only prolong your debt payments and make you feel like you are running in place, rather than running down your debt. Aim to put down more than the minimum payment for your debts, focusing your efforts on the debt with the lowest amount. This could mean increasing your credit card payments so you are paying $500 a month on the debt, rather than the minimum payment of $250 a month. This will allow you to pay off the debt faster and stay motivated to pay off the other debts on your list.

Try to negotiate the interest rates on your debts. Some credit card interest rates can seem impossibly high and difficult to pay off. Call your credit card company and discuss the possibility of arranging a lower interest rate, at this is often done by certain credit card companies. If you have a good history of paying your bills on time, your credit card company may be more sympathetic to your request. You can also try to negotiate interest rates on other debts, such as student loan debt. The worst they can say is no, so it is worth a try, especially if this means you will have less interest to pay on your debts as you work to get rid of them.

Use any unexpected money to pay off your debts. Use an unexpected windfalls and put it towards your debts. This could be a tax refund, an inheritance, a winning bet, or even a winning lottery ticket. The more money you put towards your debt, the faster it will go away.

Consider using peer-to-peer lending services. Peer-to-peer lending services allow individuals to make unsecured loans to other individuals, with no bank or middle man involved. Sites like Prosper and LendingClub can offer you lower interest rates than a credit card and fixed loan payments, usually within three to five years.

Increasing Your Income

Look for part-time job or a seasonal position. Take up a part-time job at a restaurant or bar nearby or look for a seasonal position in retail for the holiday season. You can then take the earnings from your part-time job and put that money towards your debts.

Turn a hobby into a side business. Maybe you love to knit and spend your downtime knitting scarves and hats in front of the TV, or maybe you have writing and editing skills that you can apply to contract editing jobs. Work your hobbies or skills and try to make money off of them, either on your own through sales to friends and co-workers or through a contracting site that links you to freelance jobs and opportunities.

Pick up extra shifts or hours at your existing job. Ask your boss or supervisor if the company needs someone to pick up extra shifts or hours, or if you can cover for someone else and pick up their extra hours. Increasing your pay check every month will allow you to put down more money on your debts.

Ask for a pay raise at your job. Approach your boss about the possibility of a raise, especially if you have been working in the same position or department for some time and have high employee performance reviews. Talk to your supervisor about increasing your hourly wage, reiterating that you are a model employee who works hard and is loyal to the company.

Adopting a More Frugal Lifestyle

Cut back on any unnecessary expenses. This means reducing your cable or cell phone bill every month, not eating out, and skipping your morning coffee at the local coffee shop. Focus on trimming down on any unnecessary expenses so you can put this money towards your debt. You may want to set a time frame on this cut back, noting that if you cut down on these expenses for six months to a year, you will reach a certain amount of money that you can then apply to your debt. After the year mark, you may then loosen up your spending and budget for a morning coffee every now and then.

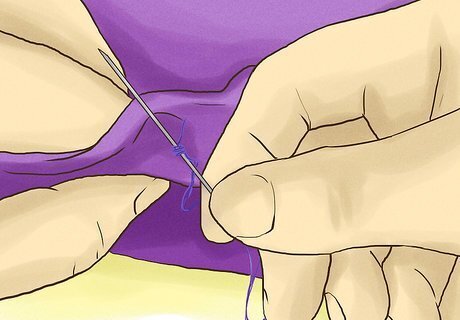

Repair or reuse items, rather than buy new items. Though it may be tempting to simply replace a broken item or a used item, you should try to repair the item on your own or repurpose it in some way so you do not have to spend money on new items. This could be fixing your headphones with electrical tape or repairing a broken coffee maker instead of spending money on a new one. Be creative and think of ways you can avoid spending money and still get through your day.

Sell items you no longer need or use. Look over your belongings and consider if there are any items that you no longer use that you can sell. Consign used clothing at a local consignment store or sell clothing items or other used items online. If you used to collect expensive electronics, consider selling off your collection to buyers online and using that money to pay off your debts.

Take debt counseling to get your spending habits under control. If you struggle with keeping your spending habits in check, you may want to consider taking professional debt counseling. Contact The National Foundation for Credit Counseling to set up a meeting with a credit counselor who can help you develop a debt repayment plan. They may charge you a one time fee for their time or a monthly fee if you see them more frequently. You can also enroll in a debt payment plan with the help of a debt management company. These are third party companies who negotiate your interest rates, your payments, and any fees with your creditors. You usually have to pay a monthly fee to the debt management company, but they will then take this fee and pay your creditors for you. Be wary of debt repayment scam companies, who are not legitimate and will not help you effectively repay your debts. Avoid companies who promise to reduce the amounts you owe for you or ones that charge large upfront fees.

Comments

0 comment