views

Addressing Selfish Behavior

Try to understand where they’re coming from. Make an effort to see things from your sibling’s perspective. They may believe that they have a valid reason for acting the way they do. Acknowledging their feelings will help you talk to them in a way that they’ll respond to. A brother or sister who's significantly younger, for instance, may feel entitled to special treatment from your parents because they've always been catered to. Getting a grasp of your sibling’s motivations doesn’t mean giving them a pass to do whatever they please. If anything, it leaves you better armed to confront their selfishness effectively.

Point out how they’re being selfish. Help your sibling see that by behaving the way they are, they’re only thinking of themselves. Don’t just tell them they’re being selfish, tell them how. In order to make them see the error of their ways, it may help to explain your own or someone else’s point of view. If you're quarreling with one of your siblings over a piece of land, you might suggest a compromise by saying, "I have just as much claim to the lakefront property as you do. Maybe we could each use it for half the year." To keep the conversation from breaking down into an argument, try to present your side of things in a non-confrontational way.

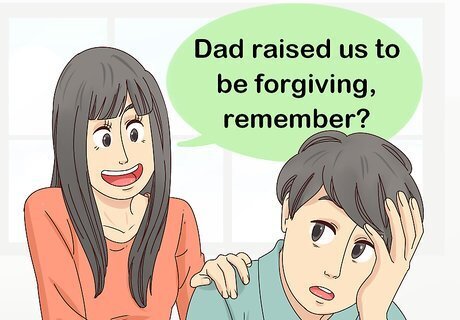

Appeal to their sense of familial duty if they continue to be stubborn. Remind your brother or sister that family comes first. Even if they feel justified in their position, the idea of hurting the people closest to them may lead them to make things right, or at least reconsider their actions. For example, if one of your brothers is bitter after being burned in a bad business deal with the other, encouraging them to be the bigger person may convince them to reach out and end their grudge. Don’t go for a guilt trip by saying things like, ”Dad would be so disappointed in you.” Instead, stress the importance of taking the high road with a gentle admonition: "Dad raised us to be forgiving, remember?"

Tell your sibling exactly what you want them to do to motivate change. Your brother or sister may be more willing to change their habits if they have an idea of what’s expected of them. This could be as simple as telling an absent-minded younger sibling, “Don’t forget to get Aunt Carol something for her birthday,” or as urgent as asking for help picking out an assisted living facility for one of your parents. To give your requests more weight, make it clear to your sibling how their actions affect others. “Would you mind letting me know when you're coming over from now on?” is more persuasive, and more diplomatic, than, “Don't show up unannounced again.” There’s a possibility that they’ll be uncooperative even after you’ve pleaded with them. In this case, all you can do is take heart in the fact that you tried.

Think carefully before cutting a greedy sibling out of your life. If there’s just no getting through to your sibling, you may be tempted to cut off all contact with them. Before you do, however, consider how doing so might impact the rest of your family. Generally, it’s best to try to patch things up with your siblings as best you can rather than putting yourself at odds with them for good. Feuding with a sibling could cause them to feel unwelcome at holiday gatherings or refuse to let their kids play with yours. These sorts of outcomes can be hurtful to more people than just the two of you. Severing ties with a sibling may be the best option if their behavior has reached the point of becoming abusive or exploitative, or if the only interactions you have with them are negative.

Handling Financial Issues

Avoid loaning money to an untrustworthy sibling. If a brother or sister with a bad financial track record asks you for money, just say no. Your answer may offend them, but it won’t give them the opportunity to take from you without any intention of paying you back. Let your sibling down easy by telling them something like, "Sorry, Frank, it's a personal policy of mine not to loan money to anyone, not even my favorite brother." They may be quite insistent, so be prepared to stand firm in order to send the message that your decision is final.

Keep your valuables in a safe to prevent the possibility of theft. Consider purchasing a floor safe and using it to secure cash, jewelry, prescription medication, family heirlooms, and anything else that’s liable to be stolen and pawned by a thieving relative. Memorize the safe’s combination, or write it down in code so that only you’ll know what it is. Don’t give the combination to anyone who might pass it along to your sibling. Your safe can also hold items that have no value in themselves but provide access to things that are worth a lot of money, such as spare house and car keys, original birth certificates, social security cards, passports, and copies of insurance policies. Spring for a safe with a fire rating of at least one hour to make sure its contents stay safe in the event of a disaster.

Talk with your family about their inheritance plans in advance. Get your siblings together and sit down with your parents to discuss what will be done with their money when they pass. This can be an uncomfortable subject to bring up, but it’s an important one, as it will let everyone know where they stand, and may help prevent fierce legal battles later on. Things can sometimes get pretty heated when money is involved. Do your best to keep your siblings calm and promote open, civil communication. If your siblings protest or accuse you of being manipulative, assure them that you have nothing to gain from the meeting and that you simply feel like it’s your duty to honor your parents’ wishes.

Urge your parents to create a living trust. Consult a financial expert who specializes in estate law to help your parents draft their trust document and ensure that it meets all the necessary legal criteria. Otherwise, it may be possible for a scheming sibling to have it declared invalid in court. Living trusts basically lay out the guidelines for distributing a person’s money or property following their death. They’re essential in situations where one sibling stands to receive a larger portion than another. Your parents’ trust document will also allow them to name a beneficiary for their life insurance policy, 401k, and personal assets.

Taking Legal Action

Hire a qualified lawyer to protect you and your family’s interests. A good attorney can help you navigate confusing legal matters like inheritance and estate laws. They’ll also be there to represent you in the worst-case scenario that one of your siblings tries to sue you. Their job is not just to protect you, but to improve relations with your siblings as much as possible. Your attorney can lend you a hand completing and understanding important documents and advise you about what you can do to block your siblings from attempting to claim more than their fair share.

Ask a mediating attorney to help oversee the dispute. See if you can get your sibling to agree to meet with you and your lawyer to resolve the matter without litigation. A mediating attorney will be able to help you make sense of complex laws and loopholes, shed light on who has claim to what, and go over your options should one of you decide to move forward with a lawsuit. If your sibling isn't willing to cooperate with your personal attorney, consider hiring an outside legal consultant to act in an impartial capacity. Formal mediation may be your last chance to smooth things over with your sibling, or at least prevent them from getting any messier than they have to be.

Prepare to go to probate court if necessary. Probate court is a special type of court where people go to settle disagreements over property after the lawful owner has died. If you think you have no other choice, ask your attorney to help you begin putting together the necessary documents to start the probate process. This can be a lengthy ordeal, but if you're in a strong position, you'll have full authority of the law on your side. Challenging your sibling in probate court will cost you a considerable amount of time and money, even if you win. For this reason, it's best used as a last resort. There is, of course, one major benefit to taking your case to probate court—once the ruling comes back, there will be no more question as to who is in the right.

Comments

0 comment