views

X

Research source

Essentially, you are the independent sales force banks will use when they don’t want to use their own internal staff. To become an ISO, you must form your business structure with your state and acquire all necessary licenses and permits. Then you must find a bank to sponsor you and submit a detailed application. Make sure you read the contract carefully and confirm that becoming an ISO is a sensible financial decision.

Forming Your ISO Business

Pick a business name. Your business must have a unique name. You should choose something that is memorable and that suggests the services you provide. “Credit Connectors” or something similar might work well. Remember not to use another business’ trademark or service mark in your name. Visa and MasterCard are service marks, and many banks have obtained trademark protection for their names. Accordingly, don’t call your business “Visa Helpers” since that is illegal. Check with your state’s Secretary of State to make sure that your name hasn’t been taken. Most states also let you reserve a name for a limited amount of time for a fee.

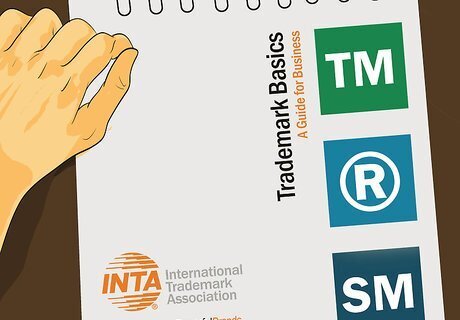

Choose a business form. Your business must have a certain form or structure. For ISOs, the most common are corporations and partnerships, but you could also form a limited liability company. You should compare the strengths and weaknesses of each form. Consult with your business lawyer for more information. Corporation. A corporation is owned by its shareholders. You must register it with your state and file annual paperwork. A corporation is a separate legal entity from its owners. This will protect you personally from legal liability for the corporation’s debts or actions. If someone sues the corporation, then they can only get corporate assets, not assets from the owners. Partnership. A partnership is any joint business run by two or more people. Typically, you don’t file anything with the state. However, partners are usually personally liable for all partnership debts. This means if someone sues the partnership, they can come after your personal assets (such as your house, car, savings account). Also, each partner is fully responsible for the actions of other partners. Limited liability company. An LLC is owned by its members. In some states, you can have a one-person LLC, although other states will require more than one owner. You file paperwork with your state to form an LLC, and it shields the owners from personal liability (much like a corporation does). Sole proprietor. This is the simplest business form. It has one owner (you) and you don’t have to file paperwork with the state. However, you are personally liable for all business actions and debts. Talk with your lawyer about whether this is a good choice.

File with your state. You need to file your corporation or LLC with your state’s Secretary of State office (or its equivalent). Visit the website and download fillable forms. To incorporate, you’ll need to file Articles of Incorporation and pay a fee. To form an LLC, you’ll file Articles of Organization and pay a fee.

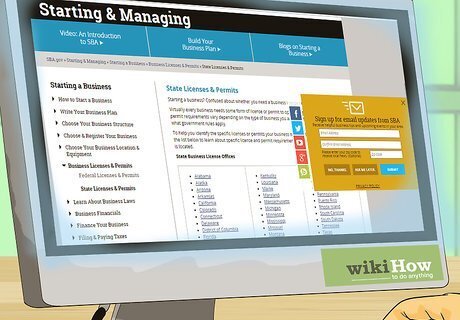

Obtain necessary permits and licenses. You need a business license from your state before you can begin working. You may also need additional licenses or permits. What you need will differ by your state. To find what you need, use the Small Business Administration’s tool at: https://www.sba.gov/starting-business/business-licenses-permits/state-licenses-permits. Click on your state.

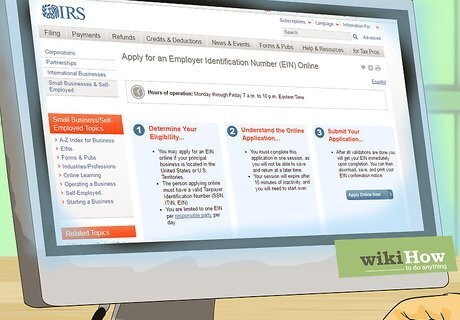

Register to pay taxes. You need to register with your state and possibly local government to pay taxes. Contact the appropriate office and ask. They should have a form for you to fill out. Also find out the schedule for paying taxes. You’ll also need a federal Employer Identification Number (EIN). You can get this from the IRS at https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online.

Draft your business rules. Unless you’re a sole proprietor, you’ll need a set of policies in place that describe how to run the business day to day. This document will differ depending on your business form. However, they typically cover similar topics, such as how profits and losses will be allocated between owners and how meetings can be called. Corporations should keep a set of bylaws at their principal place of business. LLCs need an operating agreement. Partnerships should have a detailed partnership agreement in place.

Create a business plan. A member bank will want to see a business plan before sponsoring you. Also, if you need financing, then a lender will want to see a business plan as well. There are several different types of business plans, but a typical plan will contain the following information: Executive summary. Summarize the services your business provides and the problem it solves. Overview of company. State where you are located and when you formed. Also identify if you are a corporation, LLC, partnership, or sole proprietor. Industry analysis. Identify your market and explain how large it is. Explain any emerging trends, such as the rise of ecommerce businesses. Customer analysis. Determine your target customer bases and their needs. For example, you might target certain businesses, such as start-ups in your area. Analysis of competitors. Identify and analyze your competitors. State their strengths and weaknesses, and explain what gives you a competitive advantage. Marketing plan. Explain how you will position yourself in the market, through advertising and promotion. Operations and management. Identify key milestones over the next three years as well as what you must do daily to succeed. Also identify your company’s management. Financial plan. Explain all the ways your business will generate revenue. Also calculate how much money you need to start and how you will use these funds (such as to finance marketing).

Securing a Bank Sponsor

Find a member bank to sponsor you. You won’t work directly with Visa or MasterCard. Instead, you will work for a bank that is a member of either credit card association. Multiple member banks may sponsor you, so you don’t have to limit yourself to only one. Banks are typically members of both associations. Call up banks and ask if they will sponsor you. You should start locally and visit their website first. Some banks don’t sign up ISOs. Instead, they’ll make you go through a Member Service Provider.

Gather required documents. You also need to submit a considerable amount of paperwork to the bank. Pull this information together ahead of time, so that you will have it available when you submit your application: two years of financial statements for the business or personal tax returns for all principals personal financial statement for each principal in the business your Articles of Incorporation or partnership documents business plan sales materials and solicitations list of current ISO agents and employees

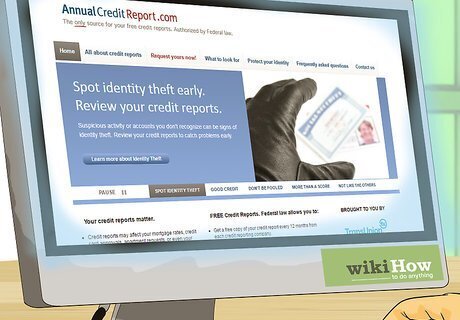

Check your credit history. All principal owners will have their credit checked to confirm that you are responsible with credit. Before the application process, you should probably look at your credit report. Correct any errors that you find. You can obtain a free credit report by calling 1-877-322-8228 or visiting www.annualcreditreport.com. You will get reports from all three credit reporting agencies: Equifax, Experian, and TransUnion. Go through the reports and find any wrong information. Common errors include credit information from someone other than you and accounts incorrectly listed as in default or closed. Make sure to dispute all wrong information. You can dispute online, but be sure to follow up with a letter.

Analyze your contract. You should read your sponsorship agreement carefully and use an attorney to help you. These contracts can be confusing, and often there are hidden clauses that don’t work to your advantage. For example, check to see if there is a minimum fee requirement. If there is, then you might be charged a fee (of several thousand dollars) if your accounts don’t generate enough transactions. Also check if you are being charged “set up” fees. You shouldn’t be. Based on any minimum fee requirement, you should calculate how many transactions you’ll need to generate to avoid the fee. Sit down with an accountant if necessary and confirm you are confident you can meet the minimum.

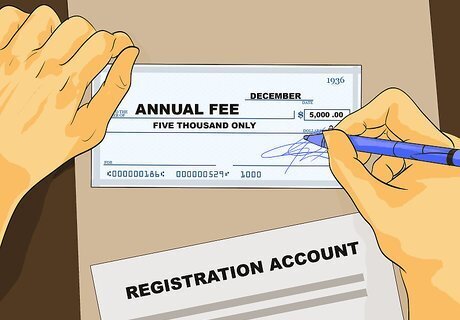

Pay your registration fees. If you are accepted, then you must pay your registration fee. The fee is $5,000 for each credit card association. You must annually review your registration and pay the fee again.

Marketing Your Services

Create a website. You’ll want a web presence so that prospective clients can find out more information about you. If you can afford it, hire someone to design a professional looking website. If you can’t afford help, then look for businesses that sell domain names and templates you can use to create a basic website. Make sure your domain name is your business name. That will make you easier to find. Remember that your sponsoring bank must be displayed on your website.

Hire sales agents. You can hire agents to work for you, although you don’t have to. They must only represent you and not their own business. You should find people with prior sales experience. You might want to hold off on hiring agents until your business is really booming. Sales agents typically get a cut of each transaction, so that will lower your profitability.

Determine your buy rate. As an ISO, you make money by marking up your services. For example, the bank will give you an initial buy rate. It could be 2.00% + $0.20. This is how much will be charged for each credit card transaction. You can increase this amount when you sell your services to the merchant. If you mark it up to 2.25% + $0.25, then you get the additional .25% and five cents on every merchant credit card transaction. This adds up when the merchant has a high volume of transactions. You want to be competitive with other ISOs in your area, so research what they are charging.

Set a processing statement fee. You can also make money by charging a fee for each processing statement. For example, the merchant typically pays $10 per statement. Your sponsoring bank will charge $5 as a buy rate. This means you’ll net $5 for each statement. Try to get the buy rate as low as possible. If your buy rate is $3, then you could pocket $7 per statement.

Hone your sales pitch. Your sponsoring bank will provide you with materials and tools to sign up customers. They may even provide you with a standard sales pitch. Your primary job as an ISO will be to sell the credit card services to possible merchants. You will need to become comfortable discussing the following: How a merchant account works. The costs of maintaining a merchant account. How to complete the required paperwork. How to set up the account.

Locate potential customers. Your potential customers are any merchants who use credit card processing for their sales. There is no one way to find clients. However, you should consider the following techniques: Cold calling. You find the phone number for businesses and call them out of the blue. This might be difficult at first, but once you get in the swing you could find many new leads. Networking. You need to meet business owners, who are your target audience. Accordingly, you can join your local Chamber of Commerce, Rotary Club, and other organizations. Make sure to attend business trade shows in your area and talk to people. Referrals from current customers. Business owners tend to know other business owners. Ask your current clients if they know anyone who is looking to purchase payment processing services. Advertising. You can set aside a portion of your budget and commit it to advertising. However, focus on advertising that will reach your target market.

Sign up accounts. Your sponsoring bank should give you forms to have merchants complete to sign up for their services. Remember that the bank handles all the payment processing. You simply sign up the clients. However, you should stay in contact with your merchant clients. New ISOs may be entering the field, and you want to maintain a good relationship with your current clients so that you don’t lose any.

Comments

0 comment