views

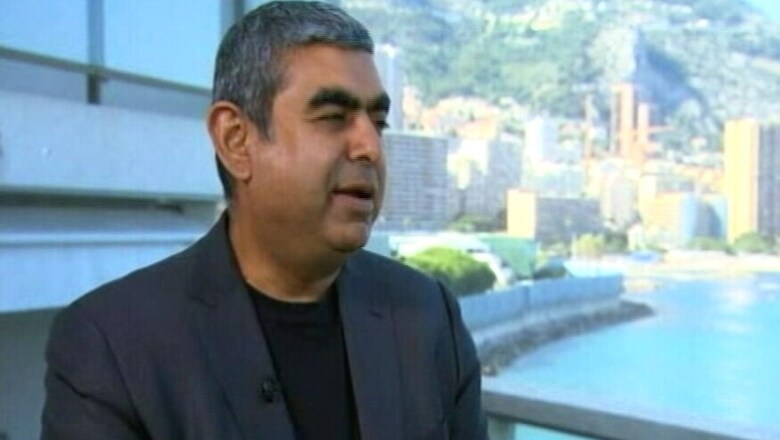

Bengaluru: Technocrat Vishal Sikka, who logged out of software major Infosys on Thursday after quitting as its first non-founder CEO on August 18, denied joining the US IT major Hewlett-Packard Enterprise (HPE), said an Indian business news channel on Saturday.

"Reports of me joining HPE are false. Someone is trying keenly to put me in a box," Sikka told CNBC-TV18 in a video interview from the US.

Sikka, 50, remarked in the light of reports that Infosys Founder N.R. Narayana Murthy had written to his advisers that "he (Sikka) was more a CTO (Chief Technology Officer) material than a CEO (Chief Executive Officer) material".

Terming the return of Nandan Nilekani as Infosys' Board Chairman an excellent idea, Sikka said the latter was an extraordinary leader and an iconic man.

"I offered to quit as Executive Vice-Chairman because I felt it was in the best interests of all concerned so that Nilekani could have a free hand. It also meant that the succession process would be complete," he noted.

Accepting Sikka's resignation as CEO, the Infosys Board appointed him as the Executive Vice-Chairman on the same day (August 18) till the new CEO took over by March 31, 2018 and elevated Chief Operating Officer (COO) U.B. Pravin Rao as the interim CEO and Managing Director (MD).

"I wanted to leave Infosys altogether after resigning as CEO last week, but the Board had insisted I stay on for the sake of continuity," he pointed out.

A huge proponent of Artificial Intelligence (AI) and its application to make a positive difference in the world, Sikka said he was excited to spend more time with his family at his Palo Alto home in the Silicon Valley of California.

Asked if he would agree to Infosys making the investigative report on the acquisition of the Israeli software firm Panaya Inc public, Sikka said it was up to the Board and he would have gone along with its decision.

Infosys acquired the US-based automation technology firm Panaya for $200 million in February 2015 to offer large-scale enterprise software management as a service to its global clients.

The Panaya buyout became a bone of contention between the co-founders and the Board due to alleged irregularities in its deal value and allegations by an anonymous whistleblower that company executives like Sikka had a personal interest in buying it.

One of the charges was that $20 million invested in Panaya before the deal were distributed to the shareholders, a charge Infosys denied claiming it (Panaya) had $18.6 million cash balance when bought.

"Panaya was looked at as an acquisition candidate based on its strategic fit. There was no conflict of interest due to Sikka's association with its investor Hasso Plattner, who was his boss in his previous job at the German software major SAP AG," said Infosys in a statement on February 20.

Though three investigations looked into the claims and found nothing, Murthy kept raising corporate governance issues at the company and asked the Board to consider making the Panaya report public.

"The allegations were baseless, false, wrong. It is a completely nonsensical detour," claimed Sikka in the television interview.

On the hefty severance package paid to Infosys former Chief Financial Officer Rajiv Bansal, Sikka said he had answered questions on it a thousand times.

Declining to share lessons he learnt at Infosys and if he could have done differently, Sikka hoped the outsourcing firm would move forward and get back to its business.

Asked if his being based out of the US and not Bengaluru was a problem, Sikka said as business was outside India, it was a complex balance of spending time, mostly in airplanes.mitting that his stint at Infosys from August 1, 2014 was an incredibly challenging job, Sikka said he was proud of the three years he spent in the iconic firm and was overwhelmed by the thousands of emails and communications he received from employees and clients.

Comments

0 comment