views

LONDON British inflation jumped unexpectedly last month to its highest rate since March, as clothing stores refrained from their usual summer discounts as they reopened after the coronavirus lockdown, official data showed on Wednesday.

Annual consumer price inflation rose to 1.0% in July from 0.6% in June, the Office for National Statistics said.

That was above all forecasts in a Reuters poll of economists that had pointed to an unchanged rate.

“Inflation is showing signs of a v-shaped recovery – not what consumers need at all,” said Jeremy Thomson-Cook, Chief Economist at Equals Money, a currency exchange company.

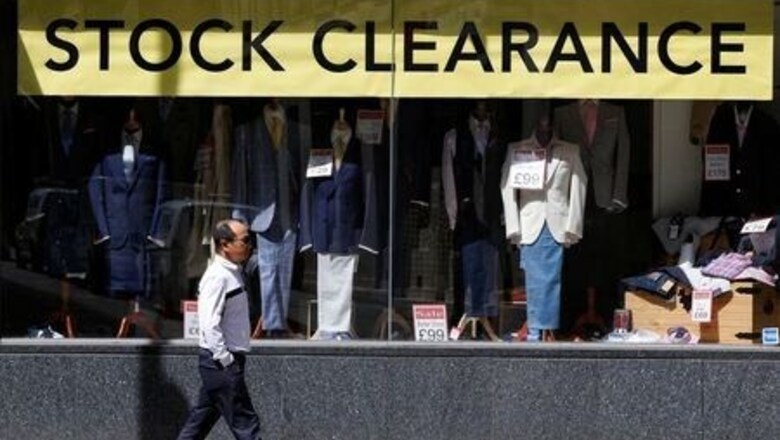

Clothing and footwear prices were the biggest contributor to the rise in inflation, the ONS said.

In most years retailers slash clothes prices between June and July to clear out their summer ranges in preparation for autumn.

This year, the drop in clothing and footwear prices was unusually small, perhaps reflecting discounting early in lockdown.

Higher petrol prices – and greater costs for haircuts, dentistry and physiotherapy – also contributed to higher inflation, the ONS said.

“Prices for private dental treatment, physiotherapy and haircuts have increased with the need for PPE (personal protective equipment) contributing to costs for these businesses,” ONS Deputy National Statistician Jonathan Athow said.

Core inflation – which excludes typically volatile energy, food, alcohol and tobacco prices – rose to its highest in a year at 1.8% from June’s 1.4%. Economists had expected the rate to fall slightly to 1.3%.

The ONS said July’s inflation number was based on near-complete coverage of its standard basket of goods and services, after widespread unavailability of some services at the start of the lockdown.

The Bank of England said earlier this month it expected inflation to turn briefly negative in the near-term, falling to -0.3% in August.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Comments

0 comment