views

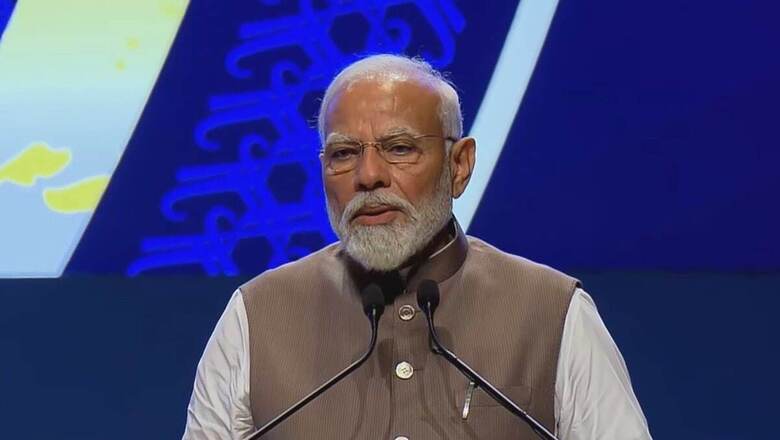

Prime Minister Narendra Modi on Monday issued a special coin to mark the commemoration of the 90th year of the Reserve Bank of India. The function was also attended by Union finance minister Nirmala Sitharaman, RBI Governor Shaktikanta Das and other members of the RBI.

The Finance Ministry unveiled a special Rs 90 denomination coin marking the 90th anniversary of the RBI. This distinctive commemorative coin, made with 99.99% pure silver and weighing around 40 grams, symbolises the rich history and accomplishments of the RBI spanning nine decades.

Features of the coin

The coin highlights the renowned RBI emblem in the centre, accompanied by the inscription “RBI@90” beneath, representing the institution’s enduring heritage and role in maintaining India’s financial resilience. It displays the Lion Capital of the Ashoka Pillar, an emblem of India’s cultural heritage and democratic principles, with the national motto “Satyamev Jayate” (Truth Alone Triumphs) engraved in Devanagari script below.

RBI history

The Reserve Bank of India (RBI) functions as the nation’s central bank. Central banking institutions are a relatively modern concept, with many of them, including those in their current form, being established around the early 1900s.

The establishment of the Reserve Bank of India was based on the recommendations of the Hilton Young Commission. Governed by the Reserve Bank of India Act, 1934 (II of 1934), the bank officially began its operations on April 1, 1935.

The Bank was constituted to

- Regulate the issue of banknotes

- Maintain reserves with a view to securing monetary stability and

- To operate the credit and currency system of the country to its advantage.

The Bank commenced its operations by assuming the responsibilities previously carried out by the Controller of Currency within the Government and by assuming management of Government accounts and public debt from the Imperial Bank of India.

From its outset, the Bank was recognized for its unique role in fostering development, particularly in agriculture. As India embarked on its planned development initiatives, the Bank’s developmental function gained prominence, particularly during the 1960s when the Reserve Bank led the way in utilising finance to spur development.

The Bank played a crucial role in fostering institutional development by establishing entities such as the Deposit Insurance and Credit Guarantee Corporation of India, the Unit Trust of India, the Industrial Development Bank of India, the National Bank of Agriculture and Rural Development, and the Discount and Finance House of India. These initiatives were aimed at strengthening the financial infrastructure of the nation.

Following liberalisation, the Bank has redirected its attention to fundamental central banking tasks such as Monetary Policy, Bank Supervision and Regulation, and Oversight of the Payments System, while also emphasising the development of financial markets.

Comments

0 comment