views

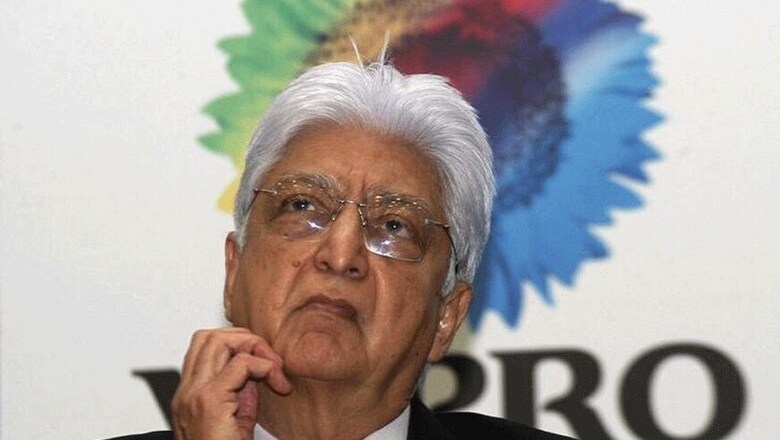

New Delhi: The promoters of Wipro Limited, India’s third-largest IT services company by revenues, are said to be in the initial stages of evaluating the sale of the company or at least some of its units.

A senior investment banker told Moneycontrol.com that the company has approached investment banks to explore the potential of a fair value.

Azim Premji, founder and chairman of Wipro, and his family own over 73% of the $7.7 billion company. It is said that they are considering a partial or full exit to either a strategic buyer of a private equity player.

“At this point of time, they have approached banks to understand what valuation they would get — the mandate to the banks is to determine a price,” the banker told Moneycontrol.

Wipro has, however, denied the development. In an emailed response to a Moneycontrol questionnaire, a company spokesman said: “This is baseless and there is no truth to these unsubstantiated rumors. We urge you not to give oxygen to such blatant falsehood.”

A merchant banker familiar with the Wipro development told Moneycontrol that though IT companies are at present struggling to grow, they are cash rich, thus making them attractive to buyers, including private equity and Western strategics.

Moneycontrol further stated that Wipro was struggling for growth for more than five years, but was sitting on liquidity of Rs 34,474 crore. But Wipro reportedly has been losing clients to its rivals, thus posing a big challenge in revenue generation.

Revenues from the digital ecosystem, which was 17.5 per cent of IT Services revenues in Q1, grew to 22.1 percent of IT Services revenues in Q4 of FY17.

The company’s commentary for FY18 has not reportedly inspired the market. Moneycontrol quoted Emkay Global as saying, following the March quarter numbers, that while Wipro’s commentary was positive with the management hoping to match industry growth by Q4FY18 in sequential terms, this, however, “might be in line with historical trends and wasn’t anything to be excited about”.

Comments

0 comment