views

The political turmoil in neighbouring Bangladesh has now escalated into an economic crisis, leading to many global companies withdrawing their businesses from the country. This raised concerns about a possible impact on India. However, on Tuesday, rating agency Crisil stated that the recent events in Bangladesh have not significantly affected Indian businesses.

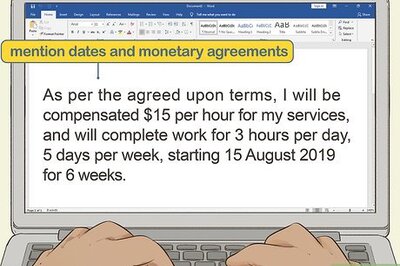

In a report, Crisil Ratings noted that the effects of the Bangladesh crisis will vary based on industry and sector-specific risks. It is not expected to have any immediate impact on the credit quality of Indian industries. The agency added, “We do not anticipate this development to have any near-term impact on India’s industry credit quality. However, if the disruption continues over an extended period, certain export-oriented industries may experience effects on revenue and working capital cycles.”

Some companies that manufacture footwear and daily-use products may experience minor effects as their production units are based in Bangladesh. These facilities faced operational challenges when the crisis began, but most of them have resumed functioning, suggesting a limited overall impact.

The credit rating agency also emphasised the need to monitor the Bangladeshi currency, Taka. According to Crisil, India’s trade with Bangladesh is relatively small, accounting for 2.5% of total exports and 0.3% of imports in the previous fiscal year, meaning the impact will largely be restricted to currency fluctuations.

India’s key exports to Bangladesh include cotton and cotton yarn, petroleum products, and electricity, while imports primarily consist of vegetable oils, marine products, and garments. As a result, only these sectors may see slight disruption from the crisis. It is worth noting that last month, Bangladesh’s economy came to a halt due to massive student protests with former Prime Minister Sheikh Hasina being dethroned, leading her to flee the country. However, the situation has since stabilised with Nobel laureate Muhammad Yunus being appointed head of the interim government.

Comments

0 comment