views

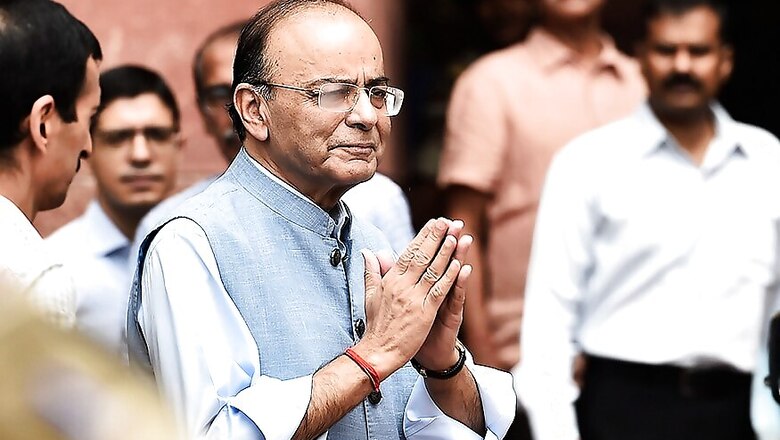

New Delhi: Finance Minister Arun Jaitley on Monday said the Centre has decided to increase its contribution to the NPS for the central government employees to 14 per cent and also made the entire withdrawal amount tax free at the time of retirement.

The decision was taken at the Union Cabinet meeting last week.

The central government's contribution to the National Pension System (NPS) will be increased to 14 per cent from the current 10 per cent. The minimum employee contribution stands at 10 per cent.

Addressing the media here, Jaitley said changes have been made in the NPS in "larger interest of employees".

Under the NPS, the subscriber is eligible to withdraw 60 per cent of the corpus. The remaining 40 per cent of the accumulated fund goes towards annuity.

Tax exemption limit for lump sum withdrawal on exit has been enhanced to 60 per cent, the minister said, adding the entire withdrawal will now be exempt from income tax.

Out of 60 per cent of the accumulated corpus withdrawn by the NPS subscriber at the time of retirement, 40 per cent is tax exempt and balance 20 per cent is taxable.

This tax exemption on withdrawal is for all sections of employees.

Additional burden due to the increase in government's contribution on the exchequer will be Rs 2,840 crore for the 2019-20 fiscal, Jaitley said.

There had been a long pending demand to bring NPS in the EEE (exempt-exempt-exempt) category and at par with employee provident fund (EPF) and Public Provident Fund (PPF).

Comments

0 comment