views

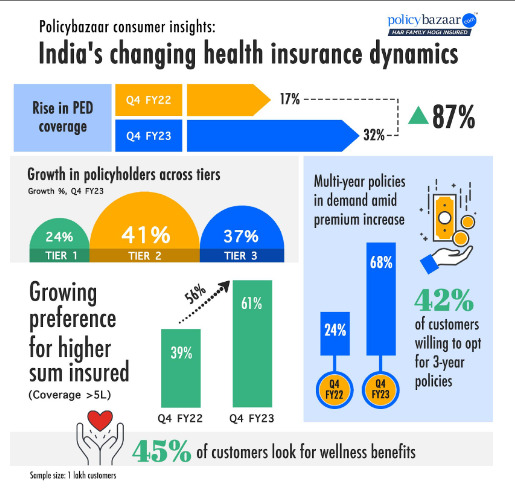

There is a surge of 87% in the share of customers opting for pre-existing diseases coverage in Q4 FY23 as compared to the same quarter last year. The insights were revealed by Policybazaar, after analysing the data of over 1 lakh health insurance customers in the period stated.

While Q4 FY22 saw 17% of customers buying coverage for pre-existing conditions, the number has doubled this year to 32%. Though alarming, the figures also represent a compelling need for adequate coverage as well as growing consumer awareness regarding new-age health insurance products amid shifting health dynamics, the research said.

A steep rise is seen in the number of customers opting for a cover higher than Rs 5 lakhs (39% in Q4 FY22 vs 61% in Q4 FY23).

Broadly, the findings revealed a positive shift in consumer awareness regarding health insurance.

Sarbvir Singh, joint group CEO, Policybazaar.com, said, “With the insurance industry evolving to focus on prevention as well as protection, these consumer insights also reflect a growing appetite for wellness and preventive healthcare features. The change in consumer sentiment is also evident with tier-2 and tier-3 cities showcasing a higher inclination for health insurance protection. We, along with our insurer partners, will continue to leverage technology to make insurance more accessible, affordable and relatable for our consumers.”

Key findings of the research are:

Rise in high-sum insured policies: Consumers are inclined towards high-sum insured in their policies as a strong shield against medical inflation. The findings showcase a steep rise of 56% in the number of customers opting for a cover higher than Rs 5 lakhs (39% in Q4 FY22 vs 61% in Q4 FY23). Not just this, the number of customers opting for a sum insured of less than Rs 5 lakhs has seen a sharp decline of 36%, reflecting a descending propensity towards lower coverage. With a rise in critical illnesses and large hospitalisation expenses, consumers now understand the significance of being adequately equipped with a higher sum insured.

Non-metros fare better: Non-metro cities demonstrate a promising level of awareness when it comes to health insurance coverage, with a 41% and 37% increase in customers from tier-2 and tier-3 cities, respectively, in contrast to a 24% uptick in tier-1 cities. The spurt in numbers also points towards improved access to protection products owing to increased online consumption of financial services in recent times.

Multi-year policies in demand: The share of multi-year policies in the overall pie has increased from 24% to 68%. The primary reason behind this is an average 17% hike in premiums of popular plans by insurance companies. As many as 42% of customers are willing to pay upfront for 3 years in a bid to spare themselves the future financial strain of growing medical inflation.

Top features demanded: Not only this, the rider for a higher cover amount also ranks at the top of most-asked-for features by consumers. Other popular riders are coverage for annual health check-ups and OPD (outpatient department). Around 60% of the customers look for an annual health check-up feature in their policies, showcasing a growing inclination towards preventive healthcare.

Wellness benefits are sought-after: The demand for preventive healthcare is also reflected in the high demand for wellness benefits wherein customers are entitled to discounts or benefits upon renewal for meeting the fitness criteria in their policy. As many as 45% of customers look for wellness benefits, which not only characterises growing consumer awareness for healthcare but also for new-age features in health insurance products.

The other features that emerged as popular choices in the findings were locking premium as per age, 7x higher sum assured, unlimited restoration benefit and low or no waiting period for senior citizens. These features make health insurance plans more flexible and customisable to suit changing consumer needs.

Read all the Latest Business News here

Comments

0 comment