views

Requesting a New PIN by Phone

Call the 1-800 number printed on the back of your card. Check for the number along the bottom portion of the card. The customer service hotlines for most banks and financial institutions are usually available 24 hours a day, 7 days a week, and are almost always toll-free, which means you won’t be billed for your call. If you don’t happen to have your card on hand, you can also call the company directly and ask to be connected to the customer service department.

Follow the instructions for resetting your PIN if you're on an automated hotline. After a short greeting, you’ll be instructed to make a series of button-presses, each of which corresponds to a different service. Wait until you hear the phrase, “account information” or, “card information” and press the indicated button. Then, follow the subsequent prompts until you arrive at the option to reset your PIN. Listen carefully—if you press the wrong button, you may be forced to start over from the beginning. If you’re uncertain about what to do next, choose the option to be connected with a customer service agent.

Explain your situation to a customer service agent if you get a real person. Tell the agent that you’ve forgotten your PIN and either need a reminder or wish to set a new one. Be ready to provide details like your full name, the last 4 digits of your social security number, and/or your card or account number, as they’ll need some verification that you are who you say you are. Getting in touch with a live customer service rep may be your best bet if it’s your first time experiencing an issue with your card, or if you’re running into technical difficulties with the automated service system.

Enter your new PIN when prompted. Punch in the number using your phone’s keypad. As a rule, banks and card issuers ask that users designate a PIN that’s either 4 or 6 digits in length. To avoid similar issues in the future, try to pick a number that will stick in your mind. This could be a coded word, a meaningful date, or another series of numbers that has some special significance to you. Steer clear of obvious go-tos like your birth year, your zip code, or the last 4 digits of your street address. Anyone could figure out one of these numbers if they were to get hold of your wallet. You may be asked to input your new PIN multiple times in order to confirm that it’s correct.Tip: An example of a strong, secure PIN that no one is likely to guess is “7827,” which spells the word “star” when mapped out on the keypad.

Make a trip to your bank if you’d rather reset your PIN in person. Not everyone is comfortable divulging sensitive financial information over the phone. Luckily, those who aren’t can always visit their neighborhood bank branch and discuss the matter with a flesh-and-blood teller. These experienced professionals are committed to offering customers security and peace of mind. It’s a good idea to pop in for a face-to-face chat if you discover that your PIN has been blocked or invalidated inexplicably.

Resetting Your PIN Online

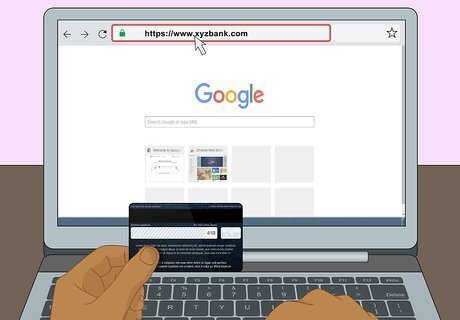

Visit the website of the bank or institution that issued your card. Most banking sites contain a section where users can view their account details and make changes to various settings and preferences. This is where you’ll be resetting your PIN. If you’re not sure how to find a particular bank or company’s website, simply type their name into Google. You’ll also typically find an organization’s web address printed somewhere on the back of the card itself. In some cases, you might be able to reset your PIN from your card issuer’s mobile app, as well.

Sign into your online banking account. Enter your email address or custom username and password, then hit “Sign In.” Once the site has verified your login credentials, you’ll be redirected to an overview page that provides a summary of your transaction history and presents different actions that you can perform as the account holder. If you’ve never made use of your bank or card issuer’s online services before, you’ll need to register an account. This will require you to provide information like your name, email address, date of birth, and social security number. It may also be necessary for you to supply your card or bank account number. Be prepared to answer one or more security questions if you haven’t signed in in a while. These generally take the form of highly-specific personal questions that only the account holder would know the answer to, such as, “What was the name of your first childhood pet?”

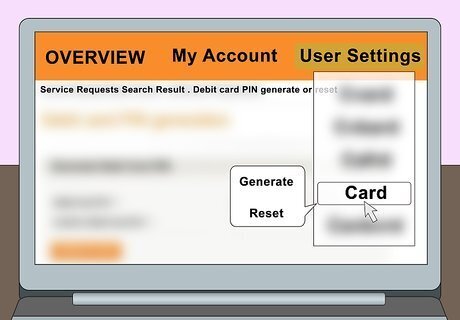

Navigate to your user settings. This is where things start to get a little tricky, as different sites and apps are set up differently. Most of the time, you’ll find a link to your user settings somewhere near the upper righthand corner of the main page. Click or tap this link to pull up a list of customizable options. The user hub on the website of your bank or card issuer could also be labelled “Account Settings,” “Preferences,” “Controls,” or something similar.

Scan your user settings for an option that allows you to manage your card. You may see it in a drop-down list, or it may be displayed somewhere on the dashboard near the top of the screen. When you find what you’re looking for, click or tap the link. Almost there! If you don’t have any luck tracking down this option, you’ll have no choice but to complete the process over the phone or in person.

Select the option to reset your PIN. This may also be phrased as, “Change Your PIN,” or, “Create a New PIN.” Click or tap the link to pull up a secure-encrypted PIN reset form. As you do, be thinking about what you want your new number to be. Some banks send out helpful PIN reminders to forgetful members. Check to see if you have the option to receive a confidential reminder if you just need a little help remembering your PIN and don’t want a different one. Not all banks and card issuers permit their users to change their PINs online. If you hit a dead end, pick up the phone or head down to your bank.

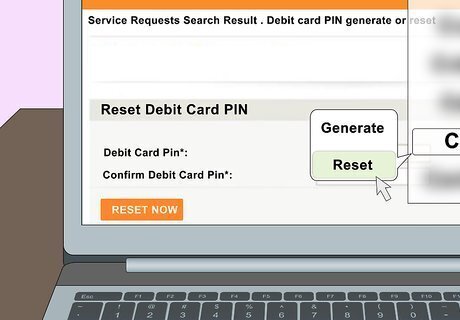

Enter your new preferred PIN. Most banks and financial institutions recommend that users specify a PIN that’s either 4 or 6 digits long. Try to choose a sequence of numbers that you’ll have no problem remembering. When you’re satisfied with your new number, click or tap “Submit” or “Confirm Your New PIN” to make it official. Don’t be surprised if you’re asked to type out your new PIN more than once. This just helps to ensure that you don't end up with the wrong number in the event that you accidentally make a typo. Assuming your bank or card issuer doesn’t give its users the freedom to create their own custom PINs, they’ll randomly generate a new number for you and send it to you by mail within 7-10 business days.Warning: Avoid using your birthday, a portion of your address or phone number, or the same repeating number as your new PIN. These sorts of passcodes are all too easy for thieves and hackers to crack.

Comments

0 comment