views

Making the Most of Your 30s

Spend your time wisely. Don’t continue to squander your time and money on people or activities which do not edify or improve your personal or professional life. Channel yourself into engaging activities which help you grow. Ask yourself what you love doing, and find time to do it. Follow your passions. If you love playing guitar, devote some time after work to doing so each day, or meet locals with whom you can jam. Perhaps the skills or talents you possess still lay dormant. In this case, try your hand at a new craft or interest. Libraries and community arts and culture organizations often host free classes or clubs which can help you learn something new. Try volunteering at local nonprofits in order to give back. You might like it. Be daring! Get active and do something that you've always wanted to do, like taking a hip hop dance class, bungee jumping, or taking a trip to an exotic destination.

Stop comparing yourself. Don’t measure yourself against people who are younger than you. This leads to obsessive thoughts. For instance, you might compare yourself to a younger coworker. If you begin to do this, you should stop and ask yourself why you feel the need to compare yourself. Let go of comparative thoughts by imagining them as a balloon floating away. Alternatively, distract yourself by working on some homework or engaging in a healthy hobby like playing guitar or writing. If you accept yourself and can honestly see your own strengths and weaknesses, you’ll know that nobody has the exact combination that you do. You’re just as unique and important as any other person, no matter their age.

Accept yourself for who you are. In your thirties, you might begin to see gray hair, smile lines, wrinkles, and other indications that, yes, you’re getting older. Being honest with yourself about these changes will make them less painful and give you an opportunity to honestly dialogue with yourself about why they should be worrisome at all. Ask yourself why you’re afraid of these physical changes. Is the anxiety you’re feeling about growing older caused by your fear of dying? Are you afraid that you’ll become unattractive? Afraid a partner will leave you? Think carefully about your fear in order to work out a plan to tackle it. Use positive self-talk in order to remind yourself that your body, like all bodies, is changing and will continue to change. There is no shame or negativity in that.

Learn to be comfortable alone. Being alone is one of the chief fears people develop as they age. But if you don’t want to conform to the standard of marriage and kids just because you’ve hit thirty, you don’t have to, and you shouldn’t be worried or afraid just because you’re living alone. There are no rules for hitting thirty or any other age. Learn to be comfortable with yourself and enjoy alone time. Learn to enjoy being quiet, silent, and contemplative. Enjoy your alone time as a solution to the stress brought on by your busy day. Read a book or watch a movie at home. Make a list of all the people in your life you’re thankful to have and write them notes telling them how important they are to you. Go for a walk or get some exercise.

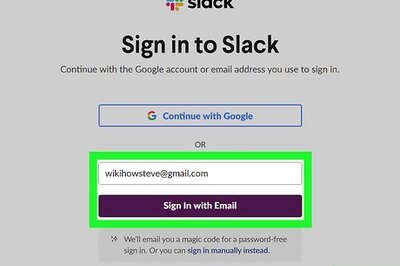

Find time for yourself. Your responsibilities might be piling up as you grow into your thirties. Perhaps you have to run young children to preschool or soccer practice. Maybe you have a busy work schedule that sees you jetting from city to city on corporate business, or constantly answering calls and emails. Whatever the case, ensure you make time to decompress and clear your mind. Schedule alone time throughout each day. For instance, perhaps you spend the first thirty minutes when you wake up, thirty minutes of your lunch hour, and the last thirty minutes before you sleep in quiet contemplation, or reading a good book. Integrate regular periods of restful alone time into your daily activities. Practice tuning out the noise. You can find alone time without being literally alone. If your partner or spouse is nearby, enjoying him or herself quietly, you can do the same. Walk more often. Walking is not only a great form of exercise, but also gives you time to yourself. Put on some headphones and some relaxing music if you want. Walking through a forest or a pleasant meadow is ideal, though a walk around a quiet neighborhood is just as good.

Express yourself. Don’t worry about what other people think. Instead of wearing a “mask” -- a role, act, style, or attitude you believe people want to see -- be open and honest about your true feelings, ideas, and thoughts. Wear clothes you’re comfortable in which match your personality. Don’t try to fit the ideal mold someone else has cast for you. If you’re still finding who you are, that’s okay, too. Try new things – go on a vacation with some friends to a new place, learn a new skill, or try a new food at a restaurant. Plumb the depths of your innermost being in order to find out what really excites, motivates, and inspires you. Recognize your own inherent value, and believe that others will see your value as well. Jeans, t-shirts, and sneakers are still mainstays outside of work. Don’t let your age determine how you dress.

Overcoming Your Age-related Anxiety

See aging as a positive, normal experience. The media and society glorify youth and tend to portray growing older – even when you’re only just turning thirty – as a negative or upsetting experience. In fact, many people find their quality of life improves after thirty. Don’t buy into the myth perpetuated by the beauty industry, glossy fashion magazines, and Hollywood movies that you need to be between the ages of 18-25 to have an exciting, fulfilling, beautiful life. As you grow older, you might begin to have more disposable income. Look forward to the opportunities this will afford you. Sexual satisfaction tends to increase as we age. As you gain confidence in the bedroom and become more comfortable with your own sexuality, you might feel more willing to experiment. If you’re married or in a long-term relationship, the intimacy you have with your partner can deepen your sexual satisfaction. Celebrate the relationships in your life that really matter. Make the most of one-on-one time with friends and/or your partner. You now have at least thirty years of experience behind you on which to draw. Wisdom comes as we age. Look back on past mistakes and regrets in order to make better decisions tomorrow.

Learn to love uncertainty. Some people think that as they age, things become more clear, choices become easier to make, and the correct path becomes more obvious. In fact, uncertainty and ambiguity are a part of life no matter what your age. While this might scare some people, learning to enjoy the possibilities and opportunities life offers is an important aspect of growing in your 30s. Feel excited and thankful for the spontaneity you’re afforded each day. In situations of uncertainty, recognize that your information is not complete. If you have an opportunity to improve upon or extend that information, wait to do so, but do not wait to make a decision based on the possibility of new information coming in. For instance, if you’ve been offered a promotion which requires you move to Germany, read a bit about German culture, society, and life. If possible, converse with American expatriates living in Germany. Discuss the offer with your family. After a few days, accept that you’ll never know if living and working in Germany is the right choice unless you go there and experience it. Let the many wonderful possibilities of life in Germany inspire and excite you. Don’t hesitate in the face of uncertainty. Just because you don’t know it all doesn’t mean you should let that realization paralyze you.

Choose not to let your fear consume you. Standing up to your fear is a choice. Acknowledge that you are afraid of aging. Try to think about what specifically bothers you with the aging process. The possibility of death? The pressure and expectations to marry or have kids that come with age? Identify these problems and realize that they are only as important as you let them be. Use positive self-talk to remind yourself that even if you don’t meet social expectations and choose not to become a parent or spouse, you are valuable intrinsically. If you have a job you’re proud of, think of some of the things you’re most proud of having accomplished at work. When you encounter a fear like “I am less sexually attractive than I once was,” let the idea slip away. Envision a balloon lifting off into the sky. Replace fearful thoughts with positive thoughts like “I have many family members and friends who care about me.”

Recognize if you are struggling to accept your age. Some people turning thirty feel they need to wear metaphorical masks to hide their anxiety about growing older. For instance, you might want to continue partying hard long into your thirties just as you did when you were of college age. You might stay out all night going from bar to bar just like you did when you were in your twenties. Instead of still acting like (or actually believing) you’re a superhuman, invulnerable to sleep and alcohol, accept that your body is changing and can’t bounce back as easily as it once did from neglect, bad diet, or exhaustion. Wearing a mask such as this is harmful for both you and those around you. The mask will make it difficult for you to accept and come to terms with the fact that you’re aging, and it makes people around you worry when they see your struggles with the aging process. Listen to the concerns of those around you in order to identify if you’re wearing such a mask.

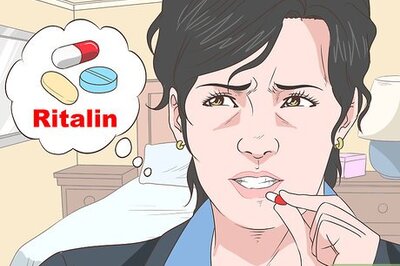

Use a de-stressing technique that work for you. Entering your thirties can be stressful, but there are a variety of stress relief techniques available to help you. Each will be effective with different individuals. Go for a walk or bike ride, hit the gym, take a warm bath, or read a book in bed. Other tried-and-true de-stressing methods like yoga, deep breathing exercises, and mediation are worth a shot as well. Other methods like regular volunteering at a homeless shelter or soup kitchen could also reduce stress. Try a variety of relaxation and stress relief methods in order to discover which works best for you.

Staying Healthy and Aging Gracefully Into Your 30s

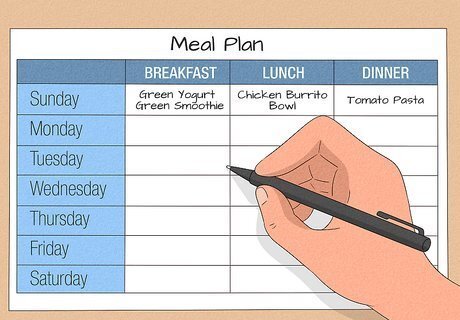

Plan your meals. In your thirties, you’re probably quite busy taking kids to soccer or school, or working hard on your career. By the time you get home, you might be tired and not feel like figuring out what to eat and cook. Planning your meals will help save you time thinking about what to cook and scrounging around for ingredients. Think about your favorite dishes when planning meals. Try to incorporate items you have on hand, and go shopping for items you want but do not have already. Stock up on staples like rice, beans, and flour. Buying only what you need to adhere to your meal plan will save you time and money at the market. Use a meal plan on a weekly or monthly basis to ensure you have some meals more-or-less ready to eat on short notice. Mix it up. Don’t eat the same meals week after week or you will get bored. Try something new and different. Involve your family or partner in the meal-making process as well. Include occasions where you plan to eat out or have snacks between meals in your meal plan. Factor leftovers into your meal plan if you have any so as not to waste food. Being realistic will reduce food waste in your household.

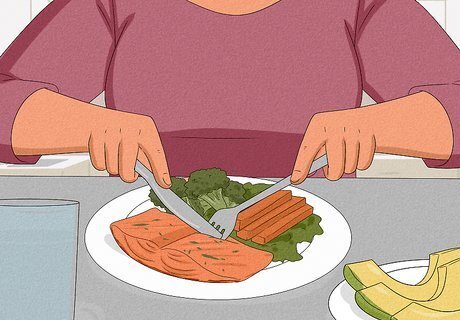

Eat a healthy diet. Avoiding obesity and its subsequent effects like diabetes and heart disease gets harder in your thirties as your metabolism changes. In order to avoid these unhealthy developments, avoid processed foods and foods loaded with sugar, salt, and fat. A healthy diet consists of mostly fruits and vegetables, fiber, and whole grains with a limited protein intake. Such a diet will reduce your risk of obesity and leave you feeling full longer than a diet which is heavy in salt, sugar, and fat. For instance, a meal of steamed spinach or broccoli along with brown rice and kidney beans is a good, healthy meal. Instant or microwave dinners, or pasta mixes with lots of salt (like ramen or mac and cheese) are not good choices if you’re aiming for a healthy diet. An easy way to reduce sugar is to cut out consumption of soda and sugary drinks. Eat in moderation. Don’t eat when you are full or not hungry. Try to consume smaller portions if you want to lose weight. Avoid snacking throughout the day, or substitute healthy snacks like carrots and celery for unhealthy snacks like cookies. Eat slowly. Eating quickly is a primary cause of overeating. Chew each bite at least eight times before swallowing. Drink at least 8 glasses of water each day. Women in their thirties generally need about 1,800 calories per day, while men in their thirties need about 2,000 calories per day. If you are more active and exercise regularly, you will require slightly more calories. Don’t try to diet in the traditional sense, eating healthy portions and foods on a temporary basis until you hit your target weight. Instead, change your diet so that you can sustain your health in the long run.

Get enough sleep. While in your twenties, you probably pulled a few all-nighters due to late-night college cramming, partying, or just watching TV with your friends. As you age, though, it becomes progressively more difficult to go without enough (or any) sleep. Aim to get between seven to eight hours of sleep each night. If you cannot find time to sleep enough, try to adjust your schedule so that you have a regular bedtime. Get quality sleep by avoiding food or drink for the three hours prior to going to bed. Ensure your bed is comfortable and your pillows soft.

Exercise regularly. Exercise has a wide variety of benefits: it reduces blood pressure, lowers risk for diabetes, maintains your immune system, keeps bones strong, improves breathing, builds muscle, and reduces fat (among other reasons). In order to gain the many benefits of exercise, aim to get at least thirty minutes of exercise each day. Include both cardio and aerobic workouts. For instance, you might run or bike for thirty minutes, then lift weights or do squats for another 15 or twenty minutes for a vigorous 45-50 minute workout. Strength training with weights is important in your thirties because as your metabolism slows, you become more likely to lose muscle and gain fat. Aim to do 15-20 reps on a bench press and at least 30 push-ups during your workout sessions. Lift weights appropriate for your weight class. Check with your doctor before engaging in a new workout routine. Get a physical to ensure you don’t have any heart conditions or other medical issues which may make exercise dangerous for you.

Becoming Financially Savvy in Your 30s

Diversify your savings. Don’t put all your money into a 401(k). While having a retirement account is important, you’ll need to set up multiple accounts for other potential future expenses like a car, vacations, your kid’s college, and a house. Check your bank’s online interface to see if you can create sub-savings account. If not, talk to a financial manager about opening such accounts in a way to maximize growth. To save for a house, you will need at least 5% of the total cost of the home you’re interested in buying. For instance, if the home you want to buy costs $100,000, you’ll need to have at least $5,000 in the bank as a down payment. To save for your child’s college, you should aim to have about $40,000 saved by the time they are 18. In other words, if your child is a newborn, you should try to save about $2,200 per year. Determine what percentage to save.

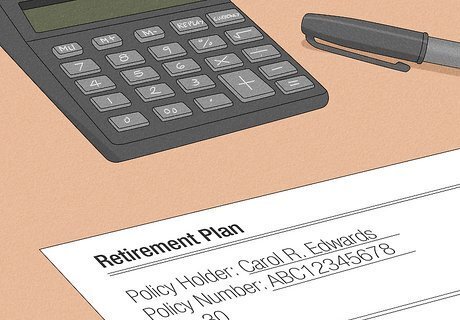

Set your priorities. You’ll be tempted to save more for your kid’s college fund than for your own retirement. This is understandable since your child will probably attend college long before you retire. However, you must continue to place priority on your retirement fund. Even though you have a good thirty or forty years before retirement, it’s not too soon to put yourself on a solid financial footing for the future. If you don’t your child might have to support you in your old age. Stay focused on your own long-term financial health before building your child’s college fund or another savings account. Try to put $100 aside each month for your retirement. If you do this for forty years, you’ll have saved $48,000 -- plus interest!

Get insured. All manner of insurance -- life, home, disability, and health -- should be in place for you and your loved ones. Identifying the best insurance plan is difficult due to the often dizzying number of options available, and many people tend to think that any plan will do as well as another. Don’t settle for just any type or level of insurance, though. Check your plan carefully and ask lots of questions to ensure it will be adequate when you need coverage. For instance, with your health insurance, ask if it will cover strokes, heart attacks, and cancers. Find out if your home insurance coverage includes deductibles for fire, hurricane (depending on where you live), flood, and other types of accidents. Ensure your disability insurance covers long-term disabilities. Around one in four people are disabled before retirement, and many people only obtain life insurance without considering the possibility of encountering a situation in which they cannot work.

Talk to your partner about money. If you’re married or planning on getting married, have a sober talk from time to time about the state of your joint finances. Understand the financial background of your partner. What are your respective salaries? If your salaries are both adequate to support each of you separately, you probably don’t need a joint account. However, if one of you requires supplemental income, or takes an extended amount of time off work to care for a child, a joint account could be a useful option to consider. Then, think about each of your spending habits. Are either of you spendthrifts? Or do you and your partner conscientiously scrimp and save? If you decide to create a joint account, draw up a written agreement about how and when to spend the money in the account. Having a written guide as to how this money is used will reduce likelihood of future money-related problems. You might not get an honest answer out of your partner about their spending habits. This is not to imply your partner is deliberately lying, but many people overestimate the amount they save and underestimate how much they spend.

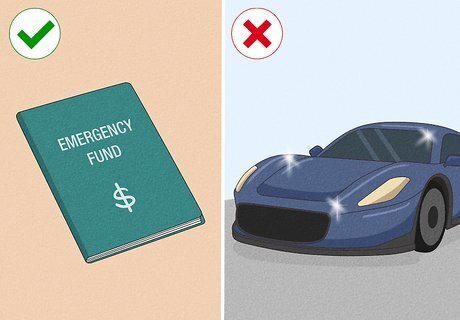

Don’t overspend on any one thing. Some people are tempted to go all-out on their wedding or their first child. While marriage and the arrival of your firstborn are monumental events, they do no justify sacrificing your long-term financial health for the immediate pleasure you’d get from the expenditure. Don’t assume that the expenditure is justified simply because you assume you will make more money in the future. This assumption may be well-founded, but it also might not be. It’s better to take the conservative route and assume you won’t increase your earning potential significantly in the future. Don’t buy a new car unless you really need it. A car should generally last you for at least ten years . Ensure you have enough in the bank for emergencies. Generally, a financial cushion should cover you for up to six months of living expenses.

Comments

0 comment