views

X

Research source

www.nsandi.com/files/published_files/asset/pdf/premium-bonds-brochure.pdf

Instead of receiving interest after a certain amount of time elapses (as with most bonds), premium bonds are akin to lottery tickets.[2]

X

Research source

www.nsandi.com/files/published_files/asset/pdf/premium-bonds-brochure.pdf

The other type of premium bond is one that is sold for higher than its face value.[3]

X

Research source

Buying Premium Bonds in the United Kingdom

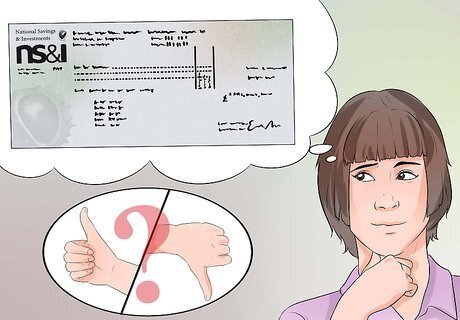

Decide if NS&I Premium Bonds are right for you. NS&I Premium Bonds are a savings account you can put money into and redeem at any time without penalty. Note that you cannot get withdraw your investment instantly like a bank account or ISA. With these bonds, the interest you earn is based on a lottery system. Your bond number is put in a system that randomly draws a certain number of bonds per month one calendar month after purchase and will continue to be entered until you cash in your bonds. Those bond numbers are paid various amounts, up to 1 million pounds. You are not guaranteed to win anything in a given month. All of the interest that is paid is tax free in the United Kingdom., One benefit to Premium Bonds is that your initial investment is very safe. The NS&I is backed by the Treasury. The maximum you can put into Premium bonds is 50,000 pounds, and this entire sum would be guaranteed by the government. While there is a chance of winning a very large sum, the odds of winning 1 million pounds is 1 in 27 billion per each 1 pound bond. Your odds of winning 25 pounds is 1 in 26 thousand per each 1 pound bond. So, most people will not win enough to match the current interest rate. On average, you can expect to win what the current established interest rate is (currently 1.35%). Therefore, it is only worthwhile if you cannot get more from a high interest savings account, or if you are willing to risk a lower return for a small chance of a much higher return.

Have your starting investment ready. You need at least 100 pounds to start your investment in NS&I Premium Bonds, though you can begin with 50 pounds if you commit to a purchase per month. Each bond is 1 pound.

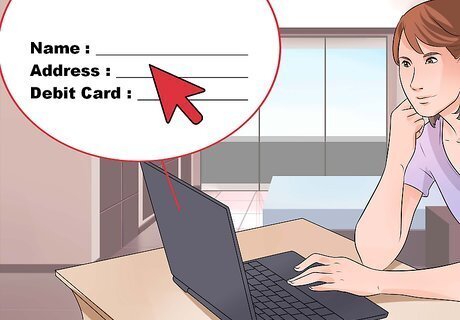

Apply online. You will need to fill in basic information, such as your name, your phone number, and your address. You'll also need you debit card information. Make sure it is one from a UK Bank. If you've registered online or by the phone, you'll need your NS&I identification number and your password, as well as your holder number. You can apply online at www.nsandi.com. Fill out the form. You'll need to answer questions such as how you want your notifications sent to you, as well as whether you want your awards cashed or reinvested as bonds.

Apply by phone. You can also apply by phone. You'll still need to have all of the same information on hand to give to the representative. Call 0500 500 000 to buy bonds.

Apply at a Post Office. You can fill out an application at the Post Office and pay for bonds on the spot. You will make out the check to Post Office Ltd.

Apply by mail. You can send in a check by mail along with your application for NS&I Premium Bonds. The application is available online. Make the check payable to National Savings and Investments, and send it with the application to NS&I, Glasgow, G58 1SB.

Purchase more bonds as needed. Each time you buy bonds, you must meet the minimum investment of 100 pounds or 50 pounds with a per-month purchase. You can purchase more bonds in your name the same way you purchase your initial bonds or by one of the other methods laid out in this article.

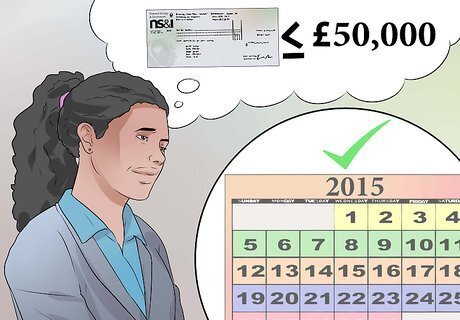

Know the limits. As of 2015, you can only hold a total of 50,000 pounds in NS&I Premium Bonds.

Buying Premium Bonds in the United States

Check your local laws. Gambling and lottery laws vary by location. NS&I Premium Bonds are technically a lottery bond, so it may or may not be legal to buy them in your state. Any interest, dividends and capital gains are subject to U.S. tax. You should receive either a 1099-DIV or 1099-INT at the end of the year, which will tell you whether or not you paid foreign taxes. If you did pay foreign taxes, you may claim a tax credit or itemized deduction on your tax return.

Apply by mail. You will need to print off the online application. You will need to provide information such as your name, address, and debit card information.

Create a UK bank account. You need UK bank account to purchase NS&I Premium Bonds. You may run into to some difficulty opening up a British account, as no bank must accept overseas clients. The easiest way to set up a British bank account is to contact your bank to see if it has a U.K.branch. Because you already have an account, you may find it easier to convince them to open a British account for you.

Decide on your investment. You must invest at least 100 pounds, equal to 100 bonds, or 50 pounds, equal to 50 bonds, if you commit to a per-month purchase. As of August 2015, 1 pound is equal to $1.57 USD.

Register for online and phone service. Once you've applied by mail, you can use that information to set up an account by phone or internet. You'll need to make certain investment decisions, such as whether you want your winnings reinvested into bonds or not. You can also register as or register someone else as Power of Attorney to make and manage your investments.

Purchase your bonds. You can purchase up to 50,000 pounds worth of bonds. Once you hold them, the British government should notify you if you win a prize amount.

Buying Regular Bonds at a Premium

Learn basic bond terminology. While premium bonds refer to the specific savings bond in the U.K. whereby winnings are determined by a lottery draw, it can also refer to the act of buying Government or Corporate bonds in the U.S. at a premium. To understand this, it is important to understand how bonds work and basic bond terminology. A bond simply refers to a type of investment, where an investor (also known as the bondholder) lends money to a business or government for a set period of time, and receives interest. In lending the money, the lender is purchasing a bond, which is essentially a certificate indicating that the borrowers owes the money back by a set date, and that the lender is entitled to receive interest payments at an agreed upon rate. Maturity date: Refers to the date the bond matures, or the date that the borrower (also known as the bond issuer), repays the value of the bond to the bondholder. Face value (also known as par value): Refers to the amount paid to the bondholder at the maturity date. If the face value of a bond is $1000, you will receive $1000 at the maturity date. Coupon: A coupon is an annual or semi-annual amount of interest paid on a bond to a bondholder. If a bond pays $50 annually, the coupon would be $50. The coupon may be expressed as a percentage of the face or par value, also known as the coupon rate. For example, you purchased a bond with a face value of $1000, and a coupon of $50. Your coupon rate would be 5%. Coupon dates: The dates throughout the year which the coupon is paid. Current yield: This is a bond’s coupon divided by its current price. For example, A bond that is purchased for $800 with a coupon rate of 5% will have a current yield of 6.25% ($50/$800).

Understand how interest rates affect the market price of bonds. Interest rates and bond prices have an inverse relationship: When interest rates rise, the market value of issued bonds fall, when interest rates fall, the market value of issued bonds increase. This relationship exists so that older bonds are liquid, i.e. can be bought and sold during the term of the bond. If interest rates are at 6%, no investor would buy a bond at face value if its coupon were 5%. In other words, no investor would pay $1000 to receive a $50 payment each year when the same $1000 could purchase another bond with a $60 payment each year. In order for the bond with the lower coupon rate to be attractive to investors, it must trade at a lower price, so that the current yields are the same. A previously issued bond with a coupon of 5% would sell at $833.33 to provide the same current yield as a bond with a coupon value of 6%. ($50/$833.33 = 6% current yield; $60/$1000 = 6% current yield). Bonds whose market value is less than face value are known as discount bonds. An investor purchasing discount bonds would receive a current yield equal to market rates plus a capital gain at maturity when the bond is redeemed at $1000. A previously issued bond with a coupon of 5% would sell at $1,250 to provide the same current yield as a bond with a coupon value of 4%. ($50/$1250 = 4% current yield; $40/$1000 = 6% current yield). Bonds whose market value is greater than premium value are known as premium bonds or bonds with a premium. An investor purchasing premium bonds would receive a current yield equal to market rates and a capital loss at maturity when the bond is redeemed at $1000. The tax treatments for premium and discount bonds can be complex with some investors amortizing a portion of the expected capital gain or loss each year. For further details, review IRS Publication 550 and see a tax professional for advice.

There can be a few advantages to paying a premium for a bond, and it is not uncommon for investors to pay a small premium when purchasing one. Premium bonds can provide greater cash flow. The reason the premium exists is because the bond offers higher coupon rates than other bonds with lower coupon rates. While it does cost more at first to purchase a bond at a premium, over the course of the bonds life, the higher costs can be offset by higher cash flows over time. While the excess interest is essentially the return of your own money, the higher cash flows mean that the time it takes to recover your initial investment is lower. This concept is know as duration - the measure of time a bond will take to return the investor’s principal. Premium bonds can provide protection when interest rates rise due to their shorter duration. Remember that when interest rates rise, bond prices fall. Premium bonds, however, generally do not lose as much value when interest rates rise as a bond trading at face value, or at less than face value, (also known as at a discount). If you believe interest rates are rising, buying a bond at a premium could be a smart decision.

Understand the risk of buying bonds at a premium. The main risk to purchasing a premium bond is the risk of it being "called early". If interest rates fall, it is possible the bond issuer will want to refinance the bonds at a lower interest rate, and may therefore "call the bond", which would force you to sell early. Although you may be paid a premium for being called early, it is still possible to lose money. Ask your broker if a bond is callable (has an option of being called early), before purchasing. If a callable bond interests you, look for callable bonds with "call protection". These allow you to own the bond for a period of usually several years without needing to worry about the bond being called back, regardless of what happens to interest rates. Ask your broker which bonds have call protection.

Comments

0 comment