views

Open EXCEL on your computer. Teens should use a computer, or a laptop or even a tablet. You can use Excel or any other spreadsheet creating software. You could use a sheet of paper, but this will involve you doing a whole lot of unnecessary maths.

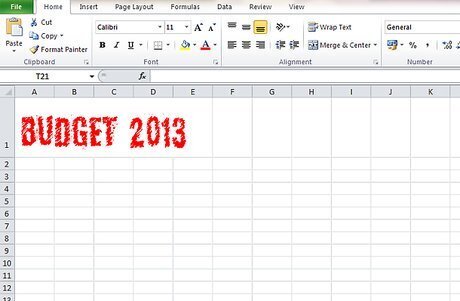

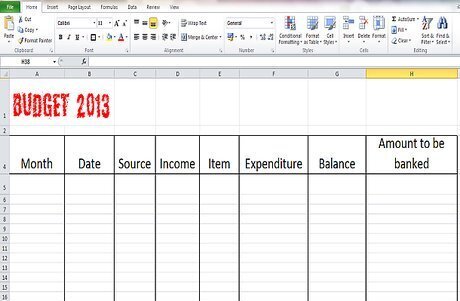

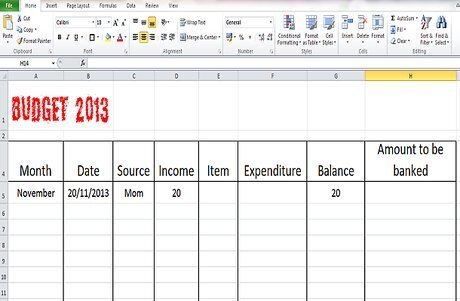

Put a jazzy title in the first row. Something like Budget-2016 in a cool font and colour. This is crucial, for teens.

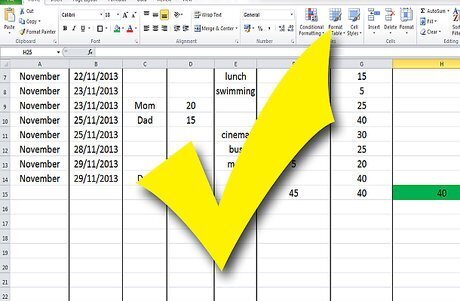

Add the following headings, each heading a column: Month, Date, Source, Income, Item, Expenditure, Balance, Amount to be Banked.

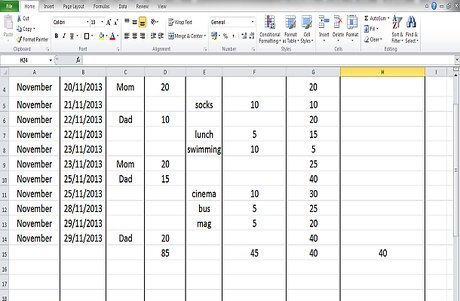

Write the month in the first column e.g. MAY.

When you receive money that month, write down the Date e.g. 01-05-16, and in the same row, the source e.g. parents, and then the amount, e.g. 12,500/-.

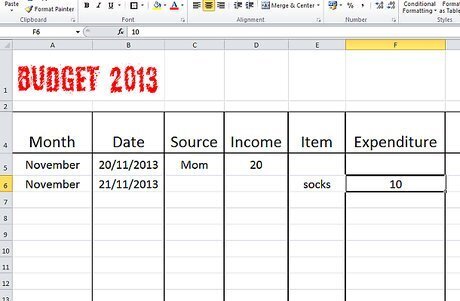

If you spend money write down the item (or place) e.g. socks, in town and the Amount e.g. £10

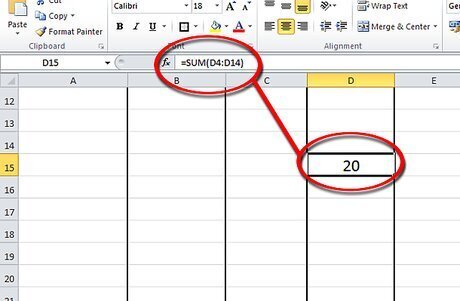

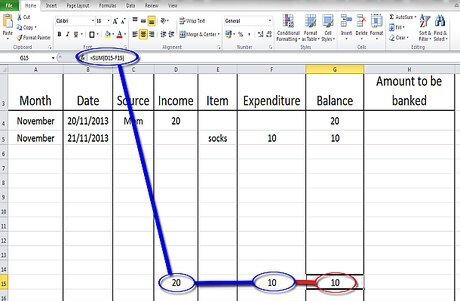

About ten rows down from where you have written your first items, in the column INCOME (D) write this: =SUM(D4:D14) (if you started your income in row 4 and are writing this in 15. Other cell numbers depending on where you are in the table.)

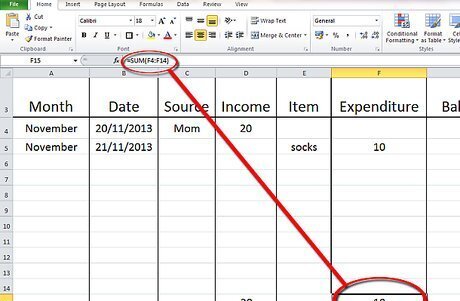

Write the same sum, with a different set of column numbers e.g. (F4:14) in the same row in your EXPENDITURE column.

In the same row as your previous two sums, in the BALANCE column, write =SUM(D15-F15) (or other numbers). This will minus your two totals, leaving YOUR BALANCE! And it will keep changing, depending what you write in the columns.

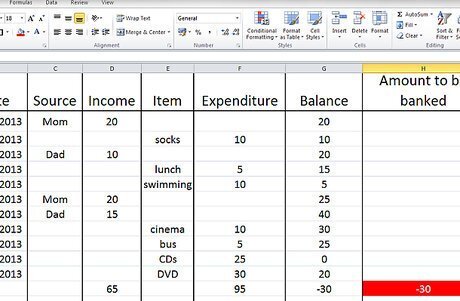

At the end of the month look at your balance. Then count up all the money in your piggy bank. It should (in theory) look the same. If it isn't either add something to the expenditure or income column.

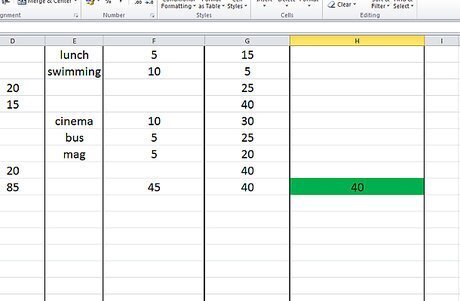

If you have a positive number highlight the cell in green. Well Done! You haven't spent more than your income. If it is over £50 you should consider banking some of it. If you are, put the amount in the BANKED column. Set this aside in a different purse until you can bank it.

If you have a negative number highlight in red. Look at your ITEM column. If it is presents or necessary items, we forgive you. Your other months will make up for it. If it is all chocolate and DVDs, you need to watch your spending more. Make sure that negative months are made up for by positive months.

Congratulations, you have a budget spreadsheet. After a few months, you will know where you are with your accounts. And hopefully be better at saving. And you can show your parents what a responsible, mature young adult you are.

Comments

0 comment