views

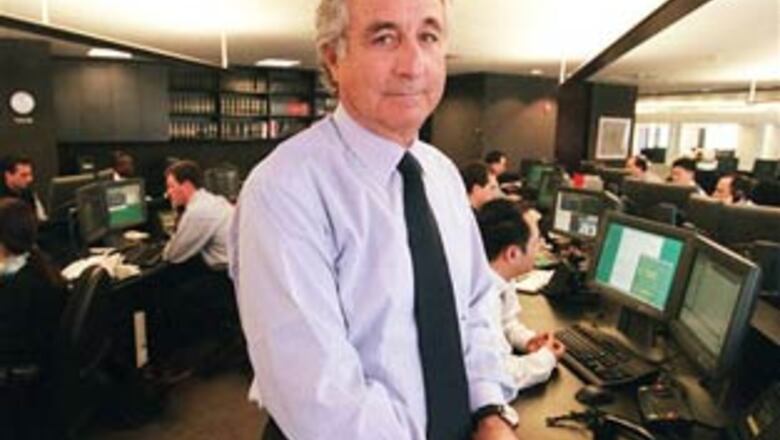

New York: Bernard Madoff, the high-flying Wall Street investor charged with a $50-billion fraud, has been placed under house arrest.

Seventy-year-old Madoff will be required to wear a tracking device and be subject to a curfew, while his wife told the judge she would give up two of her homes if he were to attempt to escape, Bloomberg News reported Wednesday.

Madoff, a former chairman of the Nasdaq exchange, was arrested last week for running a $50-billion Ponzi scheme.

His firm, Bernard L Madoff Investment Securities LLC, operated as an international market broker with a separate investment advisory business for private clients. The advisory business was kept secret by Madoff and served between 11 and 25 clients with $17.1 billion under his management.

The plot is named after Charles Ponzi, responsible for one of the biggest frauds in US history and whose name is given to pyramid-selling schemes where people pay into a programme that does not exist.

The top official in charge of watching over US stock markets, Christopher Cox, admitted late Tuesday that his agency had failed to act for nearly a decade on suspicions concerning the dealings.

In a statement, Cox, who is chairman of the US Securities and Exchange Commission (SEC), said the agency had received allegations going back to 1999 about Madoff.

Cox said there had been "credible and specific allegations" of wrongdoing by Madoff and that the allegations had been "repeatedly brought to the attention of SEC staff, but were never recommended to the commission for action".

President-elect Barack Obama is expected Thursday to announce Cox's replacement as SEC head in his incoming administration, US media reported.

Mary Shapiro, who currently leads the Financial Industry Regulatory Authority, an arm of the SEC, will be tasked with restoring the tarnished reputation of the regulator, which has also come under sharp criticism for failing to foresee the massive financial crisis striking US banks.

Comments

0 comment