views

With only few days remaining for the Union Budget 2019, citizens are eagerly waiting for the BJP-led NDA government to share its budgetary plan for the next financial year.

A few days back, finance minister Arun Jaitley, who has since temporarily handed charge to Piyush Goyal, hinted that the last budget will be more like an interim budget. As per the tradition, the outgoing government is supposed to present an interim budget or a vote-on-account before the Lok Sabha elections and the new government presents a full budget for the fiscal year.

With just eight days left before Parliamentary budget speech, here are some key changes that the government is likely to announce:

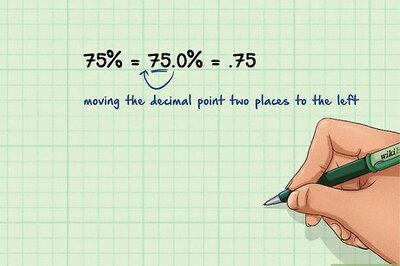

- The wish list for the common man as well as the industry chambers includes a hike in income tax exemption limit from Rs 2.5 lakh to Rs 5 lakh per annum.

- The maximum deduction limit under Section 80C may also be increased from Rs 1.5 lakh to Rs 2 lakh, which would allow taxpayers to invest in additional tax saving avenues available under Section 80C of the Income Tax Act.

- The Confederation of Indian Industry (CII) in its budget recommendation has suggested to lower the personal tax slab to 25 percent from the earlier 30 percent.

- The Confederation of All India Traders (CAIT) on Wednesday, in a letter to Prime Minister Narendra Modi, asked to make changes in the tax regime, e-commerce policy among others. The body has urged the centre that the traders registered under GST be given an Accidental Insurance of Rs 10 lakhs, as followed by Uttar Pradesh.

- The traders' representative also requested that the 18 percent slab under the regime should be abolished and the 28 percent tax slab should be restricted only to most luxurious items.

- The government is already considering an insurance scheme for lakhs of GST-registered small and medium scale traders with a view to address certain concerns of this segment. The scheme may provide accidental insurance cover on the lines of Pradhan Mantri Suraksha Bima Yojana (PMSBY) for the traders at an affordable premium.

- The government's focus will be on both middle class as well as farmers. With the Congress announcing farm loan waivers in few states after the Assembly Elections, the government is expected to announce a package for the agricultural sector.

- First time home buyers may also expect some good news in the upcoming budget as the government may extend the provisions under Section 80EE of the Income Tax Act. The said section provides for an additional deduction of Rs 50,000 for the first time home buyers whose loans were sanctioned between April 1, 2016 to March 31, 2017.

- A GST exemption on properties falling under the affordable category will help first time buyers. At the moment, sale of under construction properties attract 12 percent GST, making it costly for buyers.

- There are expectations that the upcoming budget will revise the Section 80 D limits under the Income Tax Act as well as further reduce GST for health insurance premiums.

Follow live updates here.

Comments

0 comment