views

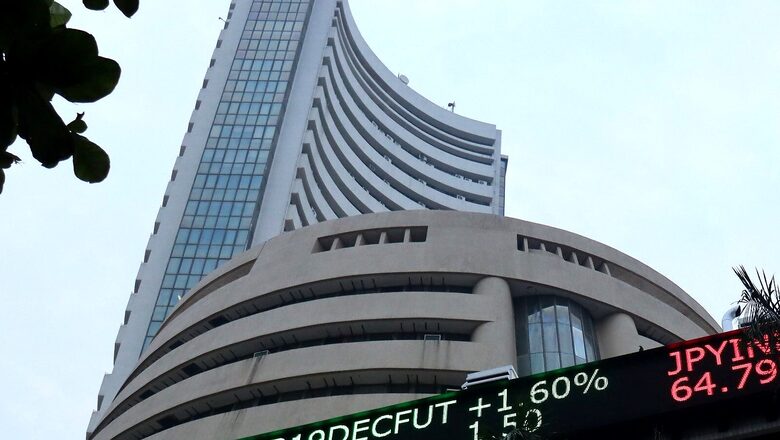

The 30-share BSE Sensex on Monday closed at 58,490.93, down 524.96 points or 0.89 per cent, and the blue-chip Nifty50 was trading at 188.30 points or 1.07 per cent at 17,396.90. About 995 shares have advanced, 2308 shares declined, and 132 shares are unchanged.

This was the second consecutive session in which the market ended in the red. The market also opened flat in early trade- thanks to the mixed global cues. Tata Steel, JSW Steel, Hindalco Industries, UPL and SBI were the top Nifty losers. HUL, ITC, Bajaj Finserv, HCL Technologies and Britannia Industries were among the top gainers.

“Index continued to show profit booking for the second consecutive session and closed a day at 17397 with loss of more than one percent forming a bearish candle on the daily chart. The index has now immediate support at 17300 followed by 17200 zone which will be trend changing level on the downside if managed to hold above-said levels one can expect a good pullback failing to hold can change the immediate trend to down, on the higher side strong hurdle is coming near 17450-17500 zone also any move around said levels will be again profit booking opportunity,” Rohit Singre, Senior Technical Analyst at LKP Securities said.

Among sectors, except FMCG, all other sectoral indices ended in the red with the metal index down nearly 7 percent. The BSE midcap and smallcap indices fell nearly 2 percent each.

“Following high volatility and weak global sentiments, the domestic market ended in a bear grip with Metal and PSU Banks leading the downward rally. Global markets traded negatively as investors were cautious ahead of multiple central bank policy meetings scheduled this week. However, due to weak US job data and inflation increasing at a slower pace, Fed is not expected to hint on taper plans in the upcoming meeting,”Vinod Nair, head of Research at Geojit Financial Services said. In the backdrop of the upcoming US Fed Meeting, and other countries central banks meeting, Asian shares eased on Monday ahead of a week with no less than a dozen central bank meetings, highlighted by the Federal Reserve which is likely to take another step toward tapering. Holidays in Japan, China and South Korea made for a thin start. Early Monday, MSCI’s broadest index of Asia-Pacific shares outside Japan dipped another 0.2 per cent, after shedding 2.5 per cent last week. Hang Seng fell 2.5 per cent in early trade.

On Friday, the equity benchmarks surged to fresh lifetime peaks on Friday but finished with modest losses, snapping their three-session winning streak, as investors rotated out of RIL, metal and IT stocks at higher levels. After gyrating 866 points during the day, the 30-share BSE Sensex settled 125.27 points or 0.21 per cent lower at 59,015.89. The broader NSE Nifty slipped 44.35 points or 0.25 per cent to close at 17,585.15, after touching an intra-day record of 17,792.95.

Read all the Latest News , Breaking News and Ukraine-Russia War Live Updates here.

Comments

0 comment