views

The Reserve Bank is unlikely to cut the benchmark interest rate in its forthcoming bi-monthly monetary policy review later in the week as retail inflation is still a cause of concern, and there is a possibility of the Middle East crisis deteriorating further, impacting crude oil and commodity prices, say experts.

Repo Rate Held Steady Since February 2023

The Reserve Bank of India (RBI) has kept the repo or short-term lending rate unchanged at 6.5% since February 2023, and experts think some easing could only be possible in December.

A Series of Rate Hikes from May 2022 to February 2023

In an off-cycle meeting in May 2022, the Monetary Policy Committee raised the policy rate by 40 basis points. It was followed by rate hikes of varying sizes, in the subsequent meetings till February 2023. The repo rate was raised by 250 basis points cumulatively between May 2022 and February 2023.

Inflation Control

The government has tasked the central bank to ensure that Consumer Price Index (CPI) based retail inflation remains at 4% with a margin of 2% on either side.

RBI Unlikely to Follow Global Trend of Rate Cuts

In the current context, experts feel that the RBI may not follow the US Federal Reserve, which lowered the benchmark rates by 50 basis points, and the central banks of some developed nations, which have reduced the interest rates.

Core Inflation and Global Uncertainty Pose Risks

Madan Sabnavis, Chief Economist at Bank of Baroda, points to rising core inflation and geopolitical risks as key factors for maintaining the status quo.

“We do not expect any change in the repo rate or stance by MPC. The reason is that inflation for September and October will be above 5%, and the present low inflation is due to the base effect. Besides, core inflation is inching upwards,” said Sabnavis.

Further, the recent Iran-Israel imbroglio can intensify, and there is uncertainty here, he said.

“Hence, the status quo is the most likely option even for new members. Inflation forecast may be lowered by 10-20 bps and no change in GDP forecast likely,” said Sabnavis.

The central bank last hiked the repo rate to 6.5% in February 2023 and since then, it has held the rate at the same level.

Status Quo

Ajit Banerjee, President & Chief Investment Officer, Shriram Life Insurance Company, said, “We feel that the MPC would continue to maintain the status quo on the policy rates since it would like to start the rate cut cycle once it gets convinced that CPI inflation has been controlled in a relatively durable way and it will not be vulnerable to the food inflation fluctuations intermittently. Further, India, as of now, doesn’t face the challenge of the GDP growth falling consistently.”

Banerjee added that the low GDP growth numbers of 6.7% in Q1 were primarily driven by adverse base effects and a slowdown in government-driven investment expenditures due to general elections in Q1. This was the main driving force behind the GDP growth of the country.

“Much to our relief, the government capex has resumed in Q2, and therefore, GDP growth numbers would fall in line with RBI projections. A dovish tone in the governor’s commentary could also set the direction moving forward,” Banerjee added.

Potential Easing from December 2024 Onwards

Icra Chief Economist Aditi Nayar suggests that a stance change could occur in the October 2024 policy review, with potential rate cuts starting in December 2024.

Nayar said that given the undershooting in the initial first quarter GDP growth relative to the MPC’s forecast and the likely sizeable undershooting in the second quarter CPI inflation print as well, “we believe a stance change to neutral may be appropriate in the October 2024 policy review”.

This could be followed by a shallow rate-cutting cycle of 25 bps each in December 2024 and February 2025, she added.

“The abundant monsoon offers some insurance for crop inflation. The impact of global political developments and geopolitical uncertainty on the growth inflation dynamics remains a risk,” Nayar added.

HSBC Report Anticipates Stance Change

An HSBC report said three developments stand out — softer growth numbers have trickled in recently, inflation has been falling, and the external environment has moved from rate hikes to cuts.

“We believe the RBI doesn’t gain from waiting any longer. We think it will change its stance from a hawkish ’withdrawal of accommodation’ to ’neutral’ in the upcoming 9 October policy meeting, followed by repo rate cuts of 25 bps each in the December and February meetings, taking the repo rate to 6%,” the report said.

The RBI kept the repo rate unchanged at 6.5% in its August bi-monthly review amid risks from higher food inflation.

This was the ninth consecutive MPC meeting, which decided to maintain the status quo on the rate front.

Real Estate Sector Hopes for Rate Cuts

Pradeep Aggarwal, founder and chairman, Signature Global (India) Limited, said while the real estate industry, developer community, and homebuyers are hoping for an interest rate cut in the upcoming monetary policy review, the RBI is likely to hold on to the interest rate cuts for the tenth consecutive time.

“The apex bank still seems uncomfortable with the overall retail inflation scenario, particularly food inflation. As such, it is expected to maintain the status quo. The recent interest rate cut by the US Federal Reserve has ignited similar hopes even in India, but the domestic scenario is very different,” he added.

SBM Bank India Head Treasury Mandar Pitale believed that the MPC has persistently advocated a restrictive policy until inflation aligns durably towards the 4% target.

“With the unfavourable base effect taking the next couple of CPI prints near 5% plus or minus, it will pose a major challenge for MPC to start easing from the October meeting,” Pitale said, adding that the MPC is also expected to deliberate upon the global factors like growth-inflation behaviour in developed economies.

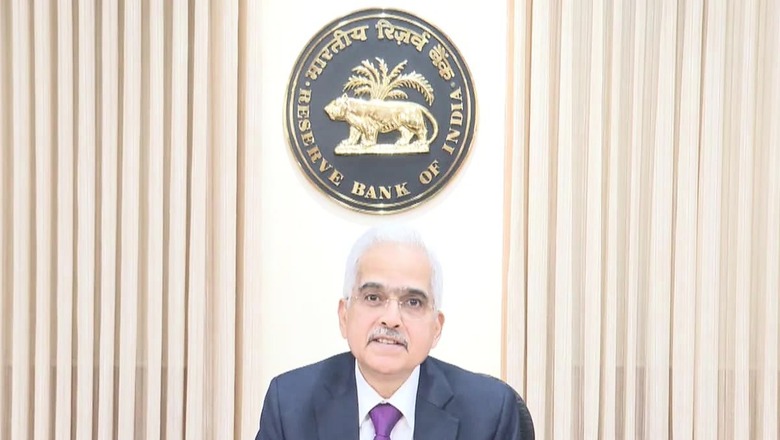

New MPC Members to Join October Policy Review

Earlier this month, the government reconstituted the Reserve Bank’s rate-setting panel. The reconstituted panel, with three newly appointed external members, will commence its maiden meeting on Monday. MPC Chairman RBI Governor Shaktikanta Das will reveal the outcome of the three-day discussion on Wednesday (October 9).

The government has appointed Ram Singh, Saugata Bhattacharya, and Nagesh Kumar as external members of the MPC. They have replaced Ashima Goyal, Shashanka Bhide, and Jayanth R Varma.

Apart from the Governor, the other internal members are the RBI Deputy Governor in charge of monetary policy Michael Debabrata Patra and the Executive Director monetary policy department of RBI Rajiv Ranjan.

Comments

0 comment