views

It’s that time of the year when you have to pay Income Tax on the income you earned in the last financial year. While paying Income Tax has its own set of benefits; delaying or not paying Tax on your Income can attract Late Fee as well as Interest besides notice from the Income Tax Department, which you must avoid at all costs.

Since 1st April 2018, a lot of changes have come to effect including penalty on late filing of ITR as well as reduction in the time-limit to revise your ITR.

As per the new rules, you must file your Income Tax Return on or before 31st July 2018, failing which, you can be liable to pay a penalty up to Rs.10,000. If you miss the bus by 31st July, then filing your ITR and paying the Tax on or before 31st December 2018 will attract Rs.5,000 only. But if you file your ITR for FY2017-18 after 31st December 2018, embrace yourself to pay a penalty of Rs.10,000.

However, the above late filing penalties are not applicable to small income groups. If your Income for the Financial year 2017-18 doesn’t exceed Rs. 5 Lakh, then the maximum fine you’ll attract is Rs.1,000 only.

Coming to the second change in time line of revising your ITR; earlier a tax payer could revise his/her ITR for any unintentional mistakes for a period of 2 years from the last date of the financial year; however, from 1st April 2018, you have time of just 1 year from the last date of the last financial year to revise the mistakes in your Income Tax Return. Thereby, if you file the return for FY17-18 now and later need to make amendments then you must do it on or before 31st March 2019 only.

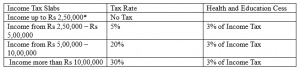

The last day to pay Income Tax for FY 2017-18 is 31st July 2018. For Individual tax payers less than 60 years old, the Income Tax Slabs are as follows:

However, if your Income is between Rs.50 Lakh and Rs. 1 Crore, then a surcharge of 10% of Income Tax is applicable.

Similarly, if your Income is above Rs.1 Crore for the last year, then you are liable to pay a surcharge of 15% on Income Tax.

The official Income Tax Return filing portal of the Government of India makes it easy for any individual to file his/her Income Tax online. Although the last day to file your ITR for FY2017-18 is 31st July 2018, you must not wait for the last date and rather file your return sooner to avoid last minute technical glitches.

You can file your Income Tax Return and pay taxes online at:

https://www.incometaxindiaefiling.gov.in

You can take help at the below mentioned help lines from Monday to Saturday during working hours (09 AM to 08 PM):

1800 103 0025

+91-80-46122000

+91-80-26500026

Comments

0 comment