views

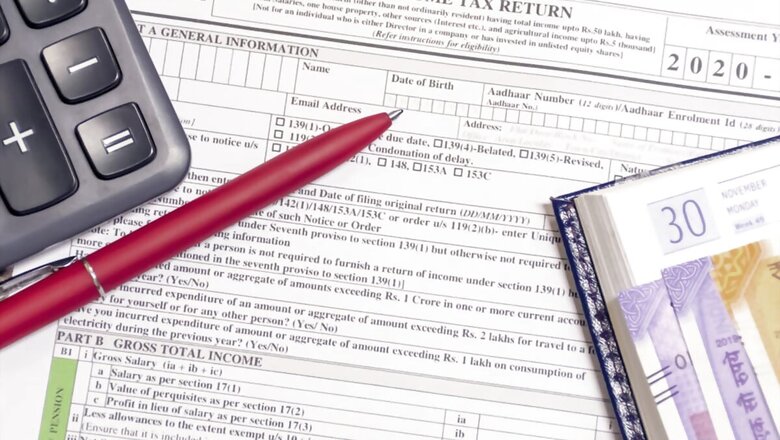

With the beginning of new financial year from April 1, a slew of changes for income tax along with other rules, which were announced by Finance Minister Nirmala Sitharaman in the Union Budget in February 2021, came into effect.

Here are some of the changes which one needs to know:

1. Option to choose new tax regime: The implementation of the new tax regime was announced in Budget 2020. Taxpayers will have an option to choose new tax regime instead of old tax regime at the time of filing their tax returns.

2. EPF investments: Individual investment in EPF account will come under the ambit of income tax from April 1, 2021. FM Sitharaman had proposed in the Budget 2021 that there should be no interest in employee contribution towards provident fund up to the maximum of Rs 2.5 lakh. The finance minister also added that any interest income from the contribution above this limit will be taxable in the hands of the employee.

3. Income Tax rule on TDS: Higher TDS (tax deducted at source) or TCS (tax collected at source) rates were proposed by the finance minister in Budget 2021 to make more people file income tax returns (ITR).

4. Change in LTC scheme: The central government had proposed to provide tax exemption to an employee receiving a cash allowance in lieu of Leave Travel Concession (LTC). The scheme was announced last year for individuals who were unable to claim their LTC tax benefit due to covid-related restrictions on travelling. People can note that this scheme was only available till March 31, 2021.

5. Income tax returns for senior citizens: Senior citizens above the age of 75 years will be exempted from filing income tax returns in order to ease the compliance burden on them. Senior citizens who do not have any other income source except pension and interest income can only avail this facility. Also, they need to note that the exemption from filing ITR would be available only in case where the interest income is earned in the same bank where the pension is deposited.

6. Pre-filled data in ITR Forms: Some more details including capital gain arising from the sale of listed securities, dividend income, interest income received from the bank or post office will be pre-filled in income tax return along with the current auto-populated information that is personal information, bank details, details of salary income as per form 16, details of TDS, TCS, taxes paid as advance tax, as per the announcement made in Budget 2021. Pre-filled data are the information that is auto-populated from external sources in the ITR.

Read all the Latest News, Breaking News and Coronavirus News here. Follow us on Facebook, Twitter and Telegram.

Comments

0 comment