views

Saving pocket money is crucial for students as it serves multiple purposes. It instils financial discipline and responsibility, teaching them the value of money and cultivating good saving habits. Saving also provides a safety net for unexpected expenses or emergencies, ensuring they can handle such situations independently without relying on others or accumulating debt.

Moreover, saving pocket money allows students to work towards their long-term goals, whether it’s funding higher education, realising a dream vacation, or purchasing a specific item. It empowers them to become financially independent, make their own purchasing decisions, and reduces their dependence on external financial support. By saving, students learn the concept of delayed gratification, understanding that postponing immediate desires can lead to more significant rewards in the future.

Here are some tips for students to efficiently utilise their pocket money:

Set a budget: The first step to managing your pocket money is to set a budget. This will help you track your spending and make sure you’re not overspending.

Be mindful of your spending: It’s important to be mindful of your spending and make sure you’re not overspending. One way to do this is to track your spending in a budget or app.

List your expenses: Once you know how much money you have to spend, make a list of your expenses. This will help you see where your money is going and identify areas where you can cut back.

Cook at home: Eating out regularly can be expensive. Try to prepare meals at home as much as possible. It’s not only cost-effective but also healthier. Remember this next time before opening food apps!

Share expenses: If you are going out with friends, consider sharing expenses. For example, you can split the cost of transportation, movie tickets, or meals. This way, you can enjoy outings without putting a strain on your pocket money.

Avoid impulse purchases: It’s easy to spend money on things you don’t need when you’re not careful. To avoid impulse purchases, take some time to think about whether you really need something before you buy it.

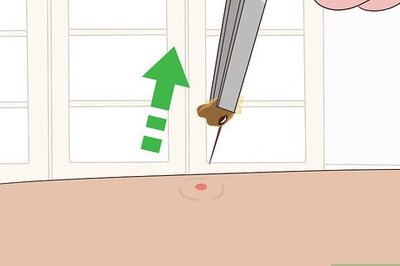

Save for the future: Even if you can only save a small amount of money each month, it will add up over time. Consider setting up a savings account and make a habit of depositing money into it each month.

Invest in yourself: You can also use your pocket money to invest in yourself. This could mean taking a class, buying a book, or joining a club. Investing in yourself will help you grow and develop as a person.

Set financial goals: It’s helpful to have financial goals in mind. This will help you stay motivated and make sure you’re on track to reach your goals.

Ask for help if you need it: If you’re struggling to manage your pocket money, don’t be afraid to ask for help from your parents, teachers, or financial advisor.

The key to efficiently utilising your pocket money is to plan ahead, prioritise your needs, and make mindful spending decisions. Developing good financial habits early on will help you manage your finances effectively in the long run.

Comments

0 comment